Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(10 pts) 11. (8 pts) 12. The Butler family is planning for their daughter's education. She is three years old and will start college

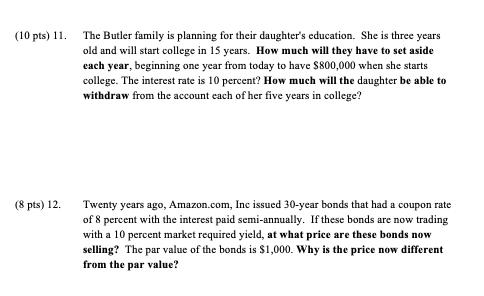

(10 pts) 11. (8 pts) 12. The Butler family is planning for their daughter's education. She is three years old and will start college in 15 years. How much will they have to set aside each year, beginning one year from today to have $800,000 when she starts college. The interest rate is 10 percent? How much will the daughter be able to withdraw from the account each of her five years in college? Twenty years ago, Amazon.com, Inc issued 30-year bonds that had a coupon rate of 8 percent with the interest paid semi-annually. If these bonds are now trading with a 10 percent market required yield, at what price are these bonds now selling? The par value of the bonds is $1,000. Why is the price now different from the par value?

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 So the daughter will be able to withdraw 1310...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started