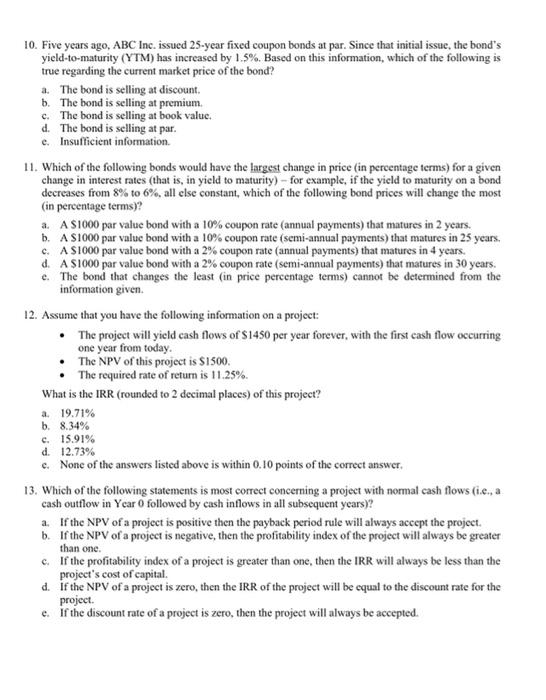

10. Five years ago, ABC Inc. issued 25-year fixed coupon bonds at par. Since that initial issue, the bond's yield-to-maturity (YTM) has increased by 1.5%. Based on this information, which of the following is true regarding the current market price of the bond? . The bond is selling at discount. b. The bond is selling at premium c. The bond is selling at book value. d. The bond is selling at par. e. Insufficient information 11. Which of the following bonds would have the largest change in price (in percentage terms) for a given change in interest rates (that is, in yield to maturity) - for example, if the yield to maturity on a bond decreases from 8% to 6%, all else constant, which of the following bond prices will change the most (in percentage terms)? a. A S1000 par value bond with a 10% coupon rate (annual payments) that matures in 2 years. b. A S1000 par value bond with a 10% coupon rate (semi-annual payments) that matures in 25 years, c. A S1000 par value bond with a 2% coupon rate (annual payments) that matures in 4 years. d. A $1000 par value bond with a 2% coupon rate (semi-annual payments) that matures in 30 years. c. The bond that changes the least (in price percentage terms) cannot be determined from the information given 12. Assume that you have the following information on a project: The project will yield cash flows of S1450 per year forever, with the first cash flow occurring one year from today The NPV of this project is $1500. The required rate of return is 11.25% What is the IRR (rounded to 2 decimal places) of this project? a. 19.71% b. 8.34% c. 15.91% d. 12.73% c. None of the answers listed above is within 0.10 points of the correct answer 13. Which of the following statements is most correct concerning a project with normal cash flows (i.e., a cash outflow in Year 0 followed by cash inflows in all subsequent years)? a. If the NPV of a project is positive then the payback period rule will always accept the project. b. If the NPV of a project is negative, then the profitability index of the project will always be greater than one. c. If the profitability index of a project is greater than one, then the IRR will always be less than the project's cost of capital d. if the NPV of a project is zero, then the IRR of the project will be equal to the discount rate for the project. e if the discount rate of a project is zero, then the project will always be accepted