Answered step by step

Verified Expert Solution

Question

1 Approved Answer

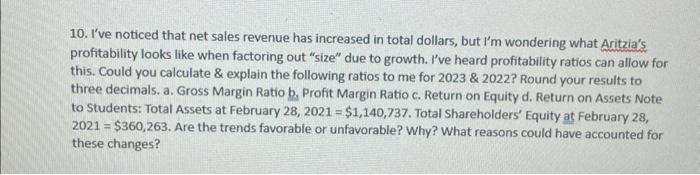

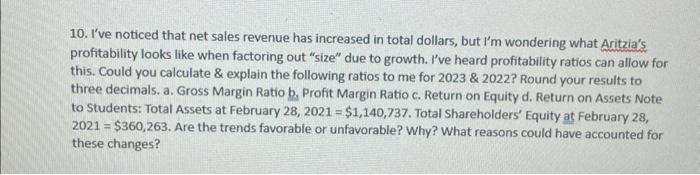

10. I've noticed that net sales revenue has increased in total dollars, but l'm wondering what Aritzia's profitability looks like when factoring out size due

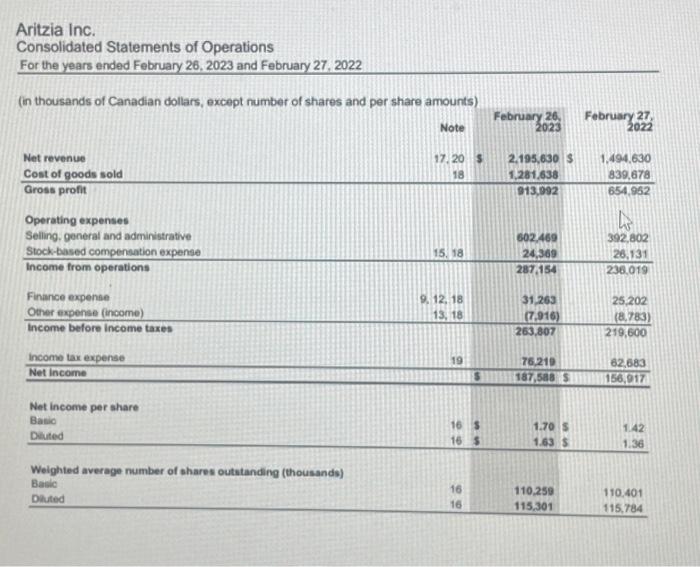

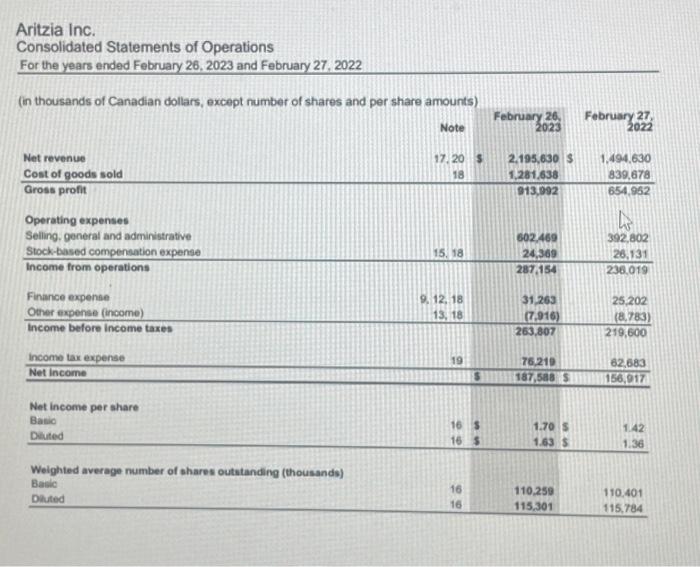

10. I've noticed that net sales revenue has increased in total dollars, but l'm wondering what Aritzia's profitability looks like when factoring out "size" due to growth. I've heard profitability ratios can allow for this. Could you calculate & explain the following ratios to me for 2023 & 2022? Round your results to three decimals. a. Gross Margin Ratio b. Profit Margin Ratio c. Return on Equity d. Return on Assets Note

to Students: Total Assets at February 28, 2021 = $1,140,737. Total Shareholders' Equity at February 28,

2021 = $360,263. Are the trends favorable or unfavorable? Why? What reasons could have accounted for

these changes?

10. I've noticed that net sales revenue has increased in total dollars, but I'm wondering what Aritzia's profitability looks like when factoring out "size" due to growth. I've heard profitability ratios can allow for this. Could you calculate & explain the following ratios to me for 2023 & 2022? Round your results to three decimals. a. Gross Margin Ratio b, Profit Margin Ratio c. Return on Equity d. Return on Assets Note to Students: Total Assets at February 28, 2021 $1,140,737. Total Shareholders' Equity at February 28, 2021 $360,263. Are the trends favorable or unfavorable? Why? What reasons could have accounted for these changes? =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Gross Margin Ratio The gross margin ratio shows how much of each dollar of revenue is left after deducting the cost of goods sold For 2023 Gross Mar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started