Question

10 points Exercise 6-14 Reducing physical inventory to cost-retail method LO6 During 2020, Harmony Co. sold $529,000 of merchandise at marked retail prices. At the

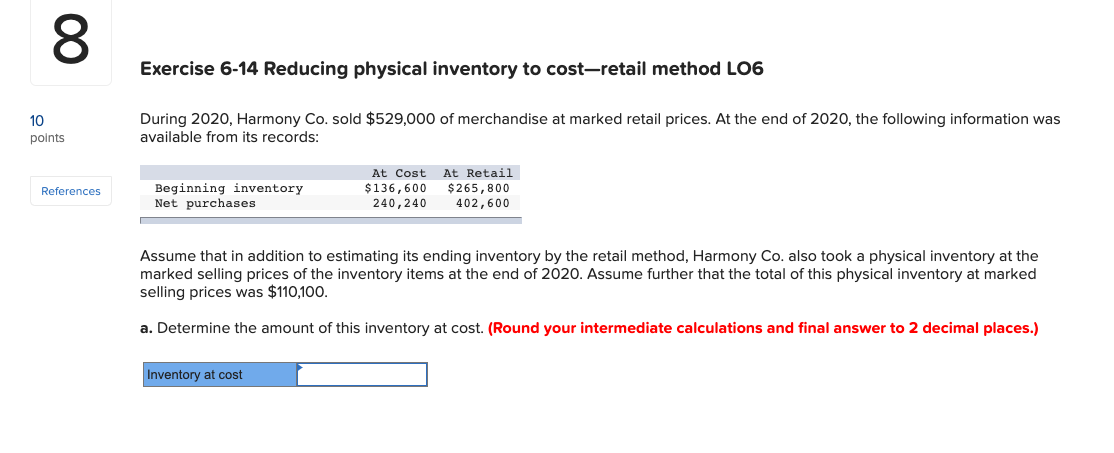

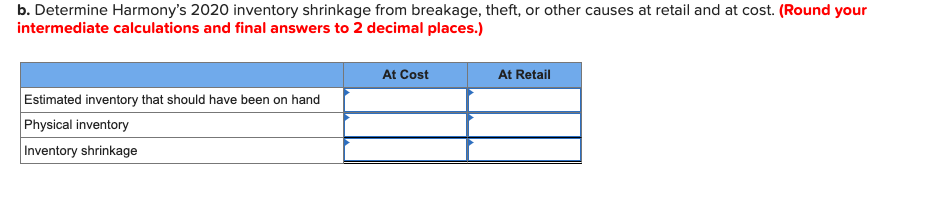

10 points Exercise 6-14 Reducing physical inventory to cost-retail method LO6 During 2020, Harmony Co. sold $529,000 of merchandise at marked retail prices. At the end of 2020, the following information was available from its records: 00 8 References Beginning inventory Net purchases At Cost At Retail $136,600 240,240 $265,800 402,600 Assume that in addition to estimating its ending inventory by the retail method, Harmony Co. also took a physical inventory at the marked selling prices of the inventory items at the end of 2020. Assume further that the total of this physical inventory at marked selling prices was $110,100. a. Determine the amount of this inventory at cost. (Round your intermediate calculations and final answer to 2 decimal places.) Inventory at cost b. Determine Harmony's 2020 inventory shrinkage from breakage, theft, or other causes at retail and at cost. (Round your intermediate calculations and final answers to 2 decimal places.) Estimated inventory that should have been on hand Physical inventory Inventory shrinkage At Cost At Retail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started