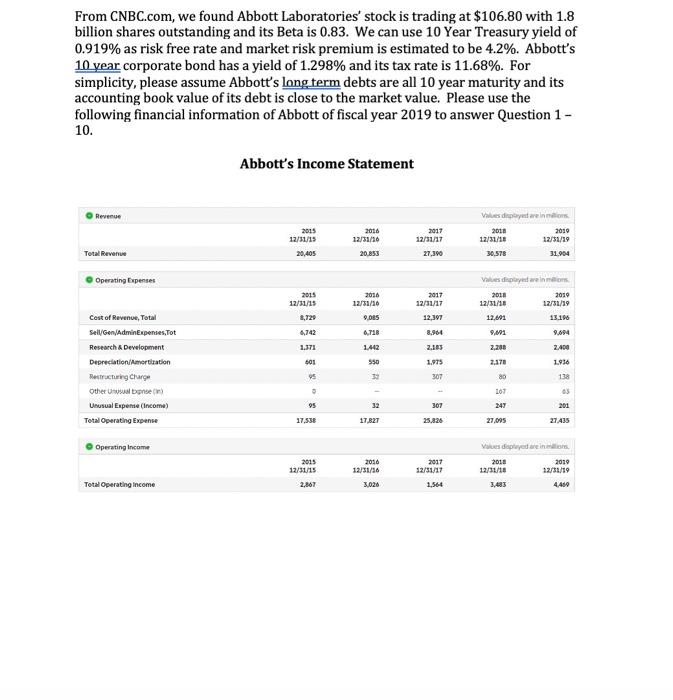

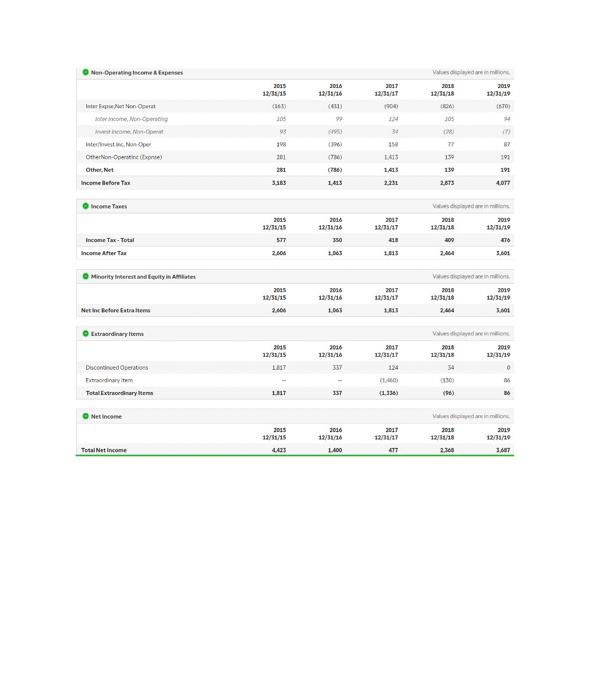

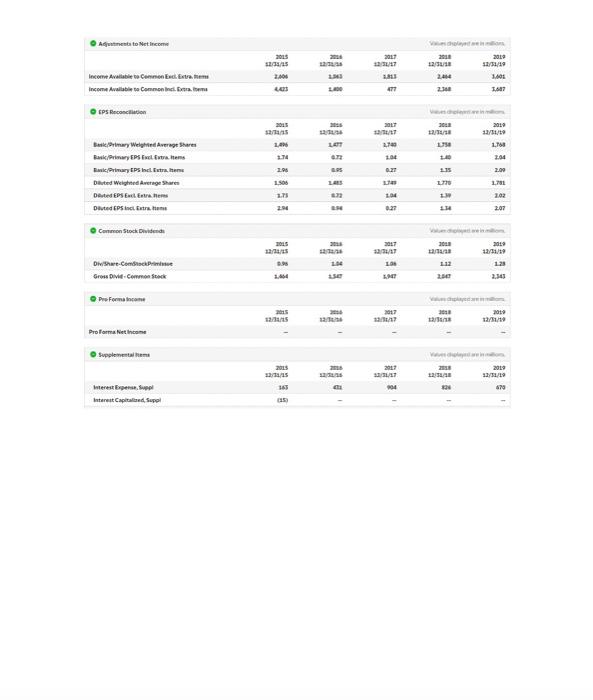

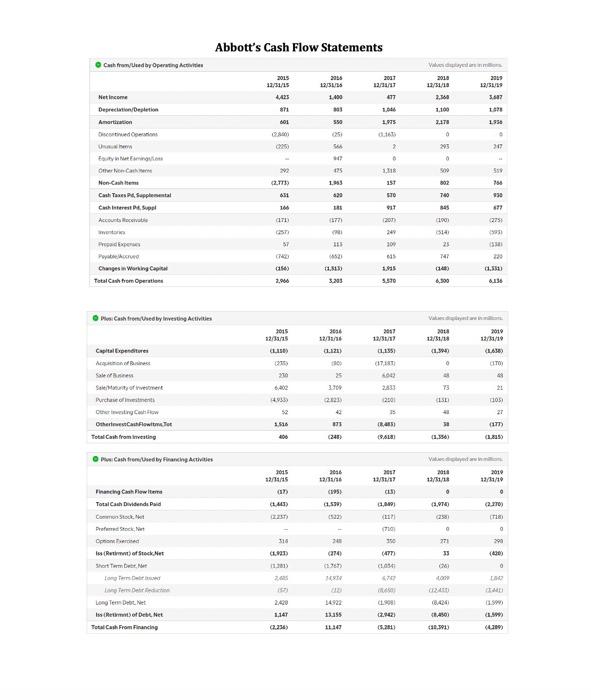

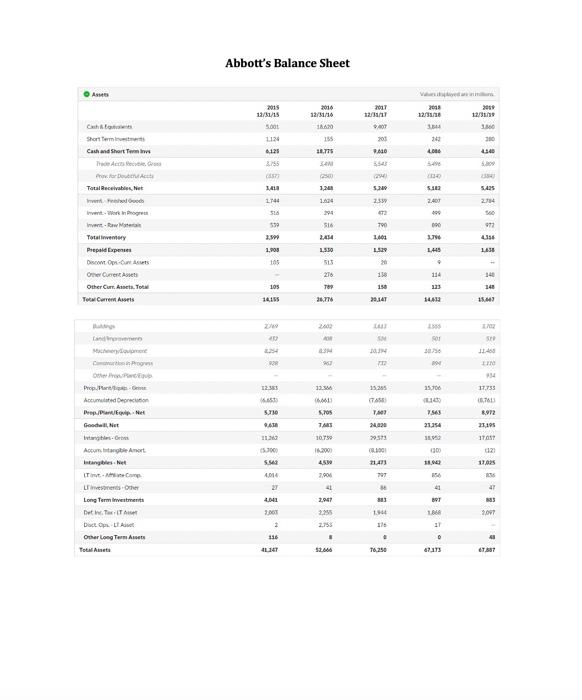

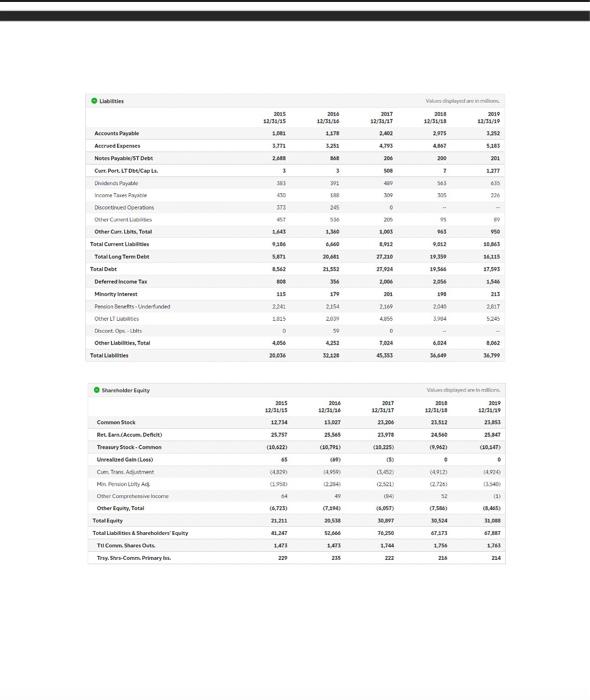

10 points Save Answer QUESTION 3 What are the pros and cons of using EV/EBITDA for equity valuation? For the toolbar, press ALT+F10 (PO) or ALT+FN+F10 (Mac). BI VS Paragraph Arial 14px !!! P O WORDS POWERED BY TINY QUESTION 4 10 points Save Answer What is Abbott's price book ratlo based on its 2019 financial Information. Should you use price book ratio for Abbott's equity valuation? Why or why not? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI VS Paragraph 14px A 2 I. Arial ili P O WORDS POWERED BY TINY From CNBC.com, we found Abbott Laboratories' stock is trading at $106.80 with 1.8 billion shares outstanding and its Beta is 0.83. We can use 10 Year Treasury yield of 0.919% as risk free rate and market risk premium is estimated to be 4.2%. Abbott's 10 year corporate bond has a yield of 1.298% and its tax rate is 11.68%. For simplicity, please assume Abbott's long term debts are all 10 year maturity and its accounting book value of its debt is close to the market value. Please use the following financial information of Abbott of fiscal year 2019 to answer Question 1 - 10. Abbott's Income Statement Revenue 2016 12/31/10 20.858 2017 12/31/17 12/31/15 20,405 Valves derno 2010 2019 12/31/15 12/31/19 30.578 31.904 Total Revenue Operating Expenses 12/31/15 2016 12/31/10 9.085 Values disayar inom 2018 2059 12/31/18 12/31/19 12.691 13.196 9.91 9.694 2017 12/31/17 12,397 8.964 2.15 8,729 6,742 6.118 1.371 2,200 2.400 1442 550 1.975 Cost of Revenue, Total Sell/Gen/Admin Expenses, Tot Research & Development Depreciation/Amortization Destructuring Charge Other ben Unusual Expense (Income) Total Operating Expense 601 95 1.936 138 33 307 80 167 95 307 201 27 A35 17,536 17.827 25.826 27.095 Operating Income 2015 12/31/15 2016 12/31/36 2017 12/31/17 1.564 Valuesdaptayed areas 2018 2019 12/31/18 12/31/19 4,459 Total Operating Income 2.67 3.026 Nun Operating come Expenses 2015 12/31/15 2018 12/31/16 2007 13/35/ 1000 Warmio 2018 2019 12/31/10 70 PIT Cor come on one.com 34 39 15 150 193 Othethion-partiet Other Net Income Before Tas 14 191 281 3.ES 1423 2.673 4.77 Income 2005 12/15 2017 12/31/17 2006 12/30/16 350 1.06 Ver 2018 2009 12/31/18 12/11/11 200 T6 2.46 5.601 Income Tax Total Income After Tax STT 2.306 Minority interest and Equity in Amster 2005 12/31/25 2100 2016 12/30/16 1.065 2017 12/31/17 111 Videos 2016 2019 12/31/18 12/31/10 101 Net In Betreftram Extraordinary 2015 2018 2019 2016 12/31/16 2017 12/31/1 LT 337 0 Discontinued Ouertos Extraordiowy item Total Extraordinary 11301 TIT 337 (1.330) 096) B6 Net Income 2015 2017 127 2016 12/30 1400 Vio 2018 2019 12/31 2.300 37 Tosal Net Income ATT 2017 2011 235/35 2.000 Income Available to Connen Exc. Extrem Income Available Connene.. em 2414 2:31 2019 32/31/10 . 1601 47 CPS Reconciliation 2015 30 13/14 T 2.100 1.16 LY 2:06 Basic Primary Weled Average Shares Bask/Primary EPS Excel Entreten Bask/Primary EPS beletre teme Diluted Weighted Average Shares Dexted EPS Excl. Entre em Dived EPS incl btre em 32/51/59 1.100 2.00 2.00 1781 1.02 2:07 1.500 2.1 3.2 104 1 0.27 Common Stock Divided 2015 2017 12/30/09 125 LOS 132 Div Share Contact Gross Dividemme Pro Forma 2 2010 12/31/10 Proforma Net income 2015 25/1 904 28 12/59/28 2019 32/33/19 679 365 Interest Expensive Interest Capitalized Super Abbott's Cash Flow Statements Cash from Uued by Operating STOR / 2006 2001 via a 2010 2009 12/09 2. 3.427 1.100 1.400 477 Net Income Deprecation/Destion 811 601 550 1.215 2.1 1550 www.wowe 0 293 20 O 125 1. 500 292 (2.TT) 5 1944 35T 802 700 631 620 STO 230 1 ET 145 1901 1877 2751 OC Non-Cashme Cash Tas P. Supplemental Cach terest Pupp Account cele wento Fredere Pove Changes in Working Capit TotalCath from Operation 57 15 06 SE SES NE 10 09 11.30 3.205 1.1) 6.136 2.966 5.510 4.500 Cushioned by investing Activities 2017 1015 12/30/15 LO 306 12/11/16 1.121) 12/01/18 2010 // 1,1551 (1.3040 Capital Expenditures Sences O CITO 25 230 6.00 4.933 73 2833 2001 2023 151 ISOT 15 Purchase Othering Chow Otherefowi.To Total Cash from 52 1.516 2T (177 TER 18.45 09.03 50 (3.356 Vaatwo 2018 2010 12/31/18 12/01/10 90 90/ 12/14/15 ) (95) O O 4) 530 9.990 Cart TA Financing Catere TotalCath Dividendi Bid Co Stock Preferred Stock Net One In Rett) of Stock.Net Short Term Deere 13/10/11 CS 11,00 (211 710 350 (47 (16541 0 O TAL 290 CL91) 0974 ST (600 190 HOP TI 2.420 La Terre Deli Long Term Date Is het of Debt.Net Total Cash From Financing 108 262) 2.59 1. 1.147 13355 1.450 2.2345 0,3913 Abbott's Balance Sheet 2016 2012 12/30/38 12/30/12 Cathos Short Termine Cash and Short Termine 50 UN 6,125 2.755 12/31/17 MOT 703 9.440 20 4. 11.775 4140 from Total Receivables, et 5. 2.39 2.754 w 1744 S16 559 1.404 294 100 090 972 700 1.46 Uso L3 1,005 1.550 1.329 LHS Inventowe Total inventory Prepeld Expenses Discount One Current Other Curry Torrent 105 276 TOP 26.776 105 14195 158 150 20.41 34 148 323 141 15.441 10 40 JAN Com 11 12:35 1234 15.25 25.700 Prop. Accumulated Deco Prop./Panel Goochelle 17,735 1,700 8.972 23.195 5.11 7.543 5.70 7.ABS 9. TAB 22 20:573 21054 10.750 TOST 300 21 5300 S. 4014 17025 21:23 797 1.2001 4.5 2.90 41 2.967 2,99 4.641 Tint- These Long Term investments Det in. Tus IT ALS Doctopul Other Long Terms Total 4 BT 303 1.544 2 31 156 . 48 3 52.666 76,250 67.13 67.587 2010 2005 12/3 2007 2010 1/31/10 12/55R 2.975 42 3.7 793 3.18 2008 MAR 200 201 3 so 7 1.27 30 565 200 95 2014 Accounts Payable Attrud Expenses Nors Payable/S Debe Cure Port ATOL Caps Dudeni Pope Inco Dweden Ole Other Cambits. To Total Current Tolong Term Debre Total Debt Deferred come ITS 24 0 20 1,00 13 26 1,6 6.40 2001 9.012 10. 1.02 21220 19.30 1115 2 306 27.94 2.00 200 2958 1.54 2045 361 Precio Benetsunderfunded OLTO Decent coher Listia, Tata Total 3 110 21 20 se 42 5220 . 110 6.024 4.166 20.036 36.79 Sheldur 2006 2016 2011 12/31/17 12/30/35 12.754 23. 23.353 33.001 25.505 10,7) 24.50 Comme Sack Relarem.Deficie Treasury Sec.Com Und G Com 25.11 (10.5221 21.910 20.2352 030 CLOSET 65 4320 090 4923 2.0 12 54 4723 21210 20.30 MUT 0.134 11. De Comedo.com Other liquiry, Total Totality Total Labie Shareholder Tu Comm. Stres Outs Thay. She-Com.Primary LES 1.14 1756 1478 229 235 226 10 points Save Answer QUESTION 3 What are the pros and cons of using EV/EBITDA for equity valuation? For the toolbar, press ALT+F10 (PO) or ALT+FN+F10 (Mac). BI VS Paragraph Arial 14px !!! P O WORDS POWERED BY TINY QUESTION 4 10 points Save Answer What is Abbott's price book ratlo based on its 2019 financial Information. Should you use price book ratio for Abbott's equity valuation? Why or why not? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI VS Paragraph 14px A 2 I. Arial ili P O WORDS POWERED BY TINY From CNBC.com, we found Abbott Laboratories' stock is trading at $106.80 with 1.8 billion shares outstanding and its Beta is 0.83. We can use 10 Year Treasury yield of 0.919% as risk free rate and market risk premium is estimated to be 4.2%. Abbott's 10 year corporate bond has a yield of 1.298% and its tax rate is 11.68%. For simplicity, please assume Abbott's long term debts are all 10 year maturity and its accounting book value of its debt is close to the market value. Please use the following financial information of Abbott of fiscal year 2019 to answer Question 1 - 10. Abbott's Income Statement Revenue 2016 12/31/10 20.858 2017 12/31/17 12/31/15 20,405 Valves derno 2010 2019 12/31/15 12/31/19 30.578 31.904 Total Revenue Operating Expenses 12/31/15 2016 12/31/10 9.085 Values disayar inom 2018 2059 12/31/18 12/31/19 12.691 13.196 9.91 9.694 2017 12/31/17 12,397 8.964 2.15 8,729 6,742 6.118 1.371 2,200 2.400 1442 550 1.975 Cost of Revenue, Total Sell/Gen/Admin Expenses, Tot Research & Development Depreciation/Amortization Destructuring Charge Other ben Unusual Expense (Income) Total Operating Expense 601 95 1.936 138 33 307 80 167 95 307 201 27 A35 17,536 17.827 25.826 27.095 Operating Income 2015 12/31/15 2016 12/31/36 2017 12/31/17 1.564 Valuesdaptayed areas 2018 2019 12/31/18 12/31/19 4,459 Total Operating Income 2.67 3.026 Nun Operating come Expenses 2015 12/31/15 2018 12/31/16 2007 13/35/ 1000 Warmio 2018 2019 12/31/10 70 PIT Cor come on one.com 34 39 15 150 193 Othethion-partiet Other Net Income Before Tas 14 191 281 3.ES 1423 2.673 4.77 Income 2005 12/15 2017 12/31/17 2006 12/30/16 350 1.06 Ver 2018 2009 12/31/18 12/11/11 200 T6 2.46 5.601 Income Tax Total Income After Tax STT 2.306 Minority interest and Equity in Amster 2005 12/31/25 2100 2016 12/30/16 1.065 2017 12/31/17 111 Videos 2016 2019 12/31/18 12/31/10 101 Net In Betreftram Extraordinary 2015 2018 2019 2016 12/31/16 2017 12/31/1 LT 337 0 Discontinued Ouertos Extraordiowy item Total Extraordinary 11301 TIT 337 (1.330) 096) B6 Net Income 2015 2017 127 2016 12/30 1400 Vio 2018 2019 12/31 2.300 37 Tosal Net Income ATT 2017 2011 235/35 2.000 Income Available to Connen Exc. Extrem Income Available Connene.. em 2414 2:31 2019 32/31/10 . 1601 47 CPS Reconciliation 2015 30 13/14 T 2.100 1.16 LY 2:06 Basic Primary Weled Average Shares Bask/Primary EPS Excel Entreten Bask/Primary EPS beletre teme Diluted Weighted Average Shares Dexted EPS Excl. Entre em Dived EPS incl btre em 32/51/59 1.100 2.00 2.00 1781 1.02 2:07 1.500 2.1 3.2 104 1 0.27 Common Stock Divided 2015 2017 12/30/09 125 LOS 132 Div Share Contact Gross Dividemme Pro Forma 2 2010 12/31/10 Proforma Net income 2015 25/1 904 28 12/59/28 2019 32/33/19 679 365 Interest Expensive Interest Capitalized Super Abbott's Cash Flow Statements Cash from Uued by Operating STOR / 2006 2001 via a 2010 2009 12/09 2. 3.427 1.100 1.400 477 Net Income Deprecation/Destion 811 601 550 1.215 2.1 1550 www.wowe 0 293 20 O 125 1. 500 292 (2.TT) 5 1944 35T 802 700 631 620 STO 230 1 ET 145 1901 1877 2751 OC Non-Cashme Cash Tas P. Supplemental Cach terest Pupp Account cele wento Fredere Pove Changes in Working Capit TotalCath from Operation 57 15 06 SE SES NE 10 09 11.30 3.205 1.1) 6.136 2.966 5.510 4.500 Cushioned by investing Activities 2017 1015 12/30/15 LO 306 12/11/16 1.121) 12/01/18 2010 // 1,1551 (1.3040 Capital Expenditures Sences O CITO 25 230 6.00 4.933 73 2833 2001 2023 151 ISOT 15 Purchase Othering Chow Otherefowi.To Total Cash from 52 1.516 2T (177 TER 18.45 09.03 50 (3.356 Vaatwo 2018 2010 12/31/18 12/01/10 90 90/ 12/14/15 ) (95) O O 4) 530 9.990 Cart TA Financing Catere TotalCath Dividendi Bid Co Stock Preferred Stock Net One In Rett) of Stock.Net Short Term Deere 13/10/11 CS 11,00 (211 710 350 (47 (16541 0 O TAL 290 CL91) 0974 ST (600 190 HOP TI 2.420 La Terre Deli Long Term Date Is het of Debt.Net Total Cash From Financing 108 262) 2.59 1. 1.147 13355 1.450 2.2345 0,3913 Abbott's Balance Sheet 2016 2012 12/30/38 12/30/12 Cathos Short Termine Cash and Short Termine 50 UN 6,125 2.755 12/31/17 MOT 703 9.440 20 4. 11.775 4140 from Total Receivables, et 5. 2.39 2.754 w 1744 S16 559 1.404 294 100 090 972 700 1.46 Uso L3 1,005 1.550 1.329 LHS Inventowe Total inventory Prepeld Expenses Discount One Current Other Curry Torrent 105 276 TOP 26.776 105 14195 158 150 20.41 34 148 323 141 15.441 10 40 JAN Com 11 12:35 1234 15.25 25.700 Prop. Accumulated Deco Prop./Panel Goochelle 17,735 1,700 8.972 23.195 5.11 7.543 5.70 7.ABS 9. TAB 22 20:573 21054 10.750 TOST 300 21 5300 S. 4014 17025 21:23 797 1.2001 4.5 2.90 41 2.967 2,99 4.641 Tint- These Long Term investments Det in. Tus IT ALS Doctopul Other Long Terms Total 4 BT 303 1.544 2 31 156 . 48 3 52.666 76,250 67.13 67.587 2010 2005 12/3 2007 2010 1/31/10 12/55R 2.975 42 3.7 793 3.18 2008 MAR 200 201 3 so 7 1.27 30 565 200 95 2014 Accounts Payable Attrud Expenses Nors Payable/S Debe Cure Port ATOL Caps Dudeni Pope Inco Dweden Ole Other Cambits. To Total Current Tolong Term Debre Total Debt Deferred come ITS 24 0 20 1,00 13 26 1,6 6.40 2001 9.012 10. 1.02 21220 19.30 1115 2 306 27.94 2.00 200 2958 1.54 2045 361 Precio Benetsunderfunded OLTO Decent coher Listia, Tata Total 3 110 21 20 se 42 5220 . 110 6.024 4.166 20.036 36.79 Sheldur 2006 2016 2011 12/31/17 12/30/35 12.754 23. 23.353 33.001 25.505 10,7) 24.50 Comme Sack Relarem.Deficie Treasury Sec.Com Und G Com 25.11 (10.5221 21.910 20.2352 030 CLOSET 65 4320 090 4923 2.0 12 54 4723 21210 20.30 MUT 0.134 11. De Comedo.com Other liquiry, Total Totality Total Labie Shareholder Tu Comm. Stres Outs Thay. She-Com.Primary LES 1.14 1756 1478 229 235 226