Answered step by step

Verified Expert Solution

Question

1 Approved Answer

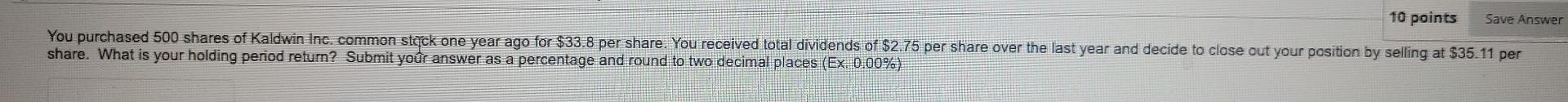

10 points Save Answer You purchased 500 shares of Kaldwin Inc. common stock one year ago for $33.8 per share. You received total dividends of

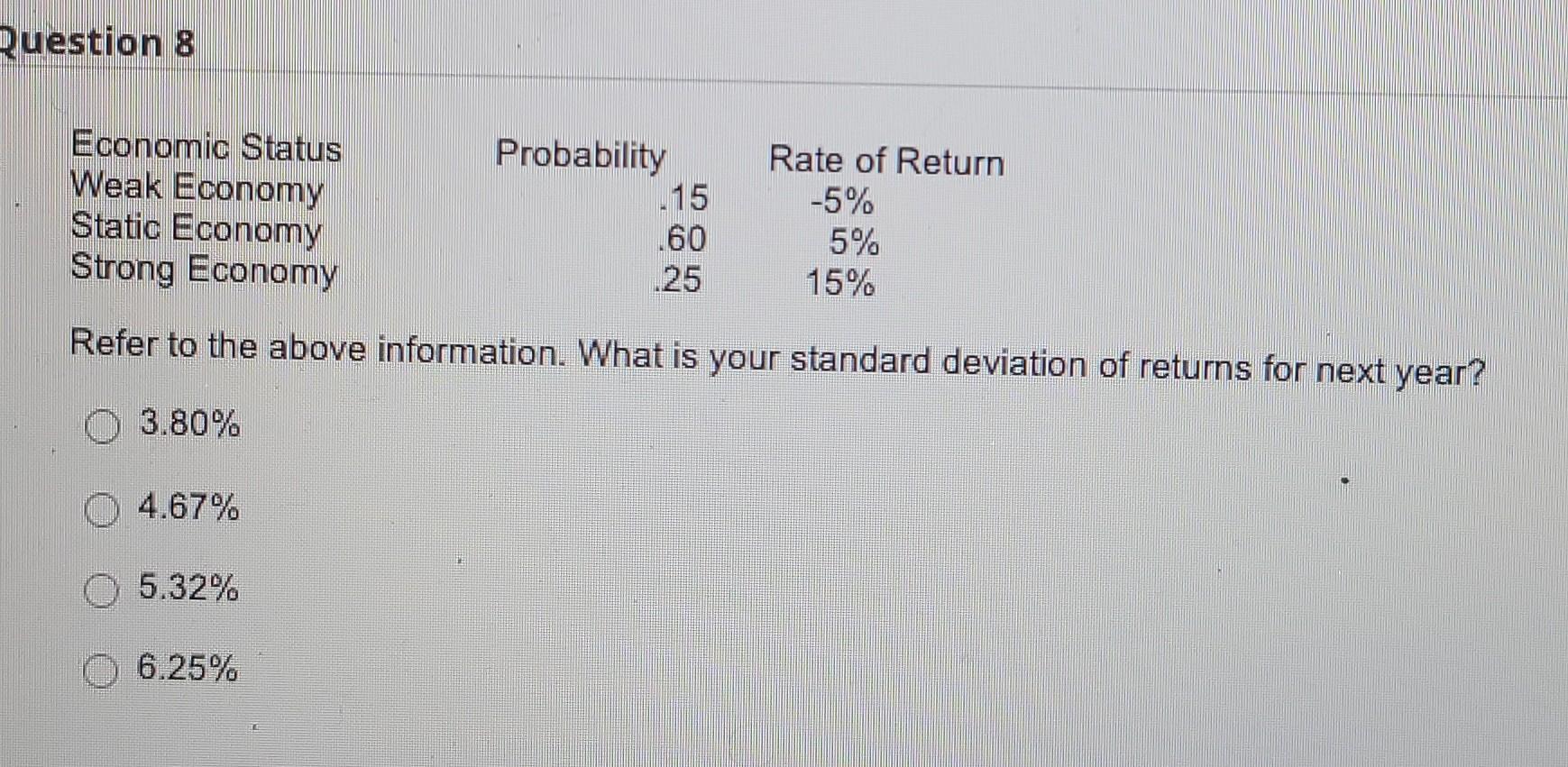

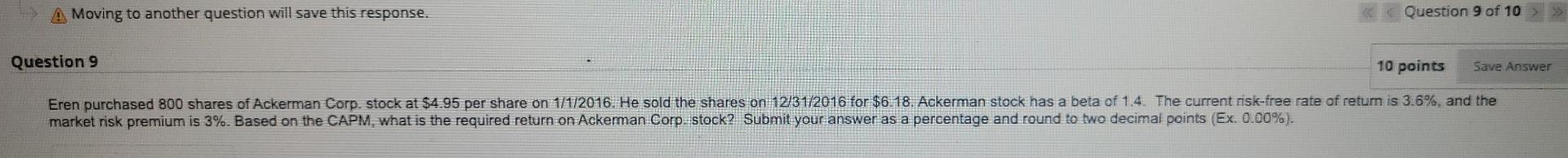

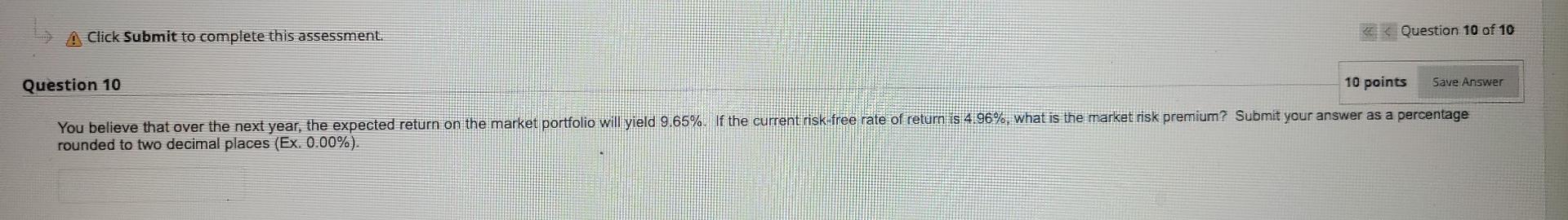

10 points Save Answer You purchased 500 shares of Kaldwin Inc. common stock one year ago for $33.8 per share. You received total dividends of $2.75 per share over the last year and decide to close out your position by selling at $35.11 per share. What is your holding period return? Submit your answer as a percentage and round to two decimal places (Ex. 0.00%) Question 8 Economic Status Weak Economy Static Economy Strong Economy Probability 15 .60 .25 Rate of Return -5% 5% 15% Refer to the above information. What is your standard deviation of returns for next year? 3.80% 4.67% 5.32% 6.25% A Moving to another question will save this response. Question 9 of 10 >> Question 9 10 points Save Answer Eren purchased 800 shares of Ackerman Corp. stock at $4.95 per share on 1/1/2016. He sold the shares on 12/31/2016 for $6. 18. Ackerman stock has a beta of 1.4. The current risk-free rate of return is 3.6%, and the market risk premium is 3%. Based on the CAPM, what is the required return on Ackerman Corp. stock? Submit your answer as a percentage and round to two decimal points (Ex. 0.00%). A Click Submit to complete this assessment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started