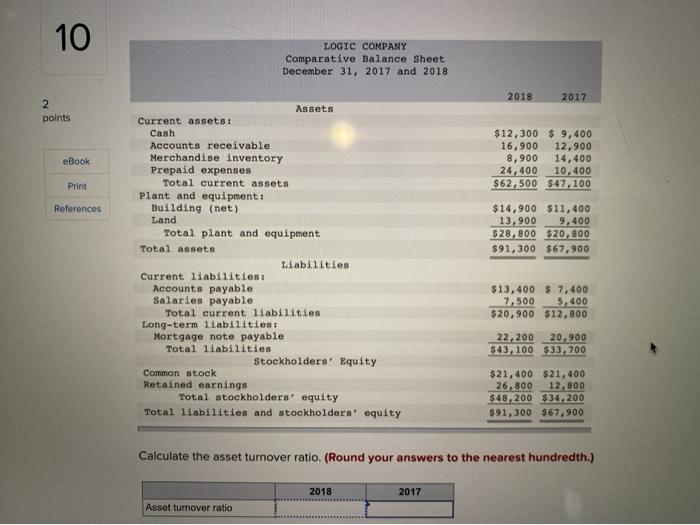

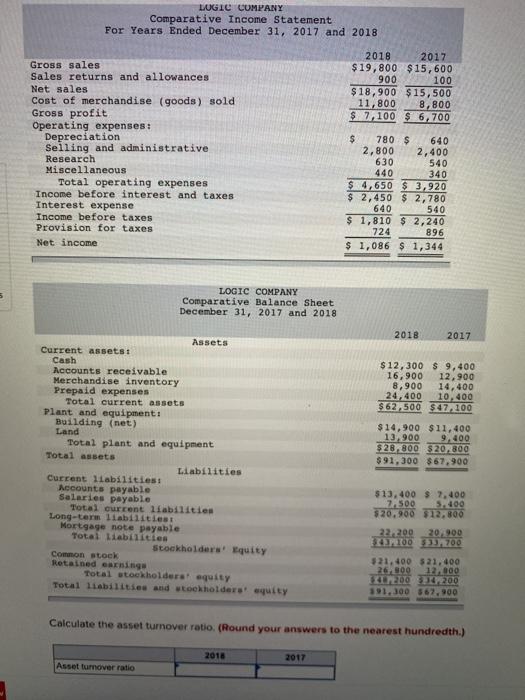

10 LOGIC COMPANY Comparative Balance Sheet December 31, 2017 and 2018 2018 2017 2 points eBook $12,300 $ 9,400 16,900 12,900 8,900 14,400 24,400 10,400 $62,500 $47,100 Print References $14,900 $11,400 13,900 9,400 $28,800 $20,800 $91,300 $67,900 Assets Current assets! Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) Land Total plant and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term liabilities Mortgage note payable Total liabilities Stockholders' Equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $13, 400 $ 7,400 7,500 5,400 $ 20,900 $12,800 22,200 20.900 $43, 100 $33,700 $21, 400 $21,400 26,800 12,800 $48,200 $34,200 $91,300 $67,900 Calculate the asset turnover ratio. (Round your answers to the nearest hundredth.) 2018 2017 Asset turnover ratio LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2017 and 2018 2018 2017 $19,800 $ 15,600 900 100 $ 18,900 $15,500 11,800 8,800 $ 7,100 $ 6,700 Gross sales Sales returns and allowances Net sales Cost of merchandise (goods) sold Gross profit Operating expenses: Depreciation Selling and administrative Research Miscellaneous Total operating expenses Income before interest and taxes Interest expense Income before taxes Provision for taxes Net income $ 780 $ 640 2,800 2,400 630 540 440 340 $ 4,650 $ 3,920 $ 2,450 $ 2,780 640 540 $ 1,810 $ 2, 240 724 896 $ 1,086 $ 1,344 6 LOGIC COMPANY Comparative Balance Sheet December 31, 2017 and 2018 2018 2017 Assets Current assets : Cash Accounts receivable Merchandise inventory Prepaid expenses Total current assets Plant and equipment: Building (net) Land Total plant and equipment Total assets Liabilities Current liabilities: Accounts payable Salaries payable Total current liabilities Long-term 11 abilities Mortgage note payable Total Liabilities Stockholders' Equity Common stock Retained earning Total stockholders' equity Total liabilities and stockholders' equity $ 12,300 $ 9,400 16,900 12,900 8,900 14,400 24,400 10,400 $62,500 $47.100 $14,900 $11,400 13.900 9,400 $28.800 $20,800 $91,300 $67,900 $13,400 $ 7,400 2500 5.400 $20.900 $12,800 22.200 20.990 OD 33200 $21.400 521,400 26,309 12000 EXLEDO 2200 191.300 562.900 Calculate the asset turnover ratio. (Round your answers to the nearest hundredth.) 2018 2017 Asset turnover ratio