Answered step by step

Verified Expert Solution

Question

1 Approved Answer

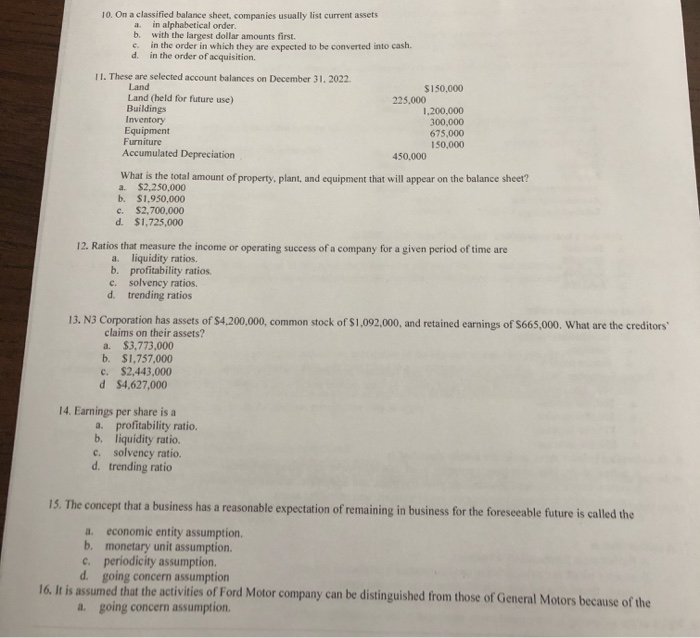

10. On a classified balance sheet, companies usually list current assets in alphabetical order. with the largest dollar amounts first. in the order in

10. On a classified balance sheet, companies usually list current assets in alphabetical order. with the largest dollar amounts first. in the order in which they are expected to be converted into cash. in the order of acquisition. a. b. e. d. 11. These are selected account balances on December 31, 2022. Land Land (held for future use) Buildings Inventory Equipment Furniture Accumulated Depreciation a. b. $1,950,000 c. $2,700,000 d. $1,725,000 450,000 What is the total amount of property, plant, and equipment that will appear on the balance sheet? $2,250,000 $150,000 a. $3,773,000 b. $1,757,000 c. $2,443,000 d $4,627,000 225,000 12. Ratios that measure the income or operating success of a company for a given period of time are a. liquidity ratios. b. profitability ratios. c. solvency ratios. d. trending ratios 14. Earnings per share is a 1,200,000 300,000 675,000 150,000 13. N3 Corporation has assets of $4,200,000, common stock of $1,092,000, and retained earnings of $665,000. What are the creditors' claims on their assets? a. profitability ratio. b. liquidity ratio. c. solvency ratio. d. trending ratio 15. The concept that a business has a reasonable expectation of remaining in business for the foreseeable future is called the a. economic entity assumption. b. monetary unit assumption. c. periodicity assumption. d. going concern assumption 16. It is assumed that the activities of Ford Motor company can be distinguished from those of General Motors because of the a. going concern assumption.

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Solution to Q 10 Under classified balan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started