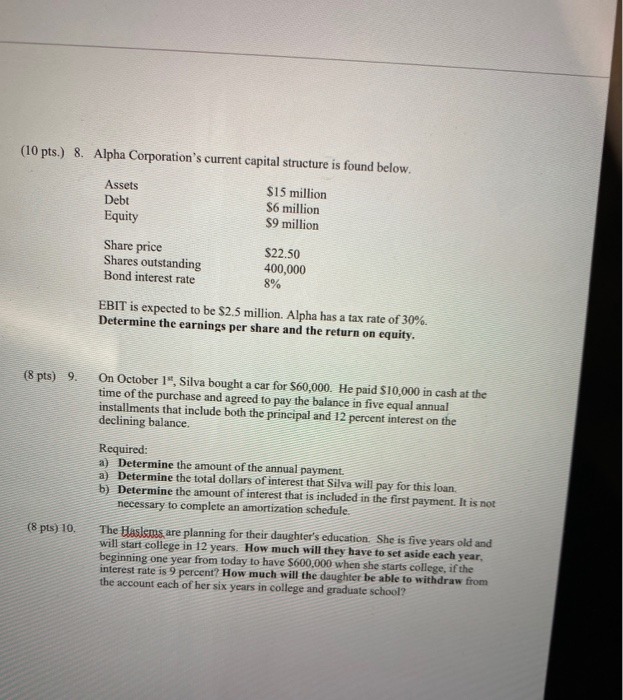

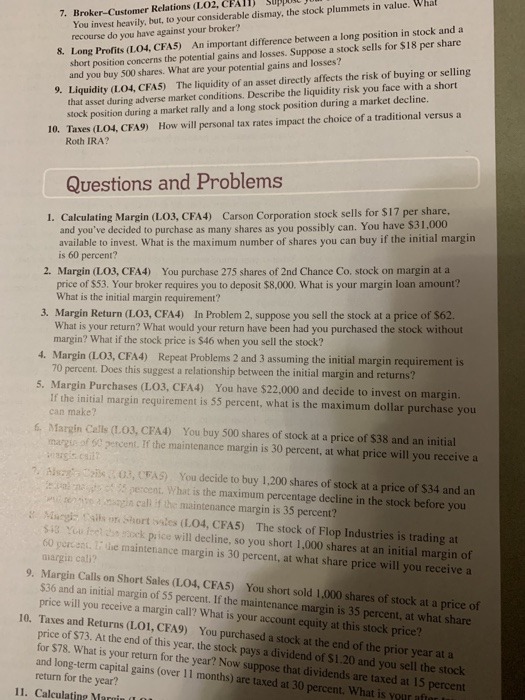

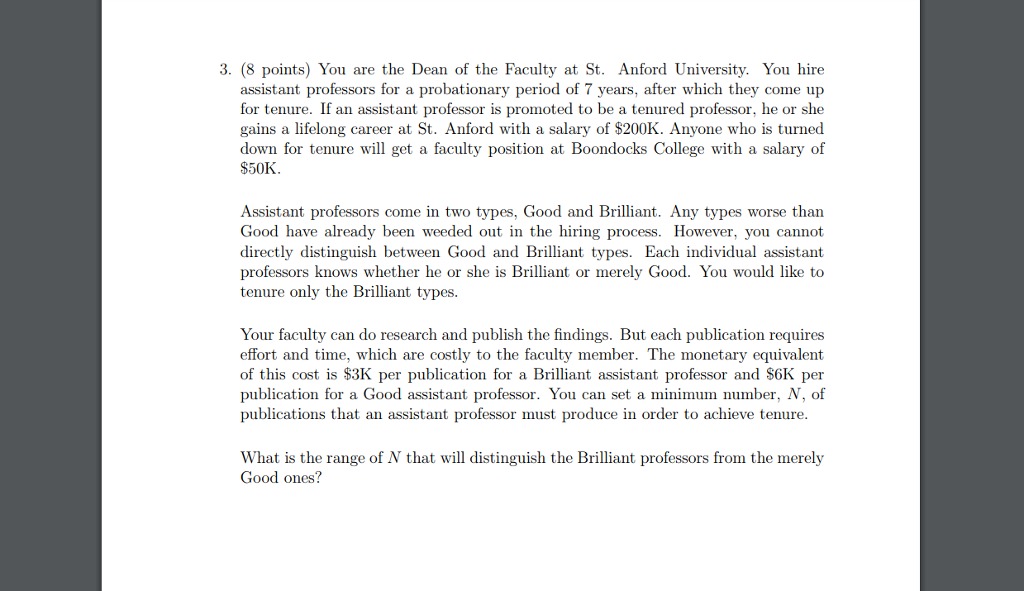

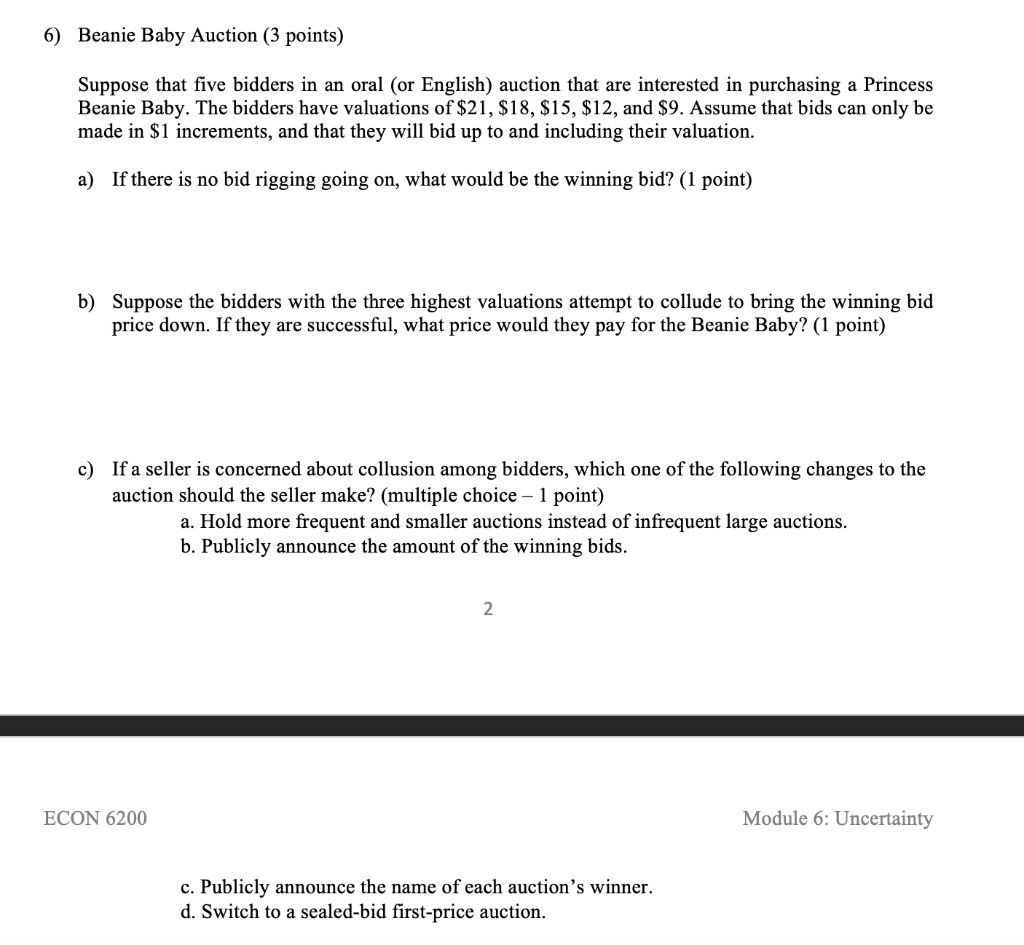

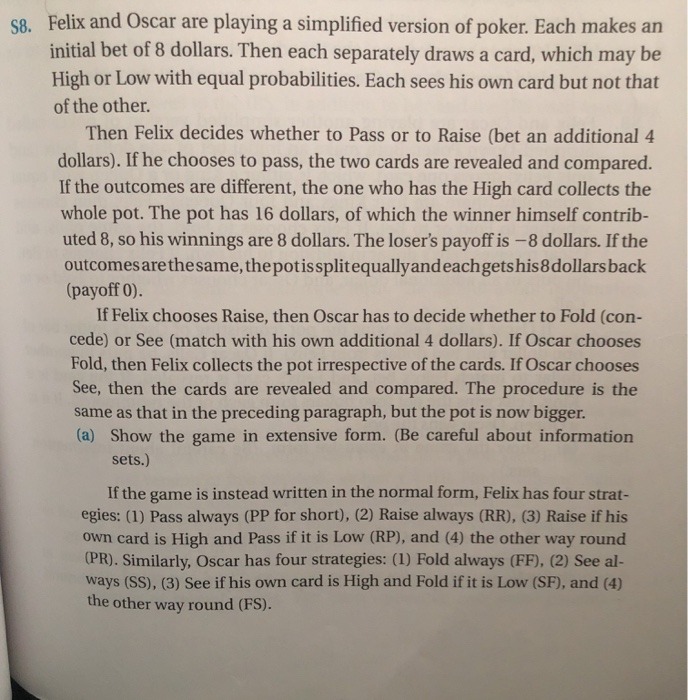

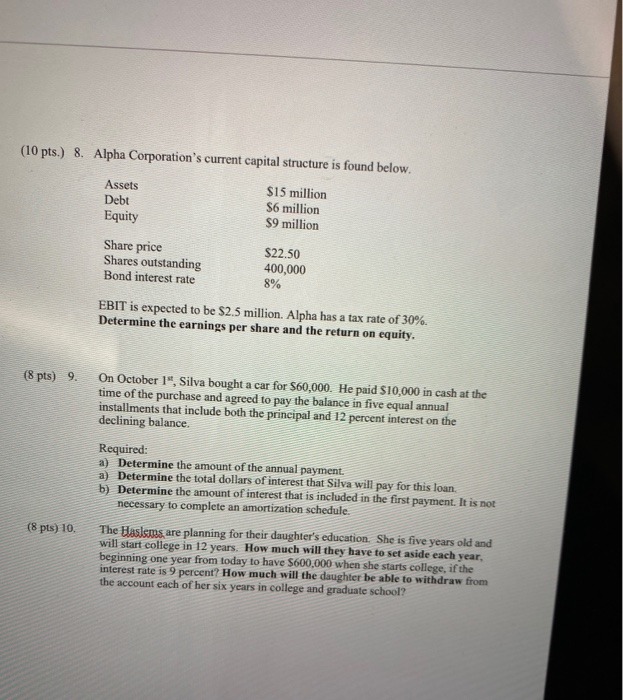

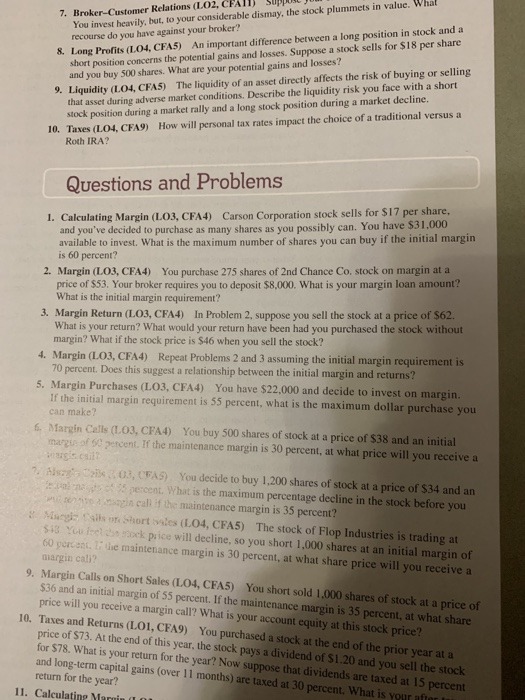

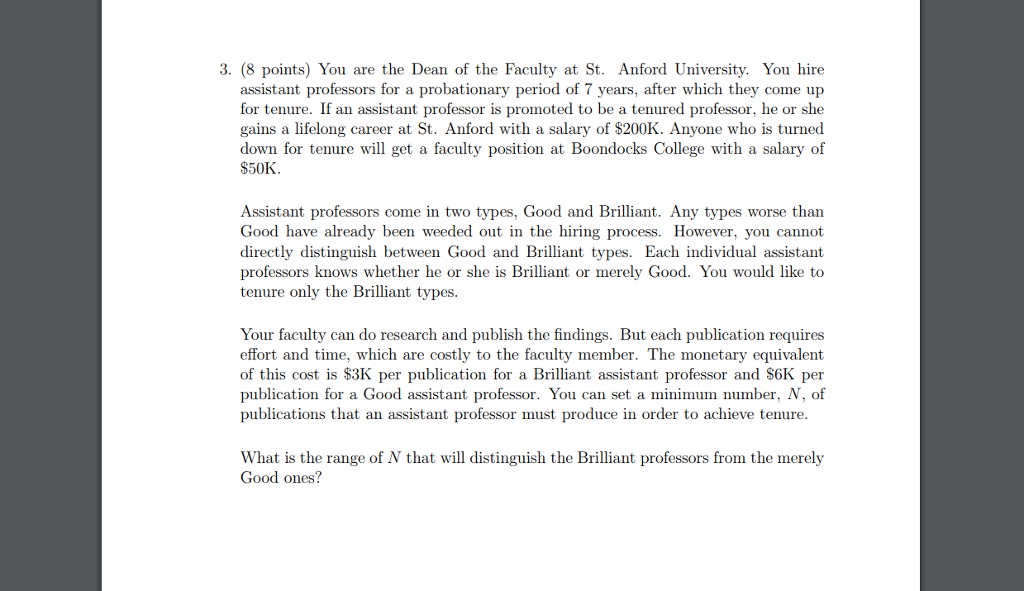

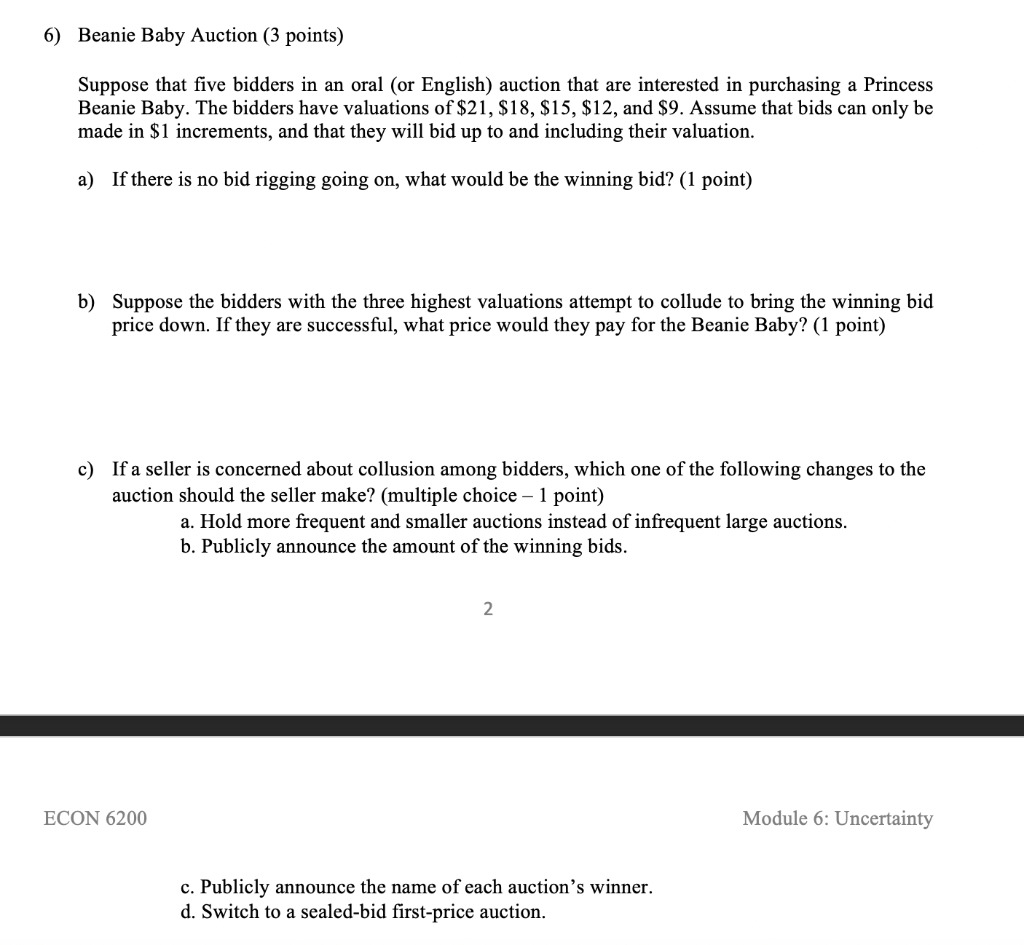

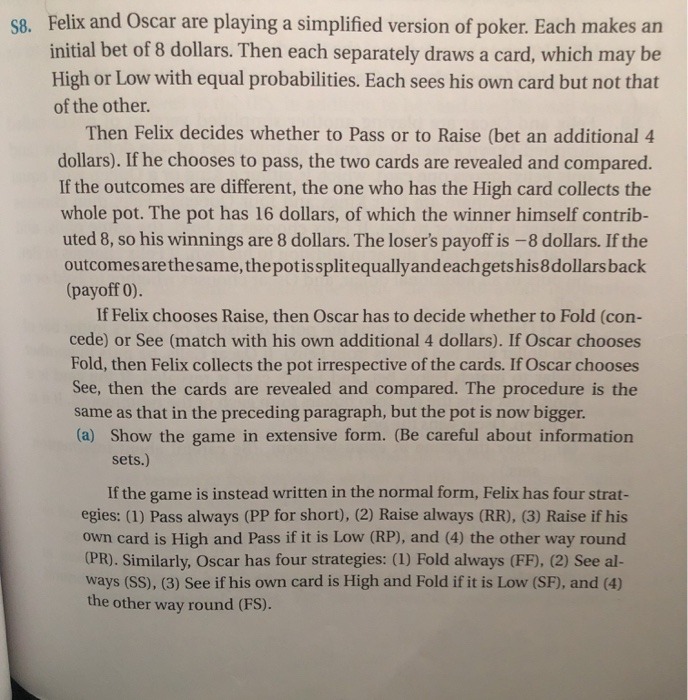

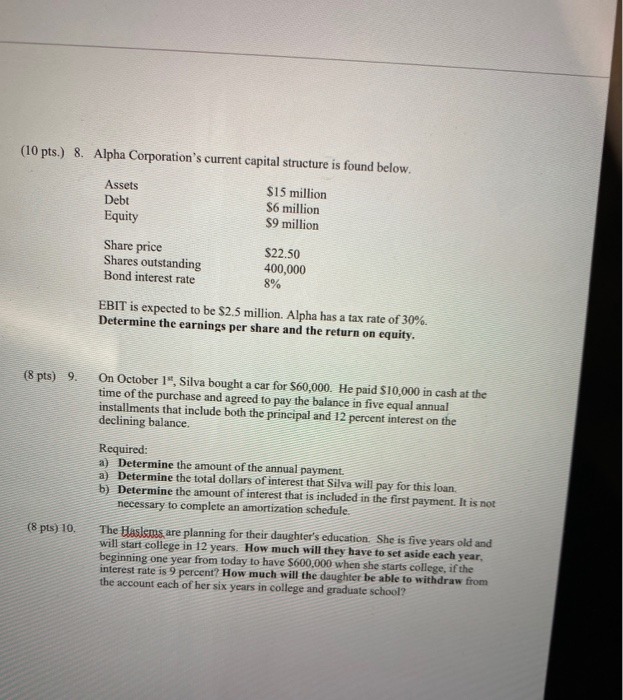

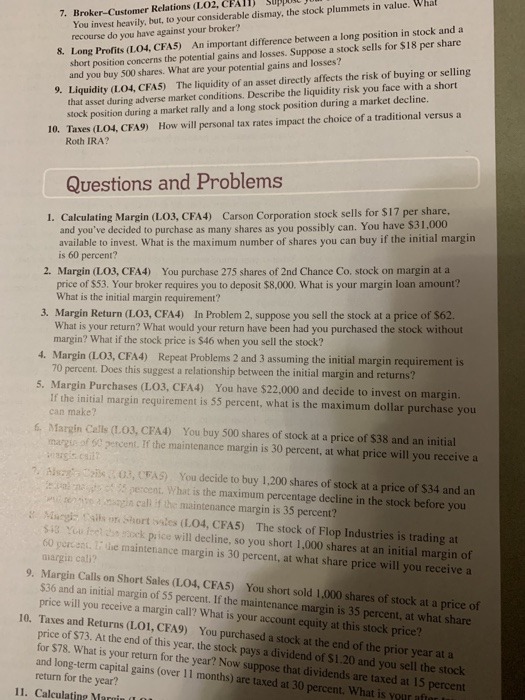

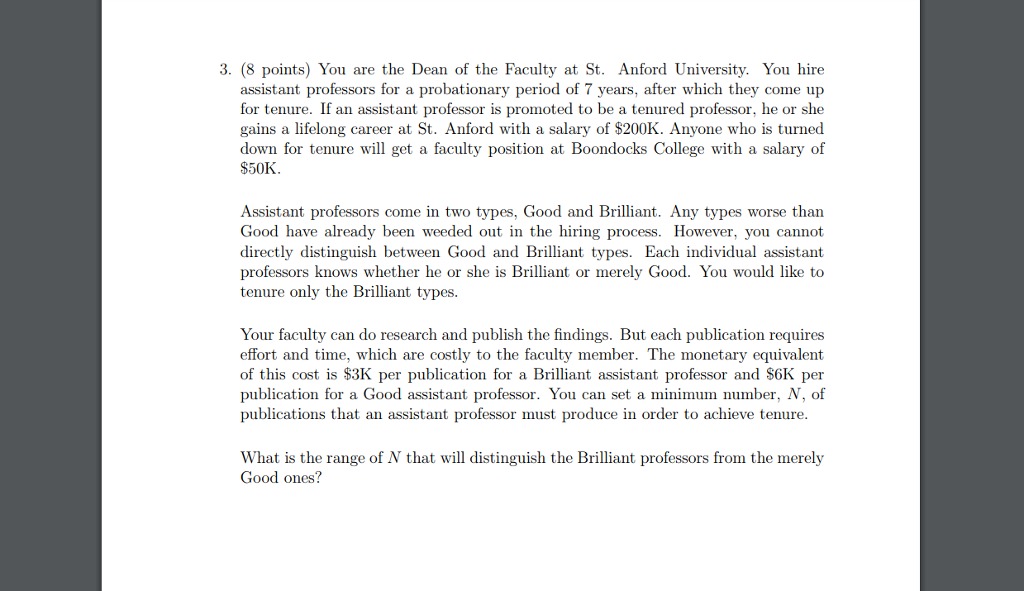

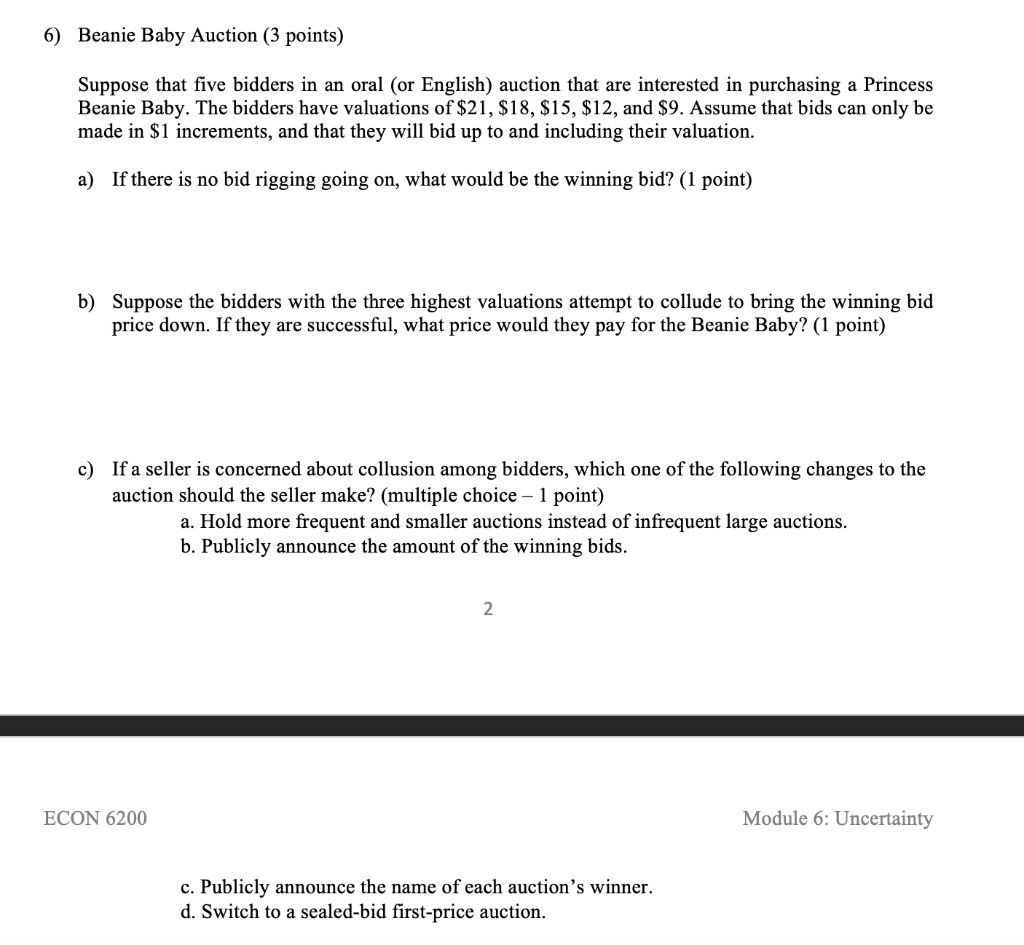

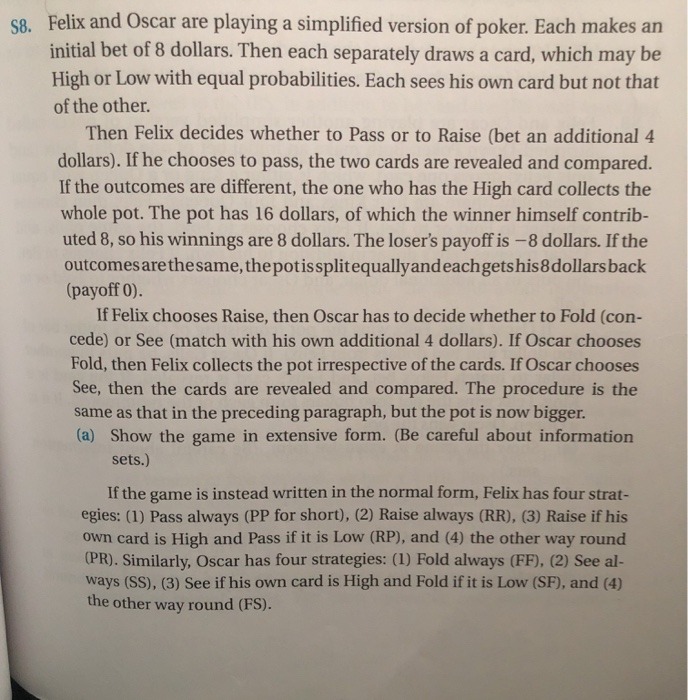

(10 pts.) 8. Alpha Corporation's current capital structure is found below. Assets $15 million Debt $6 million Equity $9 million Share price $22.50 Shares outstanding 400,000 Bond interest rate 8% EBIT is expected to be $2.5 million. Alpha has a tax rate of 30%. Determine the earnings per share and the return on equity. (8 pts) 9. On October 1", Silva bought a car for $60,000. He paid $10,000 in cash at the time of the purchase and agreed to pay the balance in five equal annual installments that include both the principal and 12 percent interest on the declining balance. Required: a) Determine the amount of the annual payment. a) Determine the total dollars of interest that Silva will pay for this loan. b) Determine the amount of interest that is included in the first payment. It is not necessary to complete an amortization schedule. (8 pts) 10. The Waslems are planning for their daughter's education. She is five years old and will start college in 12 years. How much will they have to set aside each year, beginning one year from today to have $600,000 when she starts college, if the interest rate is 9 percent? How much will the daughter be able to withdraw from the account each of her six years in college and graduate school?7. Broker-Customer Relations (102, CFAIT) You invest heavily, but, to your considerable dismay, the stock plummets in value. What recourse do you have against your broker? 8. Long Profits (104, CFA5) An important difference between a long position in stock and a short position concerns the potential gains and losses. Suppose a stock sells for $18 per share and you buy 500 shares. What are your potential gains and losses? 9. Liquidity (104, CFAS) The liquidity of an asset directly affects the risk of buying or selling that asset during adverse market conditions. Describe the liquidity risk you face with a short stock position during a market rally and a long stock position during a market decline. 10. Taxes (LO4, CFA9) How will personal tax rates impact the choice of a traditional versus a Roth IRA? Questions and Problems I. Calculating Margin (LO3, CFA4) Carson Corporation stock sells for $17 per share, and you've decided to purchase as many shares as you possibly can. You have $31,000 available to invest. What is the maximum number of shares you can buy if the initial margin is 60 percent? 2. Margin (LO3, CFA4) You purchase 275 shares of 2nd Chance Co. stock on margin at a price of $53. Your broker requires you to deposit $8,000. What is your margin loan amount? What is the initial margin requirement? 3. Margin Return (103, CFA4) In Problem 2. suppose you sell the stock at a price of $62. What is your return? What would your return have been had you purchased the stock without margin? What if the stock price is $46 when you sell the stock? 4. Margin (103, CFA4) Repeat Problems 2 and 3 assuming the initial margin requirement is 70 percent. Does this suggest a relationship between the initial margin and returns? 5. Margin Purchases (LO3, CFA4) You have $22,000 and decide to invest on margin. If the initial margin requirement is $5 percent, what is the maximum dollar purchase you can make? 6. Margin Calls (LO3, CFA4) You buy 500 shares of stock at a price of $38 and an initial margin of 69 percent. If the maintenance margin is 30 percent, at what price will you receive a Hargis caill WAver's Cabs 1:03, CFAS) You decide to buy 1,200 shares of stock at a price of $34 and an People do :595 percent. What is the maximum percentage decline in the stock before you wheregive a margin call if the maintenance margin is 35 percent? 8 Margin Calls on Short Sales (LO4, CFAS) The stock of Flop Industries is trading at $48 You feel as Stock price will decline, so you short 1,000 shares at an initial margin of margin call? 60 percent. If the maintenance margin is 30 percent, at what share price will you receive a 9. Margin Calls on Short Sales (LO4, CFA5) You short sold 1,000 shares of stock at a price of $36 and an initial margin of $5 percent. If the maintenance margin is 35 percent, at what share price will you receive a margin call? What is your account equity at this stock price? 10. Taxes and Returns (LO1, CFA9) You purchased a stock at the end of the prior year at a price of $73. At the end of this year. the stock pays a dividend of $1.20 and you sell the stock for $78. What is your return for the year? Now suppose that dividends are taxed at 15 percent and long-term capital gains (over 1 1 months) are taxed at 30 percent. What is your af return for the year? 11. Calculating Ma3. (8 points) You are the Dean of the Faculty at St. Anford University. You hire assistant professors for a probationary period of 7 years, after which they come up for tenure. If an assistant professor is promoted to be a tenured professor, he or she gains a lifelong career at St. Anford with a salary of $200K. Anyone who is turned down for tenure will get a faculty position at Boondocks College with a salary of $50K. Assistant professors come in two types, Good and Brilliant. Any types worse than Good have already been weeded out in the hiring process. However, you cannot directly distinguish between Good and Brilliant types. Each individual assistant professors knows whether he or she is Brilliant or merely Good. You would like to tenure only the Brilliant types. Your faculty can do research and publish the findings. But each publication requires effort and time, which are costly to the faculty member. The monetary equivalent of this cost is $3K per publication for a Brilliant assistant professor and $6K per publication for a Good assistant professor. You can set a minimum number, N, of publications that an assistant professor must produce in order to achieve tenure. What is the range of / that will distinguish the Brilliant professors from the merely Good ones?6) Beanie Baby Auction (3 points) Suppose that ve bidders in an oral (or English) auction that are interested in purchasing a Princess Beanie Baby. The bidders have valuations of $21 , $18, $15, $12, and $9. Assume that bids can only be made in $1 increments, and that they will bid up to and including their valuation. a) If there is no bid rigging going on, what would be the winning bid? (1 point) b) Suppose the bidders with the three highest valuations attempt to collude to bring the winning bid price down. If they are suecessful, what price would they pay for the Beanie Baby? (1 point) c) If a seller is concerned about collusion among bidders, which one of the following changes to the auction should the seller make? (multiple choice 1 point) a. Hold more frequent and smaller auctions instead of infrequent large auctions. b. Publicly announce the amount of the winning bids. ECON 6200 Module 6: Uncertainty c. Publicly announce the name of each auction's winner. d. Switch to a sealed-bid rst-price auction. $8. Felix and Oscar are playing a simplified version of poker. Each makes an initial bet of 8 dollars. Then each separately draws a card, which may be High or Low with equal probabilities. Each sees his own card but not that of the other. Then Felix decides whether to Pass or to Raise (bet an additional 4 dollars). If he chooses to pass, the two cards are revealed and compared. If the outcomes are different, the one who has the High card collects the whole pot. The pot has 16 dollars, of which the winner himself contrib uted 8, so his winnings are 8 dollars. The loser's payoff is -8 dollars. If the outcomes are the same, the potissplitequallyand each getshis8dollars back (payoff 0). If Felix chooses Raise, then Oscar has to decide whether to Fold (con- cede) or See (match with his own additional 4 dollars). If Oscar chooses Fold, then Felix collects the pot irrespective of the cards. If Oscar chooses See, then the cards are revealed and compared. The procedure is the same as that in the preceding paragraph, but the pot is now bigger. (a) Show the game in extensive form. (Be careful about information sets.) If the game is instead written in the normal form, Felix has four strat- egies: (1) Pass always (PP for short), (2) Raise always (RR), (3) Raise if his own card is High and Pass if it is Low (RP), and (4) the other way round (PR). Similarly, Oscar has four strategies: (1) Fold always (FF), (2) See al- ways (SS), (3) See if his own card is High and Fold if it is Low (SF), and (4) the other way round (FS)