Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Price-Yield Sensitivity. For the same bonds in question 9, let us now turn to focus on the relationship between price and yield. Using the

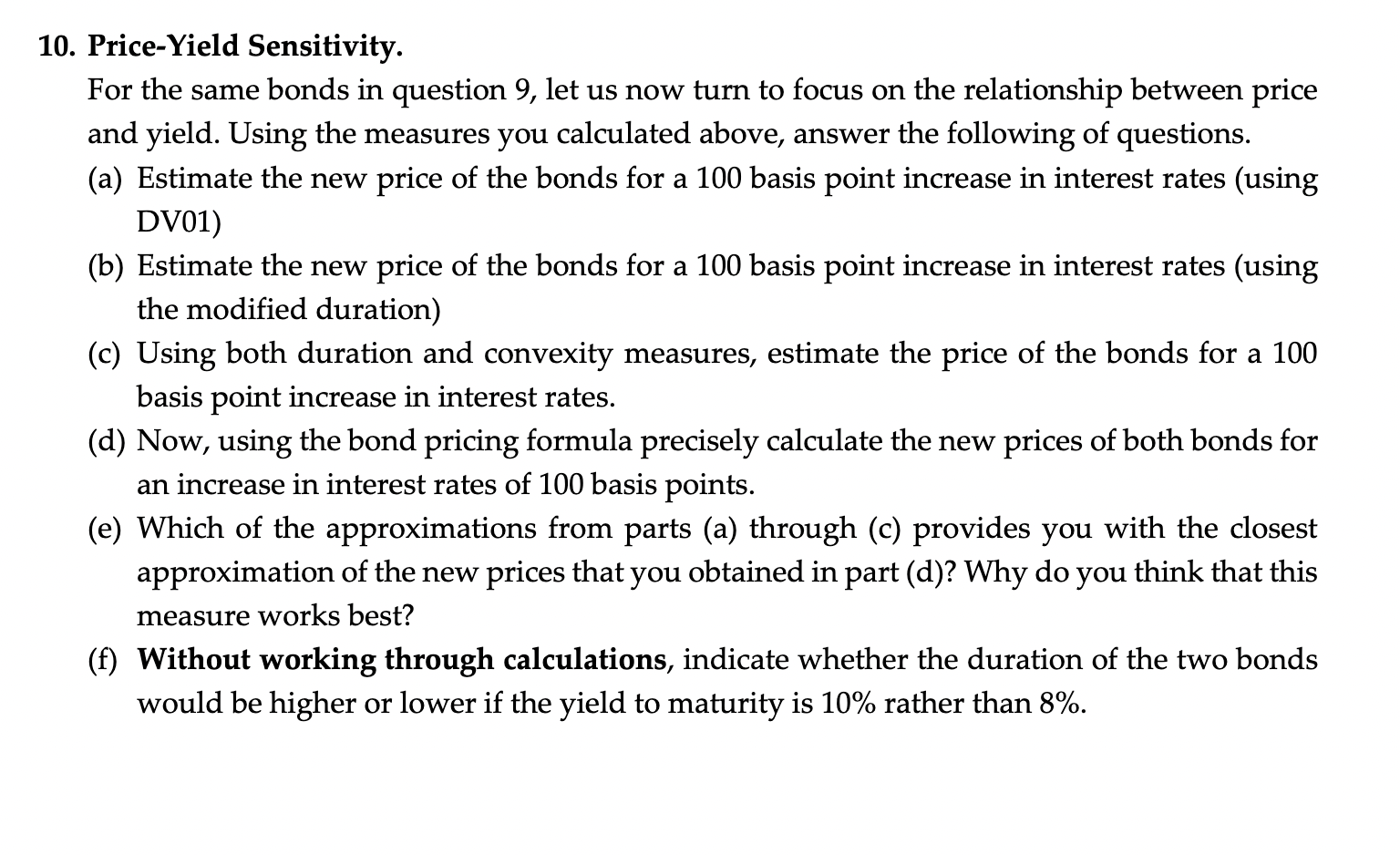

10. Price-Yield Sensitivity. For the same bonds in question 9, let us now turn to focus on the relationship between price and yield. Using the measures you calculated above, answer the following of questions. (a) Estimate the new price of the bonds for a 100 basis point increase in interest rates (using DV01) (b) Estimate the new price of the bonds for a 100 basis point increase in interest rates (using the modified duration) (c) Using both duration and convexity measures, estimate the price of the bonds for a 100 basis point increase in interest rates. (d) Now, using the bond pricing formula precisely calculate the new prices of both bonds for an increase in interest rates of 100 basis points. (e) Which of the approximations from parts (a) through (c) provides you with the closest approximation of the new prices that you obtained in part (d)? Why do you think that this measure works best? (f) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8%

10. Price-Yield Sensitivity. For the same bonds in question 9, let us now turn to focus on the relationship between price and yield. Using the measures you calculated above, answer the following of questions. (a) Estimate the new price of the bonds for a 100 basis point increase in interest rates (using DV01) (b) Estimate the new price of the bonds for a 100 basis point increase in interest rates (using the modified duration) (c) Using both duration and convexity measures, estimate the price of the bonds for a 100 basis point increase in interest rates. (d) Now, using the bond pricing formula precisely calculate the new prices of both bonds for an increase in interest rates of 100 basis points. (e) Which of the approximations from parts (a) through (c) provides you with the closest approximation of the new prices that you obtained in part (d)? Why do you think that this measure works best? (f) Without working through calculations, indicate whether the duration of the two bonds would be higher or lower if the yield to maturity is 10% rather than 8% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started