Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Leonard Company purchased a building on August 1, 2021 for P2,960,000 plus prepaid insurance for one year P12,000. The building has an estimated useful

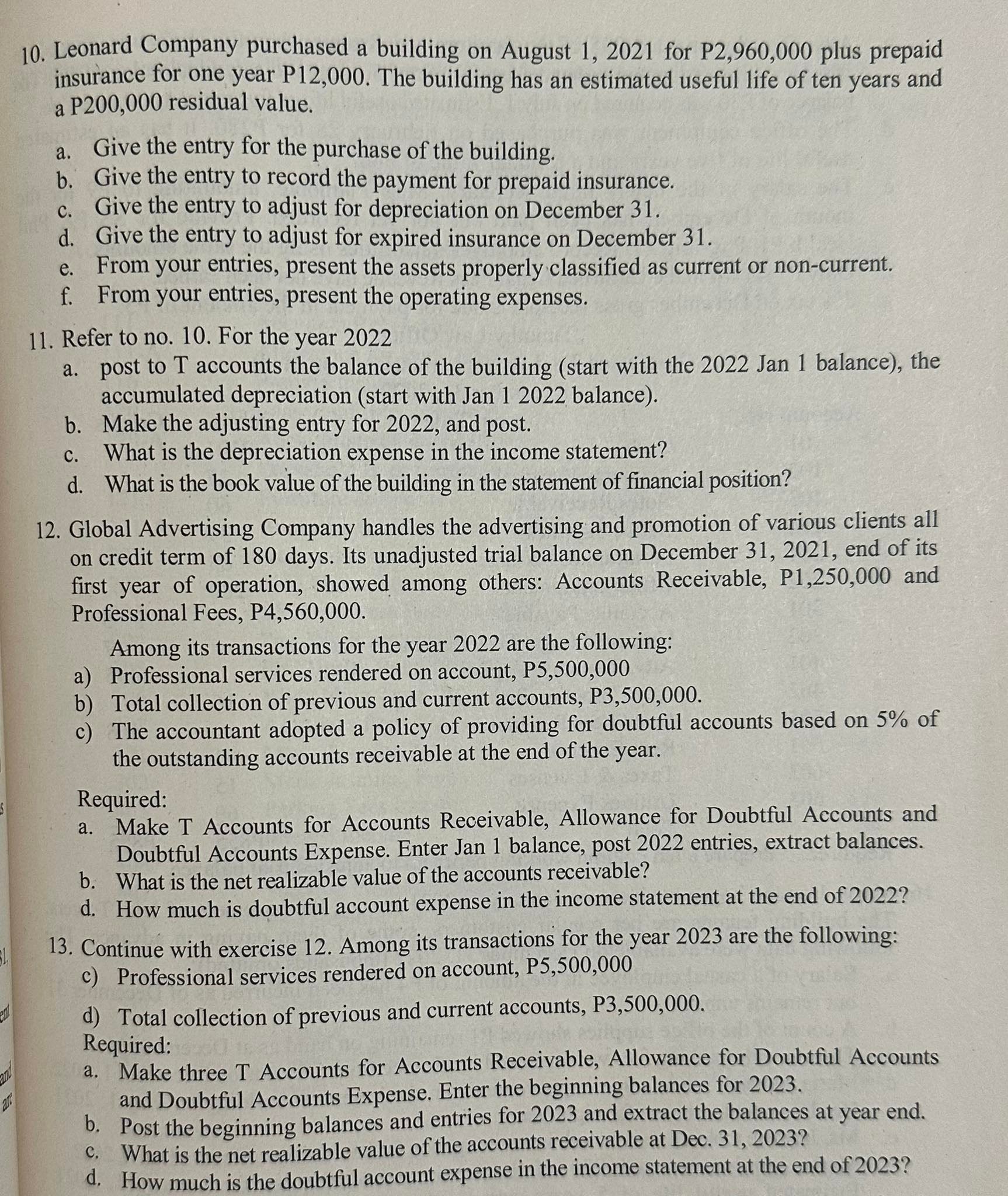

10. Leonard Company purchased a building on August 1, 2021 for P2,960,000 plus prepaid insurance for one year P12,000. The building has an estimated useful life of ten years and a P200,000 residual value. a. Give the entry for the purchase of the building. b. Give the entry to record the payment for prepaid insurance. c. Give the entry to adjust for depreciation on December 31 . d. Give the entry to adjust for expired insurance on December 31. e. From your entries, present the assets properly classified as current or non-current. f. From your entries, present the operating expenses. 11. Refer to no. 10. For the year 2022 a. post to T accounts the balance of the building (start with the 2022 Jan 1 balance), the accumulated depreciation (start with Jan 12022 balance). b. Make the adjusting entry for 2022 , and post. c. What is the depreciation expense in the income statement? d. What is the book value of the building in the statement of financial position? 12. Global Advertising Company handles the advertising and promotion of various clients all on credit term of 180 days. Its unadjusted trial balance on December 31,2021, end of its first year of operation, showed among others: Accounts Receivable, P1,250,000 and Professional Fees, P4,560,000. Among its transactions for the year 2022 are the following: a) Professional services rendered on account, P5,500,000 b) Total collection of previous and current accounts, P3,500,000. c) The accountant adopted a policy of providing for doubtful accounts based on 5% of the outstanding accounts receivable at the end of the year. Required: a. Make T Accounts for Accounts Receivable, Allowance for Doubtful Accounts and Doubtful Accounts Expense. Enter Jan 1 balance, post 2022 entries, extract balances. b. What is the net realizable value of the accounts receivable? d. How much is doubtful account expense in the income statement at the end of 2022? 13. Continue with exercise 12 . Among its transactions for the year 2023 are the following: c) Professional services rendered on account, P5,500,000 d) Total collection of previous and current accounts, P3,500,000. Required: a. Make three T Accounts for Accounts Receivable, Allowance for Doubtful Accounts and Doubtful Accounts Expense. Enter the beginning balances for 2023. b. Post the beginning balances and entries for 2023 and extract the balances at year end. c. What is the net realizable value of the accounts receivable at Dec. 31,2023 ? d. How much is the doubtful account expense in the income statement at the end of 2023

10. Leonard Company purchased a building on August 1, 2021 for P2,960,000 plus prepaid insurance for one year P12,000. The building has an estimated useful life of ten years and a P200,000 residual value. a. Give the entry for the purchase of the building. b. Give the entry to record the payment for prepaid insurance. c. Give the entry to adjust for depreciation on December 31 . d. Give the entry to adjust for expired insurance on December 31. e. From your entries, present the assets properly classified as current or non-current. f. From your entries, present the operating expenses. 11. Refer to no. 10. For the year 2022 a. post to T accounts the balance of the building (start with the 2022 Jan 1 balance), the accumulated depreciation (start with Jan 12022 balance). b. Make the adjusting entry for 2022 , and post. c. What is the depreciation expense in the income statement? d. What is the book value of the building in the statement of financial position? 12. Global Advertising Company handles the advertising and promotion of various clients all on credit term of 180 days. Its unadjusted trial balance on December 31,2021, end of its first year of operation, showed among others: Accounts Receivable, P1,250,000 and Professional Fees, P4,560,000. Among its transactions for the year 2022 are the following: a) Professional services rendered on account, P5,500,000 b) Total collection of previous and current accounts, P3,500,000. c) The accountant adopted a policy of providing for doubtful accounts based on 5% of the outstanding accounts receivable at the end of the year. Required: a. Make T Accounts for Accounts Receivable, Allowance for Doubtful Accounts and Doubtful Accounts Expense. Enter Jan 1 balance, post 2022 entries, extract balances. b. What is the net realizable value of the accounts receivable? d. How much is doubtful account expense in the income statement at the end of 2022? 13. Continue with exercise 12 . Among its transactions for the year 2023 are the following: c) Professional services rendered on account, P5,500,000 d) Total collection of previous and current accounts, P3,500,000. Required: a. Make three T Accounts for Accounts Receivable, Allowance for Doubtful Accounts and Doubtful Accounts Expense. Enter the beginning balances for 2023. b. Post the beginning balances and entries for 2023 and extract the balances at year end. c. What is the net realizable value of the accounts receivable at Dec. 31,2023 ? d. How much is the doubtful account expense in the income statement at the end of 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started