Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(10) Please explain this through inputs on a business calculator (CF0, F01, etc.) Ruby is considering opening a new business for a long-term care facility.

(10) Please explain this through inputs on a business calculator (CF0, F01, etc.)

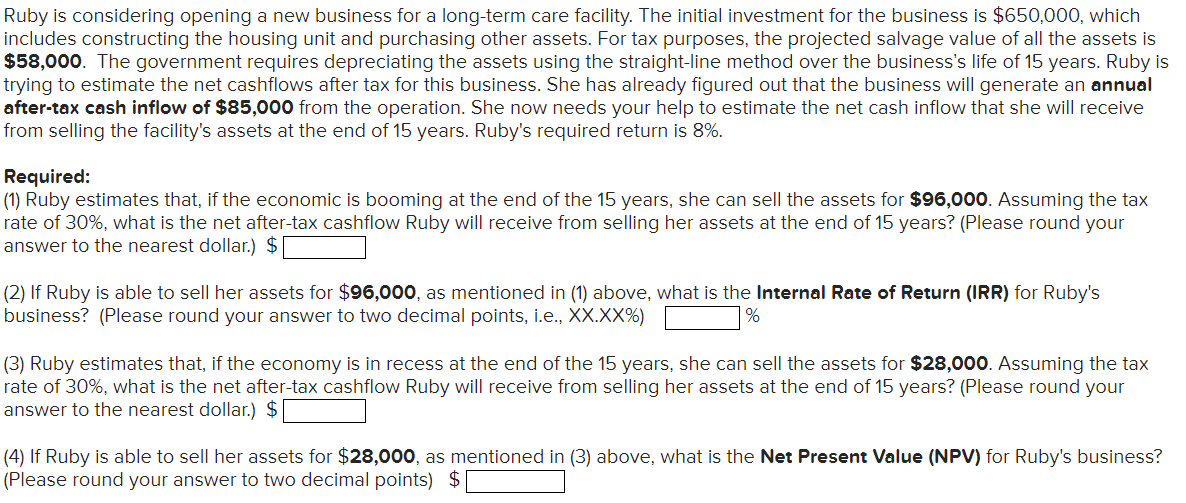

Ruby is considering opening a new business for a long-term care facility. The initial investment for the business is $650,000, which includes constructing the housing unit and purchasing other assets. For tax purposes, the projected salvage value of all the assets is $58,000. The government requires depreciating the assets using the straight-line method over the business's life of 15 years. Ruby is trying to estimate the net cashflows after tax for this business. She has already figured out that the business will generate an annual after-tax cash inflow of $85,000 from the operation. She now needs your help to estimate the net cash inflow that she will receive from selling the facility's assets at the end of 15 years. Ruby's required return is 8%. Required: (1) Ruby estimates that, if the economic is booming at the end of the 15 years, she can sell the assets for $96,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Ruby will receive from selling her assets at the end of 15 years? (Please round your answer to the nearest dollar.) \$ (2) If Ruby is able to sell her assets for $96,000, as mentioned in (1) above, what is the Internal Rate of Return (IRR) for Ruby's business? (Please round your answer to two decimal points, i.e., XX.XX\%) \% (3) Ruby estimates that, if the economy is in recess at the end of the 15 years, she can sell the assets for $28,000. Assuming the tax rate of 30%, what is the net after-tax cashflow Ruby will receive from selling her assets at the end of 15 years? (Please round your answer to the nearest dollar.) \$ (4) If Ruby is able to sell her assets for $28,000, as mentioned in (3) above, what is the Net Present Value (NPV) for Ruby's business? (Please round your answer to two decimal points) \$Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started