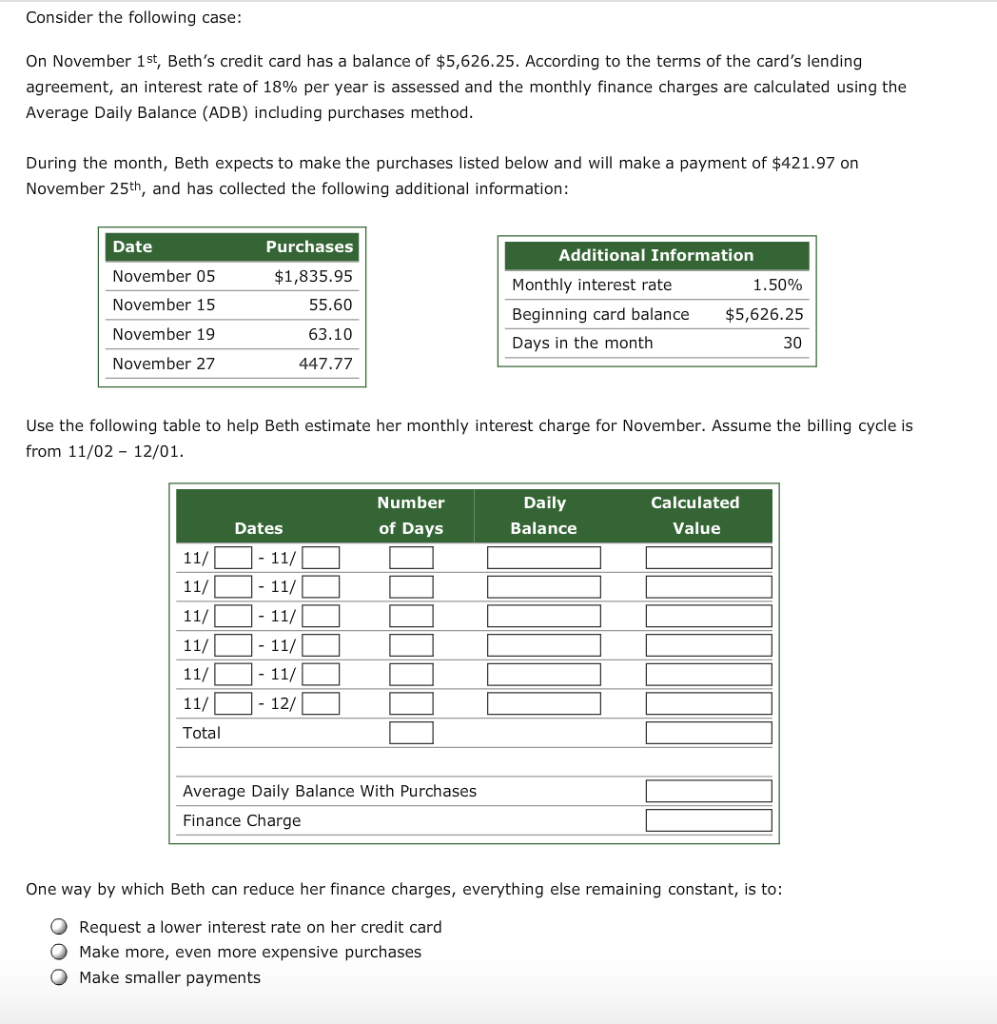

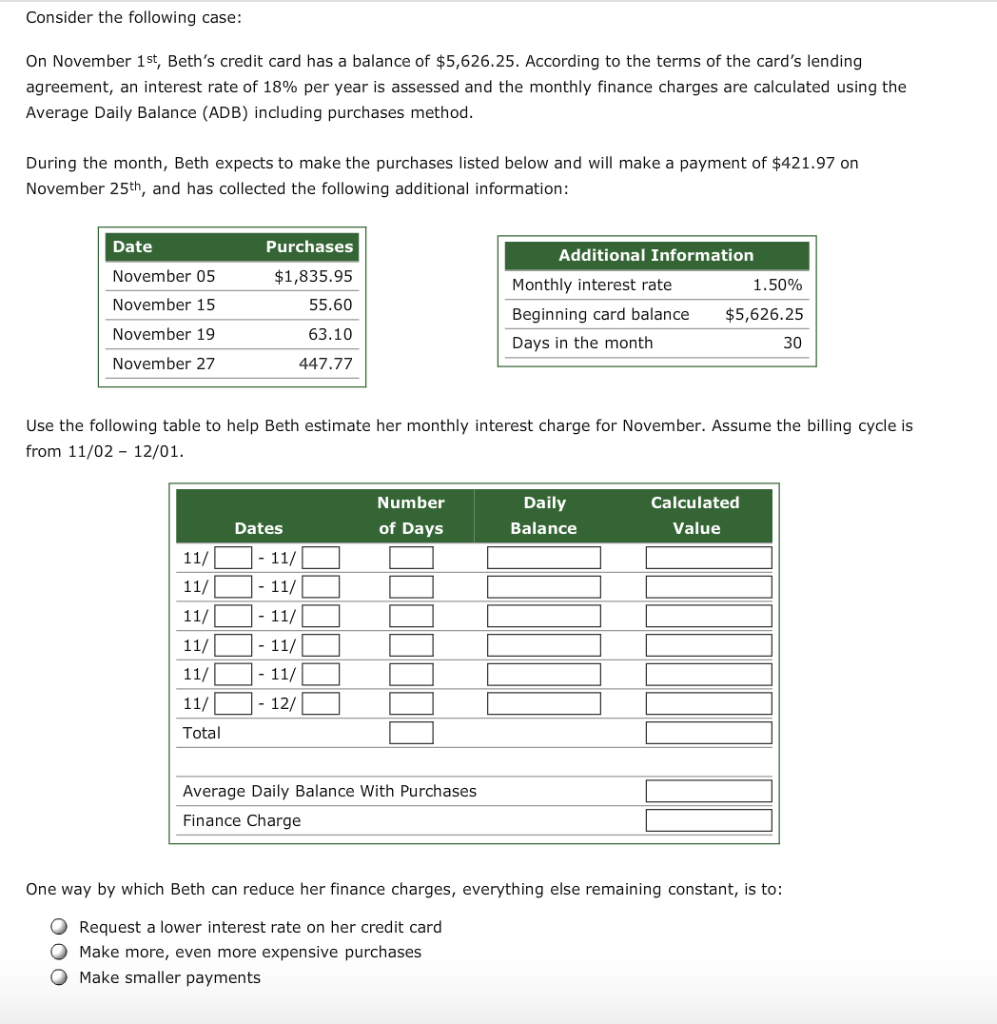

10. Finance charges on credit cards Aa Aa E Finance Charges on Credit Cards Even before you use a new credit card, what information is the institution that issued your card required by law to disclose? O The method used to compute finance charges and estimated dollar amount of finance charges The rate of interest and method used to compute finance charges The rate of interest and estimated dollar amount of finance charges In general, how does the interest rate on cash advances compare to the rate on purchases? It is The most common method that banks and retail credit card issuers use to compute finance charges is the average daily balance (ADB) method. You expect to actively use your card. Which variation of the ADB method will be least expensive for you? ADB including new purchases ADB excluding new purchases It doesn't matter Consider the following case: On November 1st, Beth's credit card has a balance of $5,626.25. According to the terms of the card's lending agreement, an interest rate of 18% per year is assessed and the monthly finance charges are calculated using the Average Daily Balance (ADB) including purchases method. During the month, Beth expects to make the purchases listed below and will make a payment of $421.97 on November 25th, and has collected the following additional information: Date November 05 November 15 November 19 November 27 Purchases $1,835.95 55.60 63.10 447.77 Additional Information Monthly interest rate 1.50% Beginning card balance $5,626.25 Days in the month 30 Use the following table to help Beth estimate her monthly interest charge for November. Assume the billing cycle is from 11/02 - 12/01. Number of Days Daily Balance Calculated Value 11/ 111 11/ 11/ 111 11/ Total Dates - 11/ -11/ - 11/ - 11/ -11/ - 12/ Average Daily Balance With Purchases Finance Charge One way by which Beth can reduce her finance charges, everything else remaining constant, is to: Request a lower interest rate on her credit card O Make more, even more expensive purchases O Make smaller payments 10. Finance charges on credit cards Aa Aa E Finance Charges on Credit Cards Even before you use a new credit card, what information is the institution that issued your card required by law to disclose? O The method used to compute finance charges and estimated dollar amount of finance charges The rate of interest and method used to compute finance charges The rate of interest and estimated dollar amount of finance charges In general, how does the interest rate on cash advances compare to the rate on purchases? It is The most common method that banks and retail credit card issuers use to compute finance charges is the average daily balance (ADB) method. You expect to actively use your card. Which variation of the ADB method will be least expensive for you? ADB including new purchases ADB excluding new purchases It doesn't matter Consider the following case: On November 1st, Beth's credit card has a balance of $5,626.25. According to the terms of the card's lending agreement, an interest rate of 18% per year is assessed and the monthly finance charges are calculated using the Average Daily Balance (ADB) including purchases method. During the month, Beth expects to make the purchases listed below and will make a payment of $421.97 on November 25th, and has collected the following additional information: Date November 05 November 15 November 19 November 27 Purchases $1,835.95 55.60 63.10 447.77 Additional Information Monthly interest rate 1.50% Beginning card balance $5,626.25 Days in the month 30 Use the following table to help Beth estimate her monthly interest charge for November. Assume the billing cycle is from 11/02 - 12/01. Number of Days Daily Balance Calculated Value 11/ 111 11/ 11/ 111 11/ Total Dates - 11/ -11/ - 11/ - 11/ -11/ - 12/ Average Daily Balance With Purchases Finance Charge One way by which Beth can reduce her finance charges, everything else remaining constant, is to: Request a lower interest rate on her credit card O Make more, even more expensive purchases O Make smaller payments