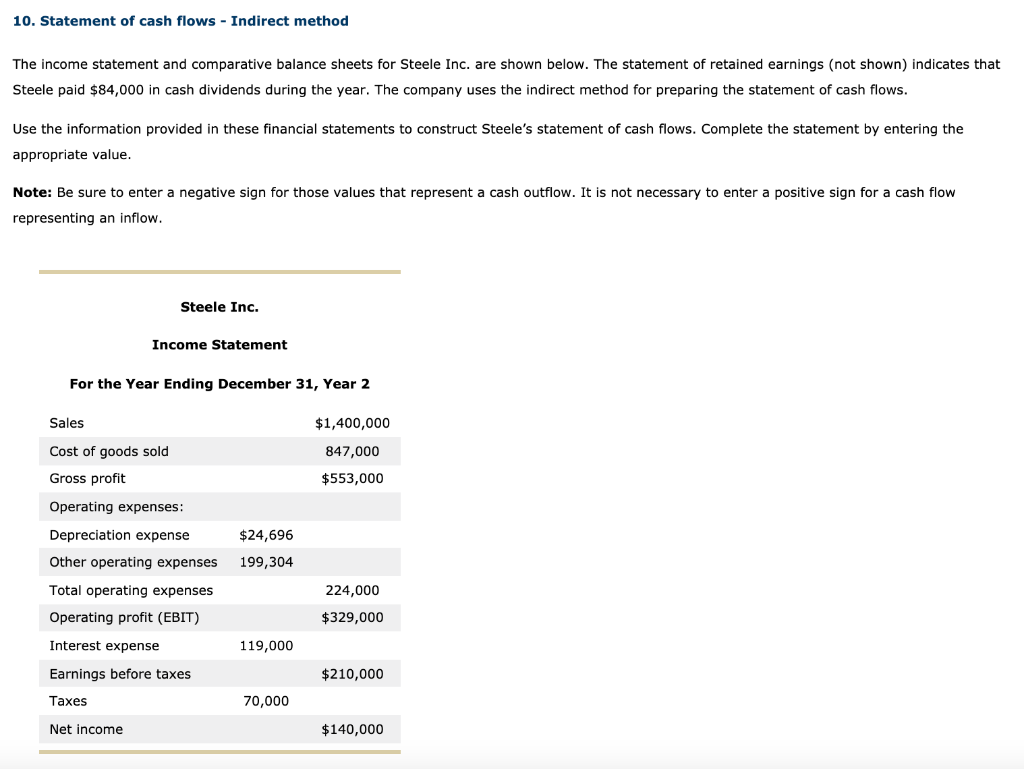

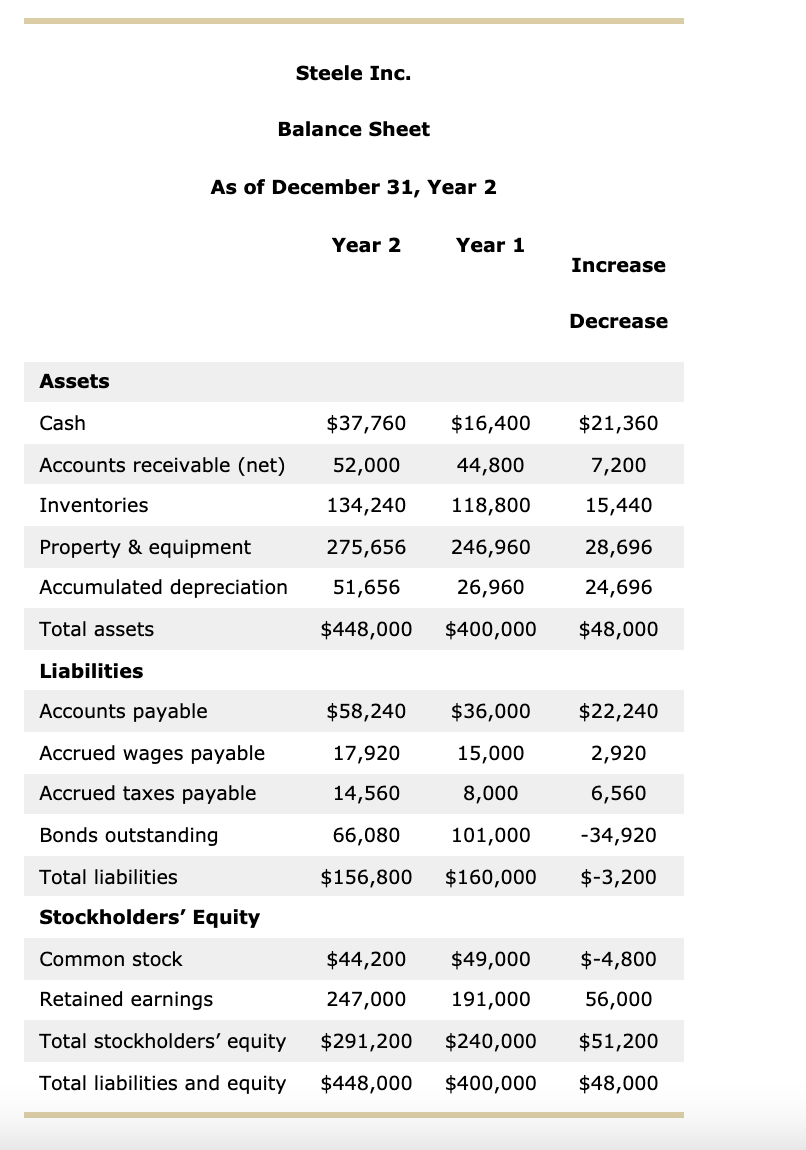

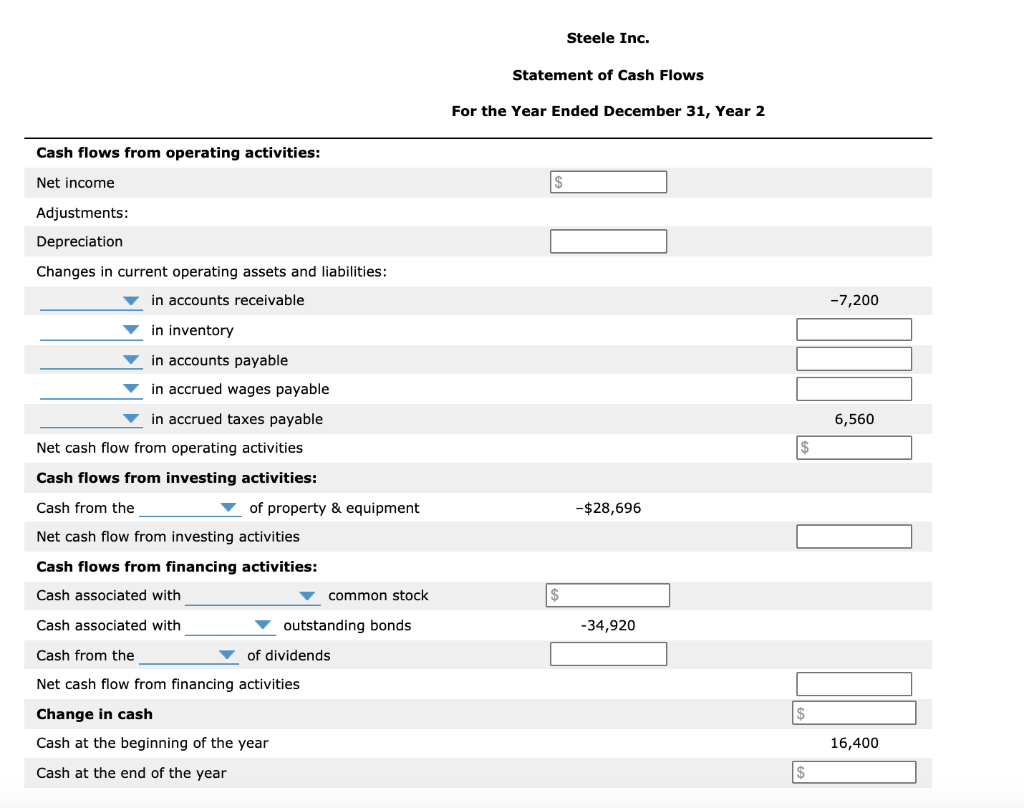

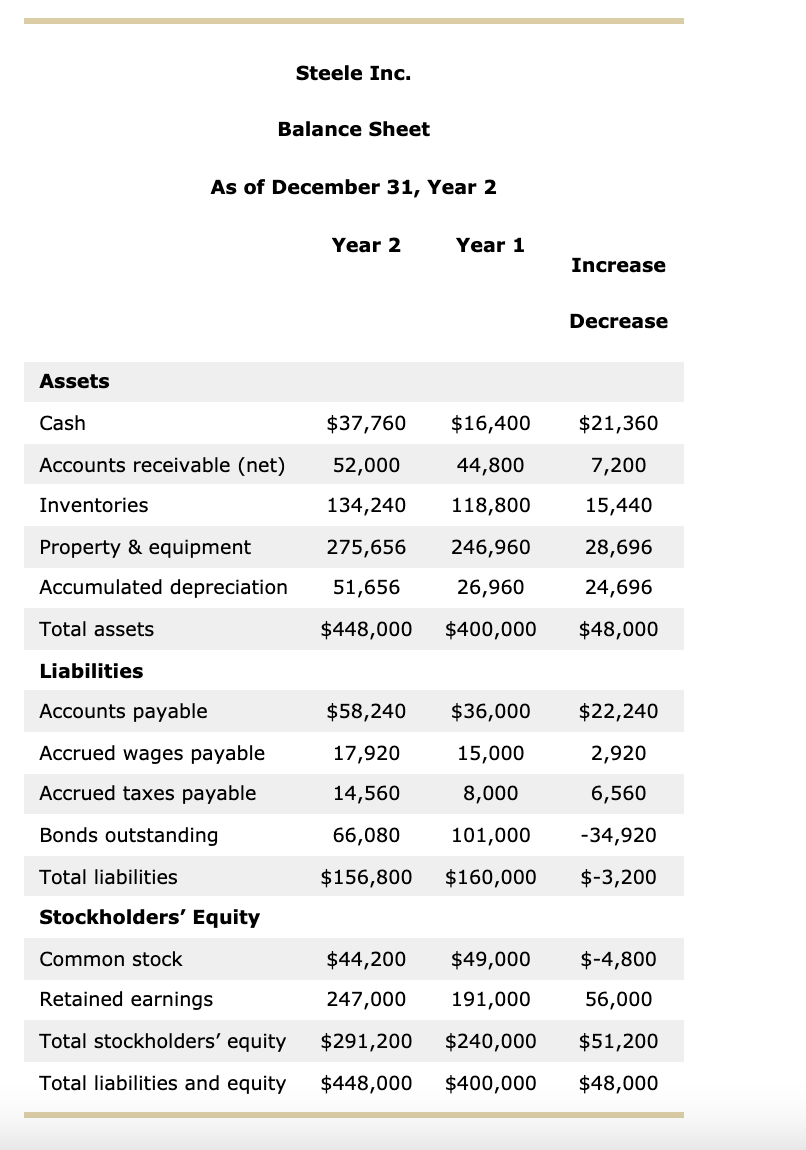

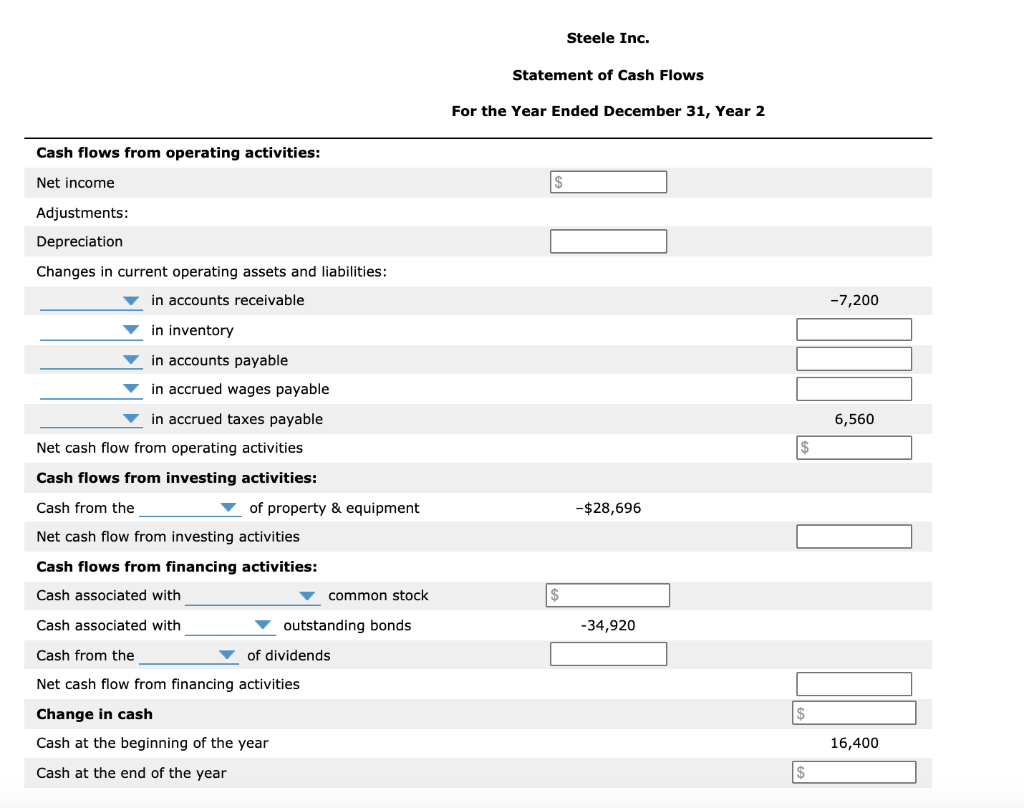

10. Statement of cash flows - Indirect method The income statement and comparative balance sheets for Steele Inc. are shown below. The statement of retained earnings (not shown) indicates that Steele paid $84,000 in cash dividends during the year. The company uses the indirect method for preparing the statement of cash flows. Use the information provided in these financial statements to construct Steele's statement of cash flows. Complete the statement by entering the appropriate value. Note: Be sure to enter a negative sign for those values that represent a cash outflow. It is not necessary to enter a positive sign for a cash flow representing an inflow. Steele Inc. Income Statement For the Year Ending December 31, Year 2 Sales $1,400,000 Cost of goods sold 847,000 $553,000 Gross profit Operating expenses: Depreciation expense $24,696 Other operating expenses 199,304 Total operating expenses 224,000 Operating profit (EBIT) $329,000 Interest expense 119,000 Earnings before taxes $210,000 Taxes 70,000 Net income $140,000 Steele Inc. Balance Sheet As of December 31, Year 2 Year 2 Year 1 Increase Decrease Assets Cash $37,760 $16,400 $21,360 Accounts receivable (net) 52,000 44,800 7,200 Inventories 134,240 118,800 15,440 275,656 246,960 28,696 Property & equipment Accumulated depreciation 51,656 26,960 24,696 Total assets $448,000 $400,000 $48,000 Liabilities Accounts payable $58,240 $36,000 $22,240 Accrued wages payable 17,920 15,000 2,920 Accrued taxes payable 14,560 8,000 6,560 Bonds outstanding 66,080 101,000 -34,920 Total liabilities $156,800 $160,000 $-3,200 Stockholders' Equity Common stock $49,000 $-4,800 $44,200 247,000 Retained earnings 191,000 56,000 Total stockholders' equity $291,200 $240,000 $51,200 Total liabilities and equity $448,000 $400,000 $48,000 Steele Inc. Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Net income $ Adjustments: Depreciation Changes in current operating assets and liabilities: in accounts receivable -7,200 in inventory in accounts payable in accrued wages payable in accrued taxes payable Net cash flow from operating activities Cash flows from investing activities: 6,560 -$28,696 Cash from the of property & equipment Net cash flow from investing activities Cash flows from financing activities: Cash associated with common stock $ Cash associated with outstanding bonds -34,920 Cash from the of dividends Net cash flow from financing activities Change in cash $ 11: 16,400 Cash at the beginning of the year Cash at the end of the year $