Answered step by step

Verified Expert Solution

Question

1 Approved Answer

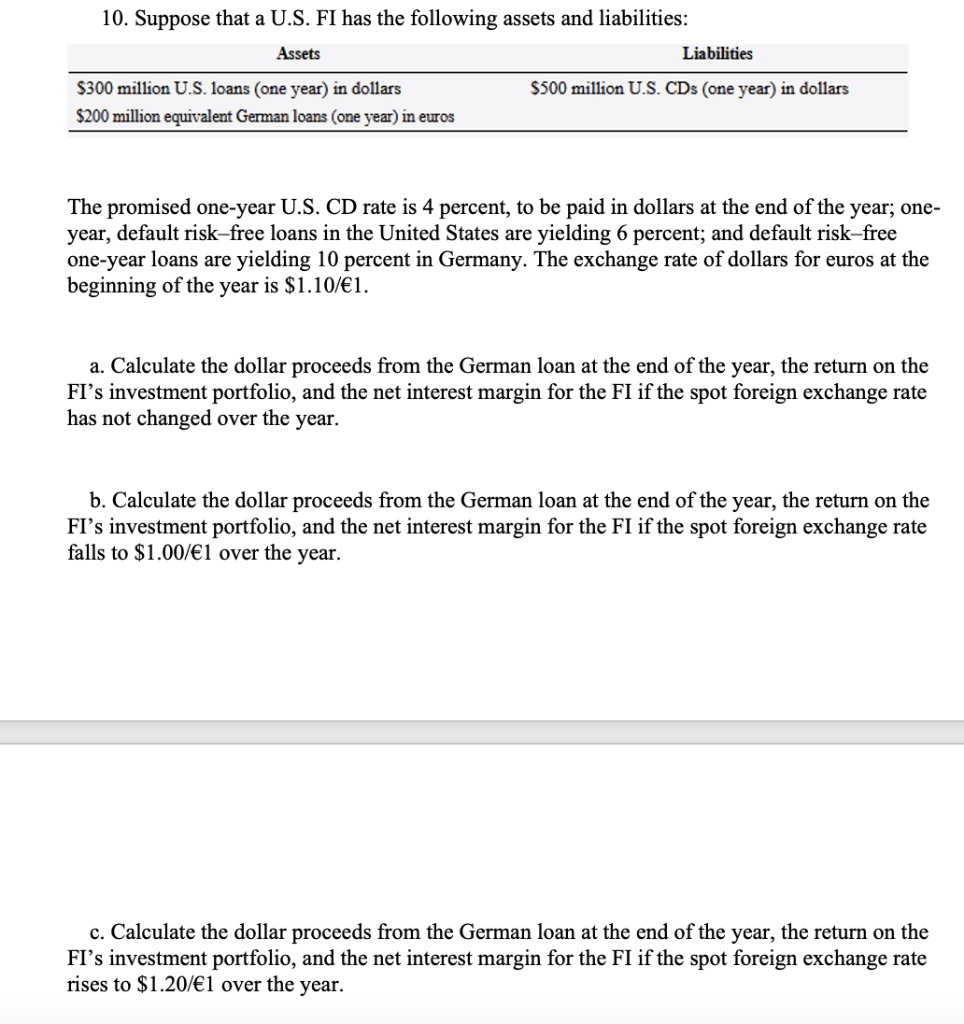

10. Suppose that a U.S. FI has the following assets and liabilities: Assets Liabilities $300 million U.S. loans (one year) in dollars $500 million U.S.

10. Suppose that a U.S. FI has the following assets and liabilities: Assets Liabilities $300 million U.S. loans (one year) in dollars $500 million U.S. CDs (one year) in dollars $200 million equivalent German loans (one year) in euros The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one- year, default risk-free loans in the United States are yielding 6 percent; and default risk-free one-year loans are yielding 10 percent in Germany. The exchange rate of dollars for euros at the beginning of the year is $1.10/1. a. Calculate the dollar proceeds from the German loan at the end of the year, the return on the FI's investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate has not changed over the year. b. Calculate the dollar proceeds from the German loan at the end of the year, the return on the FI's investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate falls to $1.00/1 over the year. c. Calculate the dollar proceeds from the German loan at the end of the year, the return on the FI's investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate rises to $1.20/1 over the year. 10. Suppose that a U.S. FI has the following assets and liabilities: Assets Liabilities $300 million U.S. loans (one year) in dollars $500 million U.S. CDs (one year) in dollars $200 million equivalent German loans (one year) in euros The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one- year, default risk-free loans in the United States are yielding 6 percent; and default risk-free one-year loans are yielding 10 percent in Germany. The exchange rate of dollars for euros at the beginning of the year is $1.10/1. a. Calculate the dollar proceeds from the German loan at the end of the year, the return on the FI's investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate has not changed over the year. b. Calculate the dollar proceeds from the German loan at the end of the year, the return on the FI's investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate falls to $1.00/1 over the year. c. Calculate the dollar proceeds from the German loan at the end of the year, the return on the FI's investment portfolio, and the net interest margin for the FI if the spot foreign exchange rate rises to $1.20/1 over the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started