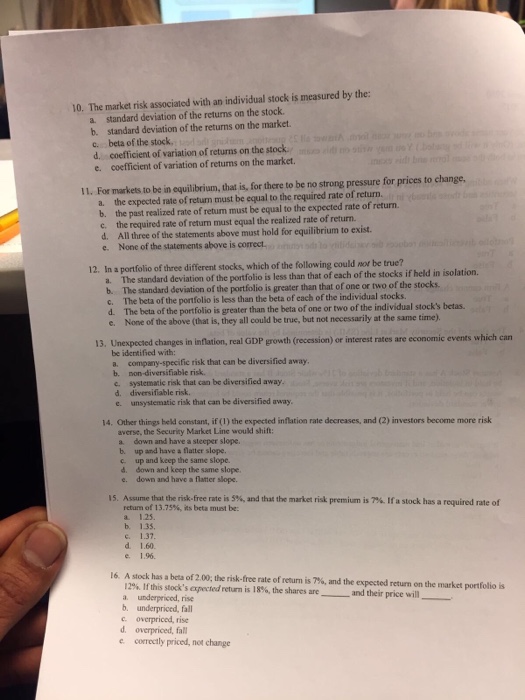

10. The market risk associated with an individual stock is measured by the: a standard deviation of the returns on the stock b. standard deviation of the returns on the market c. beta of the stock. d. coefficient of variation of returns on the stock e. coefficient of variation of returns on the market. 11, For markets to be in equilibrium, that is, for there to be no strong pressure for prices to change, a. the expected rate of return must be equal to the required rate of return. b. the past realized rate of retun must be equal to the expected rate of return. c. the required rate of return must equal the realized rate of return. d. All three of the statements above must hold for equilibrium to exist. e. None of the statements above is correct. 12. In a portfolio of three different stocks, which of the following could nor be true? a. The standard deviation of the portfolio is less than that of each of the stocks if held in isolation. b. The c The beta of the portfolio is less than the beta of each of the individual stocks. d. The beta of the portfolio is greater than the beta of one or two of the individual stock's betas e. None of the above (that is, they all could be true, but not necessarily at the same time). standard deviation of the portfolio is greater than that of one or two of the stocks. 13. Unexpected changes in inflation, real GDP growth (recession) or interest rates are economic events which can be identified with: a. company-specific risk that can be diversified away b. non-diversifiable risk. c. systematic risk that can be diversified away d. diversifiable risk. e. unsystematic risk that ean be diversified away 14. Other things held constant, if (1) the expected inflation rate decreases, and (2) investors become more risk averse, the Security Market Line would shift: down and have a steeper slope. up and have a flatter slope. b. c up and keep the same slope. d. down and keep the same slope e. down and have a flatter slope 15. Ass methat the risk-free rate is 5% and that the market risk premium is 7% ira stock has a required rate of return of 13.75%, its beta must be: a 125 b. 135. c. 1.37. d. 1.60. e 1.96 16. A stock has a beta of 200, the risk-free rate of return is 7%and the expected return on the market portfolio is 2%. If this stock's expected retum is 1956, the shares are-_ and their price will a underpriced, rise b. underpriced, fall c overpriced, rise d. overpriced, fall e correctly priced, not change