Answered step by step

Verified Expert Solution

Question

1 Approved Answer

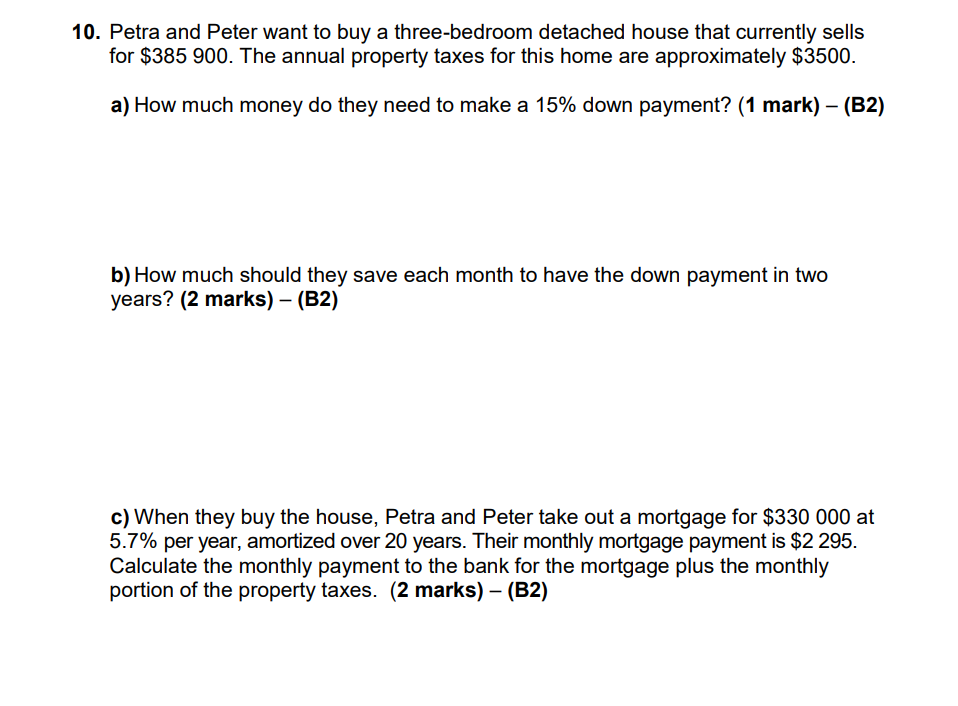

10. Petra and Peter want to buy a three-bedroom detached house that currently sells for $385 900. The annual property taxes for this home

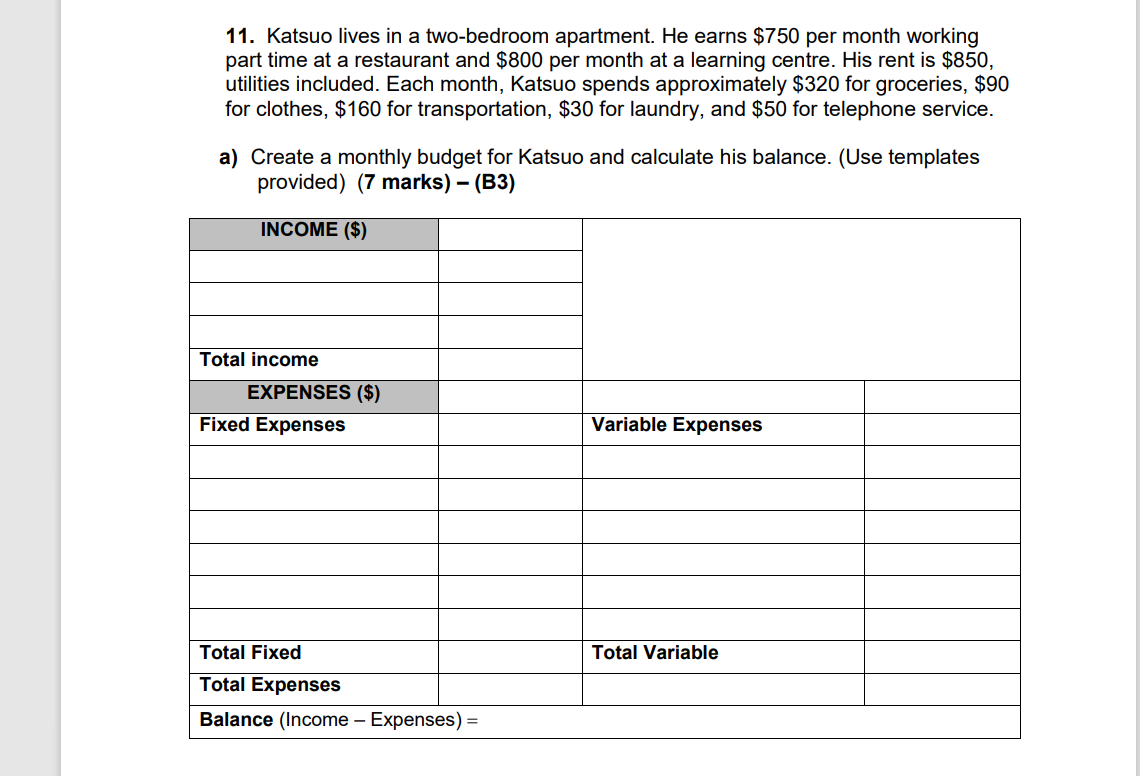

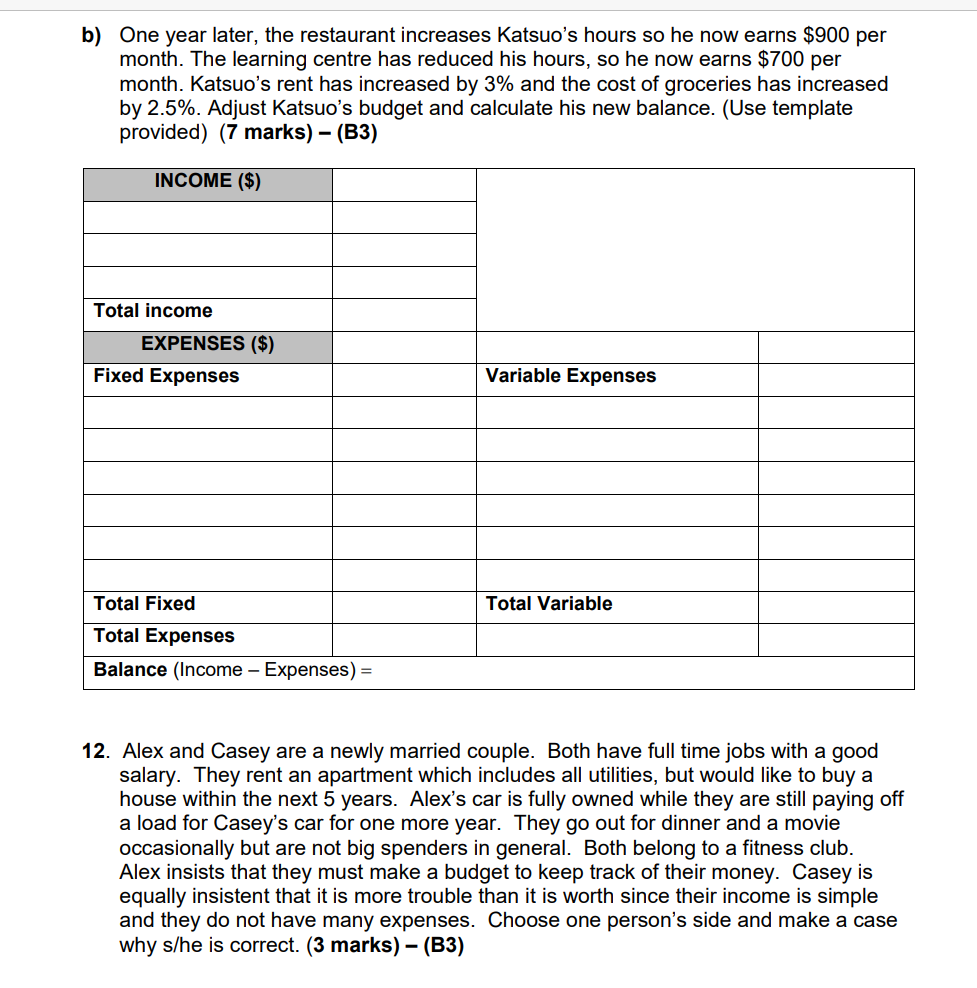

10. Petra and Peter want to buy a three-bedroom detached house that currently sells for $385 900. The annual property taxes for this home are approximately $3500. a) How much money do they need to make a 15% down payment? (1 mark) (B2) b) How much should they save each month to have the down payment in two years? (2 marks) - (B2) c) When they buy the house, Petra and Peter take out a mortgage for $330 000 at 5.7% per year, amortized over 20 years. Their monthly mortgage payment is $2 295. Calculate the monthly payment to the bank for the mortgage plus the monthly portion of the property taxes. (2 marks) (B2) 11. Katsuo lives in a two-bedroom apartment. He earns $750 per month working part time at a restaurant and $800 per month at a learning centre. His rent is $850, utilities included. Each month, Katsuo spends approximately $320 for groceries, $90 for clothes, $160 for transportation, $30 for laundry, and $50 for telephone service. a) Create a monthly budget for Katsuo and calculate his balance. (Use templates provided) (7 marks) - (B3) INCOME ($) Total income EXPENSES ($) Fixed Expenses Total Fixed Total Expenses Balance (Income - Expenses) = Variable Expenses Total Variable b) One year later, the restaurant increases Katsuo's hours so he now earns $900 per month. The learning centre has reduced his hours, so he now earns $700 per month. Katsuo's rent has increased by 3% and the cost of groceries has increased by 2.5%. Adjust Katsuo's budget and calculate his new balance. (Use template provided) (7 marks) - (B3) INCOME ($) Total income EXPENSES ($) Fixed Expenses Total Fixed Total Expenses Balance (Income - Expenses) = Variable Expenses Total Variable 12. Alex and Casey are a newly married couple. Both have full time jobs with a good salary. They rent an apartment which includes all utilities, but would like to buy a house within the next 5 years. Alex's car is fully owned while they are still paying off a load for Casey's car for one more year. They go out for dinner and a movie occasionally but are not big spenders in general. Both belong to a fitness club. Alex insists that they must make a budget to keep track of their money. Casey is equally insistent that it is more trouble than it is worth since their income is simple and they do not have many expenses. Choose one person's side and make a case why s/he is correct. (3 marks) - (B3)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

10 a 15 of 385900 is 015 385900 57885 b They need to save 57885 in 2 years In 2 years there are 24 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started