Answered step by step

Verified Expert Solution

Question

1 Approved Answer

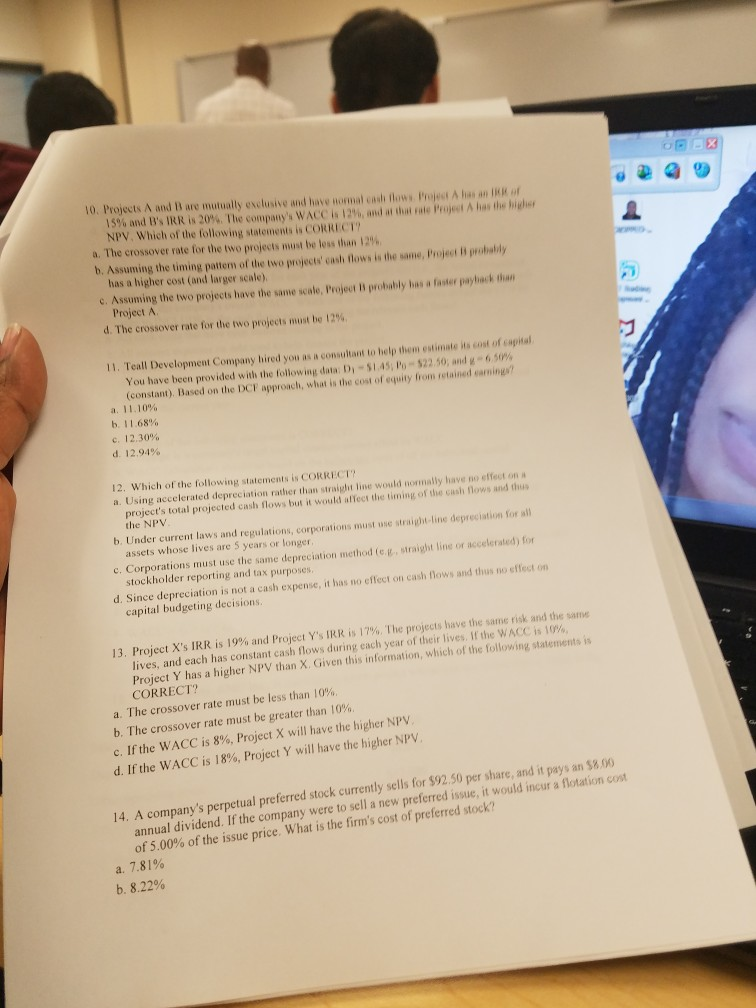

10. Projects A and B are mutually exclusive and have normal cash flows ProjectA has an 1KR of 15% and B's IRR is 20%. The

10. Projects A and B are mutually exclusive and have normal cash flows ProjectA has an 1KR of 15% and B's IRR is 20%. The company's WACC is 12%, and at that rate Projest A has the higher NPV. Which of the following statements is CORRECT a. The crossover rate for the two projects must be less than 12%, b. Assuming the timing pattern of the two projects' cash flows is the same, Project B probally has a higher cost (and larger scale) c. Assuming the two projects have the same scale, Project B probably has a faster payhack than Project A. d. The crossover rate for the two projects must be 12% , d 11. Teall Development Company hired you as a consultant to help them estimate its cost of capital You have been provided with the following data: D)-S1.45;, Po-$22.50, and g-6.50% (constant). Based on the DCF approach, what is the cost of equity from retained earnings? a. 11.10% b. 11.68% c. 12.30% d. 12.94% 12. Which of the following statements is CORRECT a. Using accelerated depreciation rather than straight line would nomally have no effect on a project's total projected cash flows but it would affect the timing of the cash flows and thus the NPV b. Under current laws and regulations, corporations must use straight-line depreciation for all assets whose lives are 5 years or longer c. Corporations must use the same depreciation method (e.g., straight line or accelerated) for stockholder reporting and tax purposes d. Since depreciation is not a cash expense, it has no effect on cash flows and thus no effect on capital budgeting decisions 13, Project X's IRR is 19 % and Project Y's IRR is 17 %. The projects have the same risk and the same lives, and each has constant cash flows during each year of their lives,. If the WACC is 10%, Project Y has a higher NPV than X. Given this information, which of the following statements is CORRECT? a. The crossover rate must be less than 10%. b. The crossover rate must be greater than 10 %. c. If the WACC is 8%, Project X will have the higher NPV d. If the WACC is 18% , Project Y will have the higher NPV 14. A company's perpetual preferred stock currently sells for $92.50 per share, and it pays an $8.00 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 5.00% of the issue price. What is the firm's cost of preferred stock? a. 7.81% b. 8.22%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started