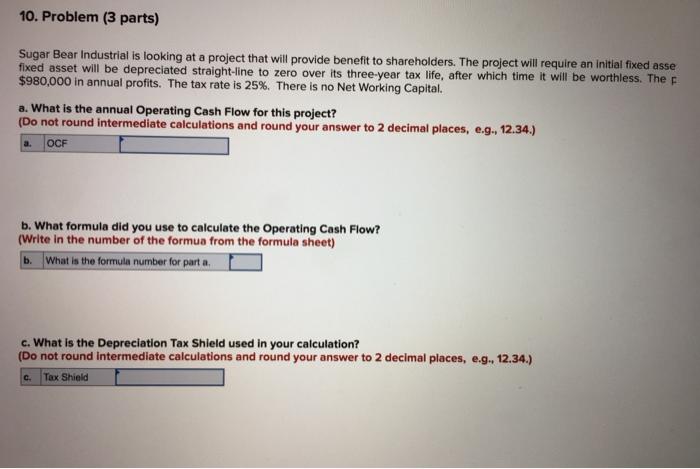

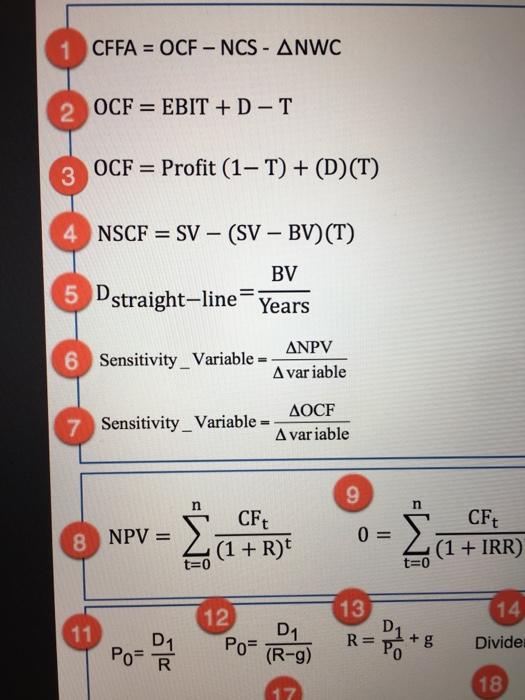

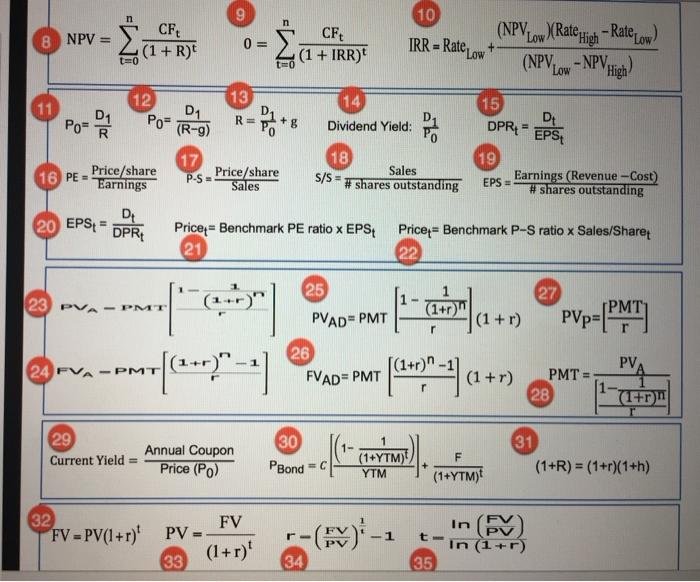

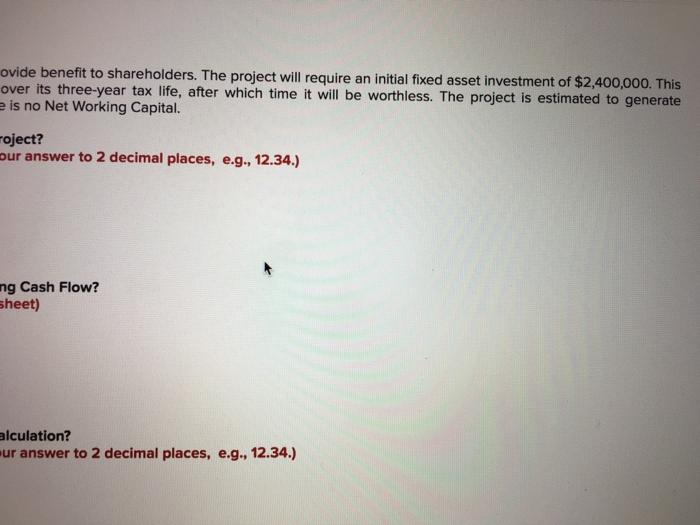

10. Problem (3 parts) Sugar Bear Industrial is looking at a project that will provide benefit to shareholders. The project will require an initial fixed asse fixed asset will be depreciated straight-line to zero over its three-year tax life, after which time it will be worthless. The $980,000 in annual profits. The tax rate is 25%. There is no Net Working Capital. a. What is the annual Operating Cash Flow for this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) OCF b. What formula did you use to calculate the Operating Cash Flow? (Write in the number of the formua from the formula sheet) b. What is the formula number for part a. c. What is the Depreciation Tax Shield used in your calculation? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) c. Tax Shield CFFA = OCF-NCS - ANWC 2 OCF = EBIT + D-T 3 OCF = Profit (1-T) + (D)(T) 4 NSCF = SV - (SV BV)(T) BV 5 Dstraight-line Years 6 Sensitivity _ Variable ANPV A variable AOCF 7 Sensitivity_Variable - A variable g n 8 NPV = CFt (1 + R) t=0 0= CFt (1 + IRR) t=0 13 12 14 11 D1 D1 Po (R-g) R= + g Divider 18 17 9 10 n 8 NPV = a CFt (1 + R) 0 = CFt (1 + IRR) IRR = Rate PLAW + (NPVLow Rate High - Rate Low) (NPVLow - NPV High t=0 tm 12 13 (11 D1 Po- Po- D1 (R-9) +8 Dividend Yield: 15 D DPR - EPS 19 EPS - Earnings (Revenue - Cost) # shares outstanding 17 18 Sales 16 PE = Price/share Earnings P-s - Price/share Sales S/S = # shares outstanding 20 EPS = DE DPR Price = Benchmark PE ratio x EPS Price = Benchmark P-S ratio x Sales/Sharet 22 21 25 27 23 PVA - PMT 1 (1+r) PVAD=PMT (1+r) PVP=[PMT r (14) -=[(2-1)-4) PV 24 FVA 26 FVAD= PMT PMT (+)-4(1+r) PMT 28 (1+r) 29 Current Yield Annual Coupon Price (Po) 30 PBond - F (1+YTM) YTM 31 (1+R) = (1+r)(1+h) (1+YTM) FV 32 FV = PV(1+r) PV r t- In PV in (1+r) (1+r) 33 34 35 ovide benefit to shareholders. The project will require an initial fixed asset investment of $2,400,000. This over its three-year tax life, after which time it will be worthless. The project is estimated to generate e is no Net Working Capital. roject? our answer to 2 decimal places, e.g., 12.34.) ng Cash Flow? Sheet) alculation? ur answer to 2 decimal places, e.g., 12.34.)