10. On a contract, you have a choice of receiving $25,000 six years from now or $50,000 twelve years from now. At what implied

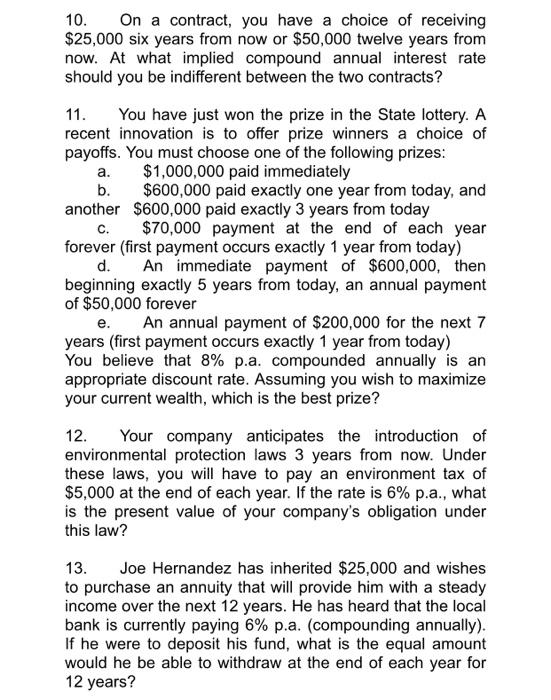

10. On a contract, you have a choice of receiving $25,000 six years from now or $50,000 twelve years from now. At what implied compound annual interest rate should you be indifferent between the two contracts? 11. You have just won the prize in the State lottery. A recent innovation is to offer prize winners a choice of payoffs. You must choose one of the following prizes: $1,000,000 paid immediately a. b. $600,000 paid exactly one year from today, and another $600,000 paid exactly 3 years from today C. $70,000 payment at the end of each year forever (first payment occurs exactly 1 year from today) d. An immediate payment of $600,000, then beginning exactly 5 years from today, an annual payment of $50,000 forever e. An annual payment of $200,000 for the next 7 years (first payment occurs exactly 1 year from today) You believe that 8% p.a. compounded annually is an appropriate discount rate. Assuming you wish to maximize your current wealth, which is the best prize? 12. Your company anticipates the introduction of environmental protection laws 3 years from now. Under these laws, you will have to pay an environment tax of $5,000 at the end of each year. If the rate is 6% p.a., what is the present value of your company's obligation under this law? 13. Joe Hernandez has inherited $25,000 and wishes to purchase an annuity that will provide him with a steady income over the next 12 years. He has heard that the local bank is currently paying 6% p.a. (compounding annually). If he were to deposit his fund, what is the equal amount would he be able to withdraw at the end of each year for 12 years?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The following are the two choices given Option 1 25000 in 6 years from now Option 2 50000 in 12 year...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started