Answered step by step

Verified Expert Solution

Question

1 Approved Answer

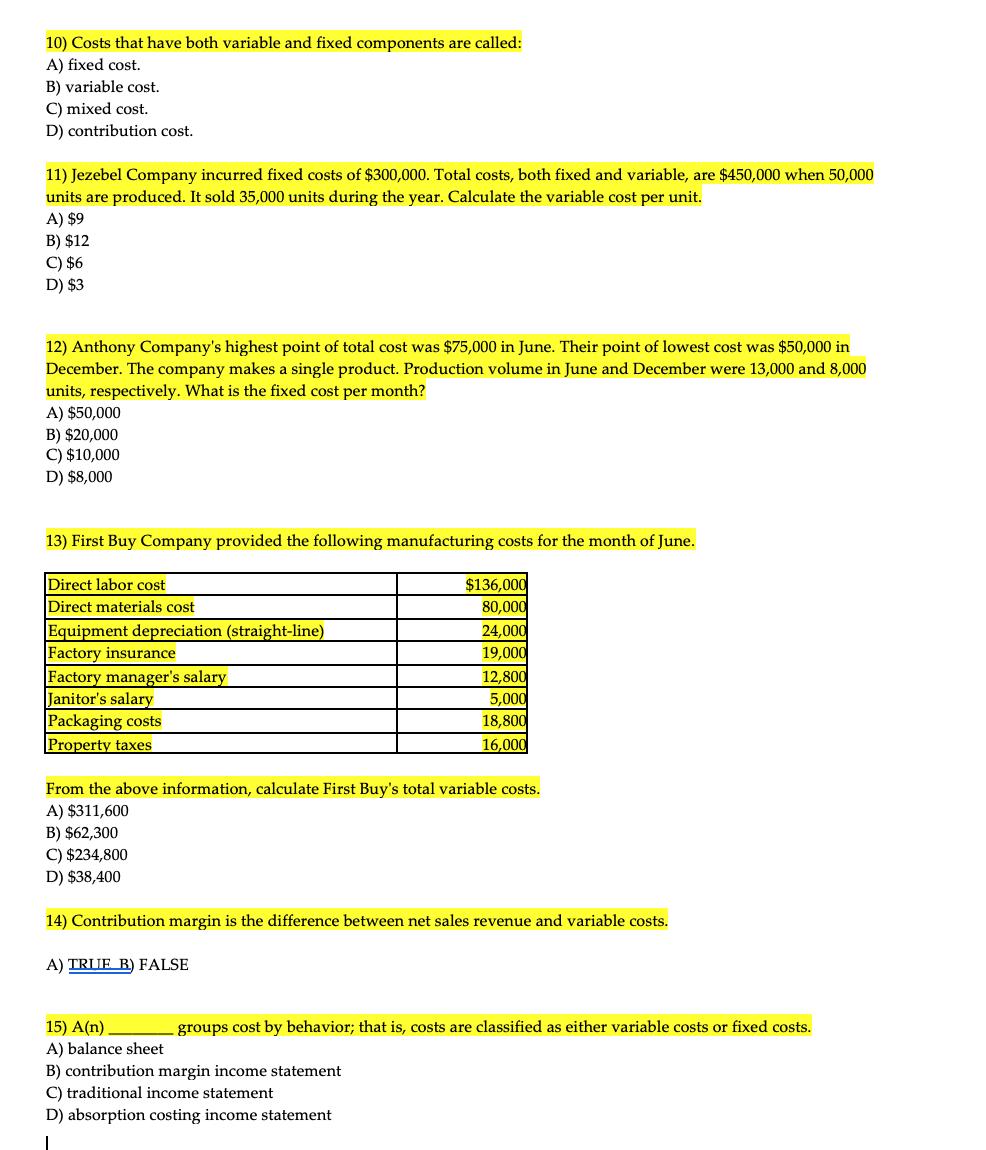

10) Costs that have both variable and fixed components are called: A) fixed cost. B) variable cost. C) mixed cost. D) contribution cost. 11)

10) Costs that have both variable and fixed components are called: A) fixed cost. B) variable cost. C) mixed cost. D) contribution cost. 11) Jezebel Company incurred fixed costs of $300,000. Total costs, both fixed and variable, are $450,000 when 50,000 units are produced. It sold 35,000 units during the year. Calculate the variable cost per unit. A) $9 B) $12 C) $6 D) $3 12) Anthony Company's highest point of total cost was $75,000 in June. Their point of lowest cost was $50,000 in December. The company makes a single product. Production volume in June and December were 13,000 and 8,000 units, respectively. What is the fixed cost per month? A) $50,000 B) $20,000 C) $10,000 D) $8,000 13) First Buy Company provided the following manufacturing costs for the month of June. Direct labor cost Direct materials cost Equipment depreciation (straight-line) Factory insurance Factory manager's salary Janitor's salary Packaging costs Property taxes A) TRUE B) FALSE $136,000 80,000 From the above information, calculate First Buy's total variable costs. A) $311,600 B) $62,300 C) $234,800 D) $38,400 15) A(n). A) balance sheet 24,000 19,000 14) Contribution margin is the difference between net sales revenue and variable costs. 12,800 5,000 18,800 16,000 B) contribution margin income statement C) traditional income statement D) absorption costing income statement groups cost by behavior; that is, costs are classified as either variable costs or fixed costs.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

10 Costs that have both variable and fixed components are called Answer is option c mix...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started