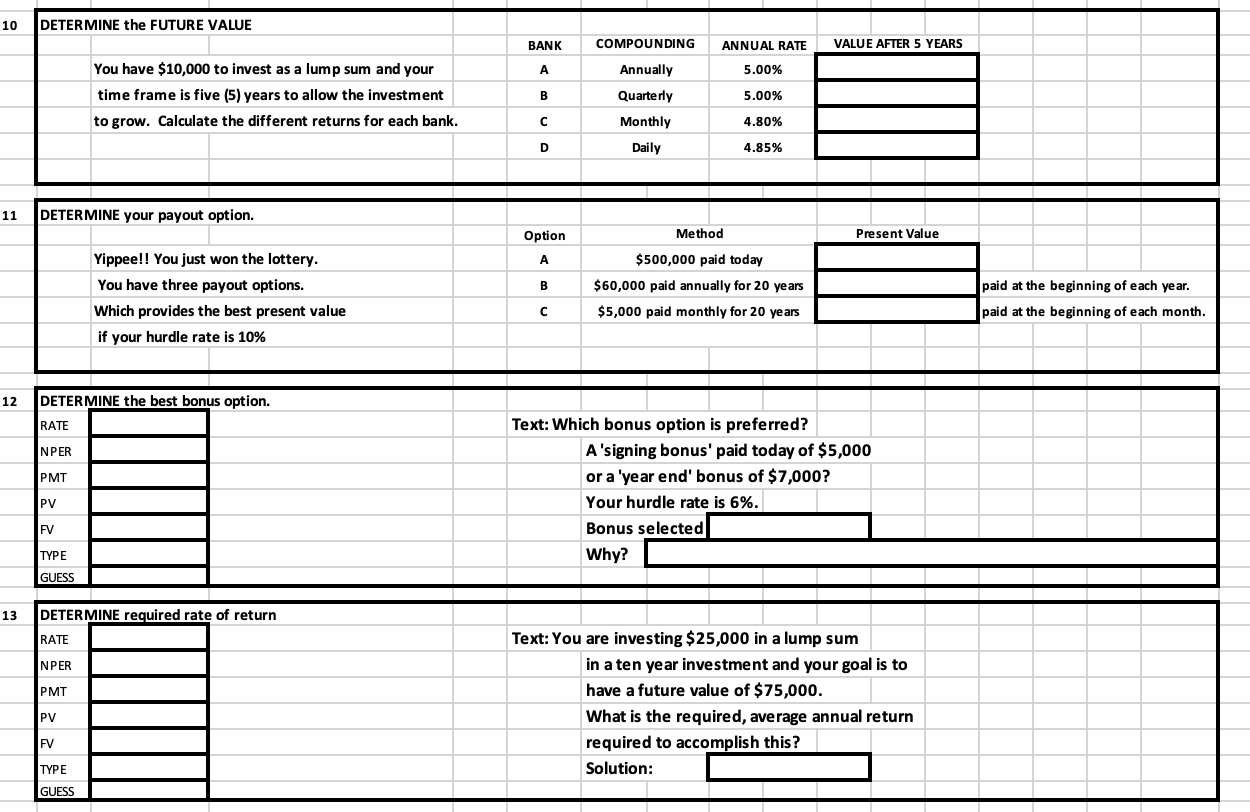

10 DETERMINE the FUTURE VALUE BANK COMPOUNDING ANNUAL RATE VALUE AFTER 5 YEARS A 5.00% You have $10,000 to invest as a lump sum and your time frame is five (5) years to allow the investment to grow. Calculate the different returns for each bank. B Annually Quarterly Monthly 5.00% 4.80% D Daily 4.85% 11 DETERMINE your payout option. Option Method Present Value A B Yippee!! You just won the lottery. You have three payout options. Which provides the best present value if your hurdle rate is 10% $500,000 paid today $60,000 paid annually for 20 years $5,000 paid monthly for 20 years paid at the beginning of each year. paid at the beginning of each month. 12 DETERMINE the best bonus option. RATE NPER PMT Text: Which bonus option is preferred? A'signing bonus' paid today of $5,000 or a 'year end' bonus of $7,000? Your hurdle rate is 6%. Bonus selected Why? PV FV TYPE GUESS 13 DETERMINE required rate of return RATE NPER PMT Text: You are investing $25,000 in a lump sum in a ten year investment and your goal is to have a future value of $75,000. What is the required, average annual return required to accomplish this? Solution: PV FV TYPE GUESS 10 DETERMINE the FUTURE VALUE BANK COMPOUNDING ANNUAL RATE VALUE AFTER 5 YEARS A 5.00% You have $10,000 to invest as a lump sum and your time frame is five (5) years to allow the investment to grow. Calculate the different returns for each bank. B Annually Quarterly Monthly 5.00% 4.80% D Daily 4.85% 11 DETERMINE your payout option. Option Method Present Value A B Yippee!! You just won the lottery. You have three payout options. Which provides the best present value if your hurdle rate is 10% $500,000 paid today $60,000 paid annually for 20 years $5,000 paid monthly for 20 years paid at the beginning of each year. paid at the beginning of each month. 12 DETERMINE the best bonus option. RATE NPER PMT Text: Which bonus option is preferred? A'signing bonus' paid today of $5,000 or a 'year end' bonus of $7,000? Your hurdle rate is 6%. Bonus selected Why? PV FV TYPE GUESS 13 DETERMINE required rate of return RATE NPER PMT Text: You are investing $25,000 in a lump sum in a ten year investment and your goal is to have a future value of $75,000. What is the required, average annual return required to accomplish this? Solution: PV FV TYPE GUESS