Answered step by step

Verified Expert Solution

Question

1 Approved Answer

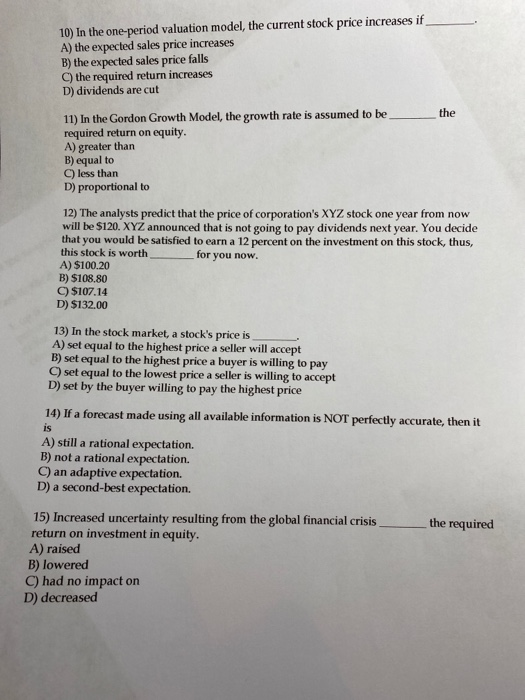

10) In the one-period valuation model, the current stock price increases if ________. A) the expected sales price increases B) the expected sales price falls

10) In the one-period valuation model, the current stock price increases if ________. A) the expected sales price increases

B) the expected sales price falls

C) the required return increases

D) dividends are cut

11) In the Gordon Growth Model, the growth rate is assumed to be ________ the required return on equity.

A) greater than

B) equal to

C) less than

D) proportional to

12) The analysts predict that the price of corporation's XYZ stock one year from now will be $120. XYZ announced that is not going to pay dividends next year. You decide that you would be satisfied to earn a 12 percent on the investment on this stock, thus, this stock is worth ________ for you now.

A) $100.20 B) $108.80 C) $107.14 D) $132.00

13) In the stock market, a stock's price is ________.

A) set equal to the highest price a seller will accept

B) set equal to the highest price a buyer is willing to pay C) set equal to the lowest price a seller is willing to accept D) set by the buyer willing to pay the highest price

14) If a forecast made using all available information is NOT perfectly accurate, then it is

A) still a rational expectation.

B) not a rational expectation.

C) an adaptive expectation. D) a second-best expectation.

15) Increased uncertainty resulting from the global financial crisis ________ the required return on investment in equity.

A) raised

B) lowered

C) had no impact on D) decreased

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started