Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Emily is an Australian professional soccer player and has just returned from England after playing soccer professionally in the EPL. She left Australia

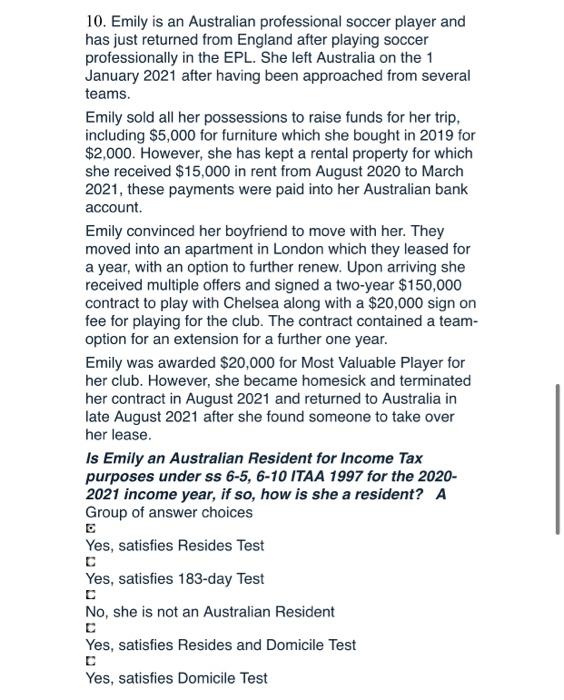

10. Emily is an Australian professional soccer player and has just returned from England after playing soccer professionally in the EPL. She left Australia on the 1 January 2021 after having been approached from several teams. Emily sold all her possessions to raise funds for her trip, including $5,000 for furniture which she bought in 2019 for $2,000. However, she has kept a rental property for which she received $15,000 in rent from August 2020 to March 2021, these payments were paid into her Australian bank account. Emily convinced her boyfriend to move with her. They moved into an apartment in London which they leased for a year, with an option to further renew. Upon arriving she received multiple offers and signed a two-year $150,000 contract to play with Chelsea along with a $20,000 sign on fee for playing for the club. The contract contained a team- option for an extension for a further one year. Emily was awarded $20,000 for Most Valuable Player for her club. However, she became homesick and terminated her contract in August 2021 and returned to Australia in late August 2021 after she found someone to take over her lease. Is Emily an Australian Resident for Income Tax purposes under ss 6-5, 6-10 ITAA 1997 for the 2020- 2021 income year, if so, how is she a resident? A Group of answer choices D Yes, satisfies Resides Test C Yes, satisfies 183-day Test C No, she is not an Australian Resident Yes, satisfies Resides and Domicile Test Yes, satisfies Domicile Test

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Emily will not be considered as Austrailian resident as s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started