Question

(10 points) Part I: Sally needs to choose between 2 health insurance plans. Assume Sally will use $4,500 worth of medical services this year.

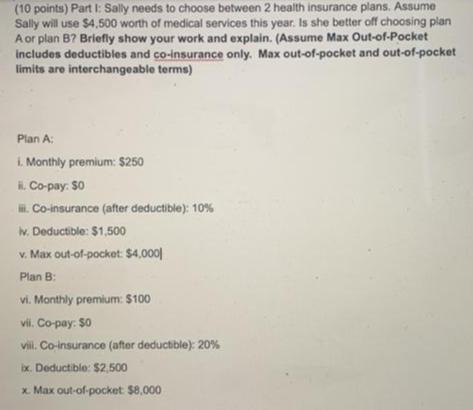

(10 points) Part I: Sally needs to choose between 2 health insurance plans. Assume Sally will use $4,500 worth of medical services this year. Is she better off choosing plan A or plan B? Briefly show your work and explain. (Assume Max Out-of-Pocket Includes deductibles and co-insurance only., Max out-of-pocket and out-of-pocket limits are interchangeable terms) Plan A: 1. Monthly premium: $250 . Co-pay. $0 . Co-insurance (after deductible): 10% v. Deductible: $1,500 v. Max out-of-pocket: $4,000| H Plan B: vi. Monthly premium: $100 vii. Co-pay: $0 vili. Co-insurance (after deductible): 20% ix. Deductible: $2,500 x. Max out-of-pocket $8,000

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Let us calculate how much total money will be spent in each planFirst we will understand meaning of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Randy Billingsley, Lawrence J. Gitman, Michael D. Joehnk

14th edition

978-1305887725, 1305887727, 1305636619, 978-1305636613

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App