Answered step by step

Verified Expert Solution

Question

1 Approved Answer

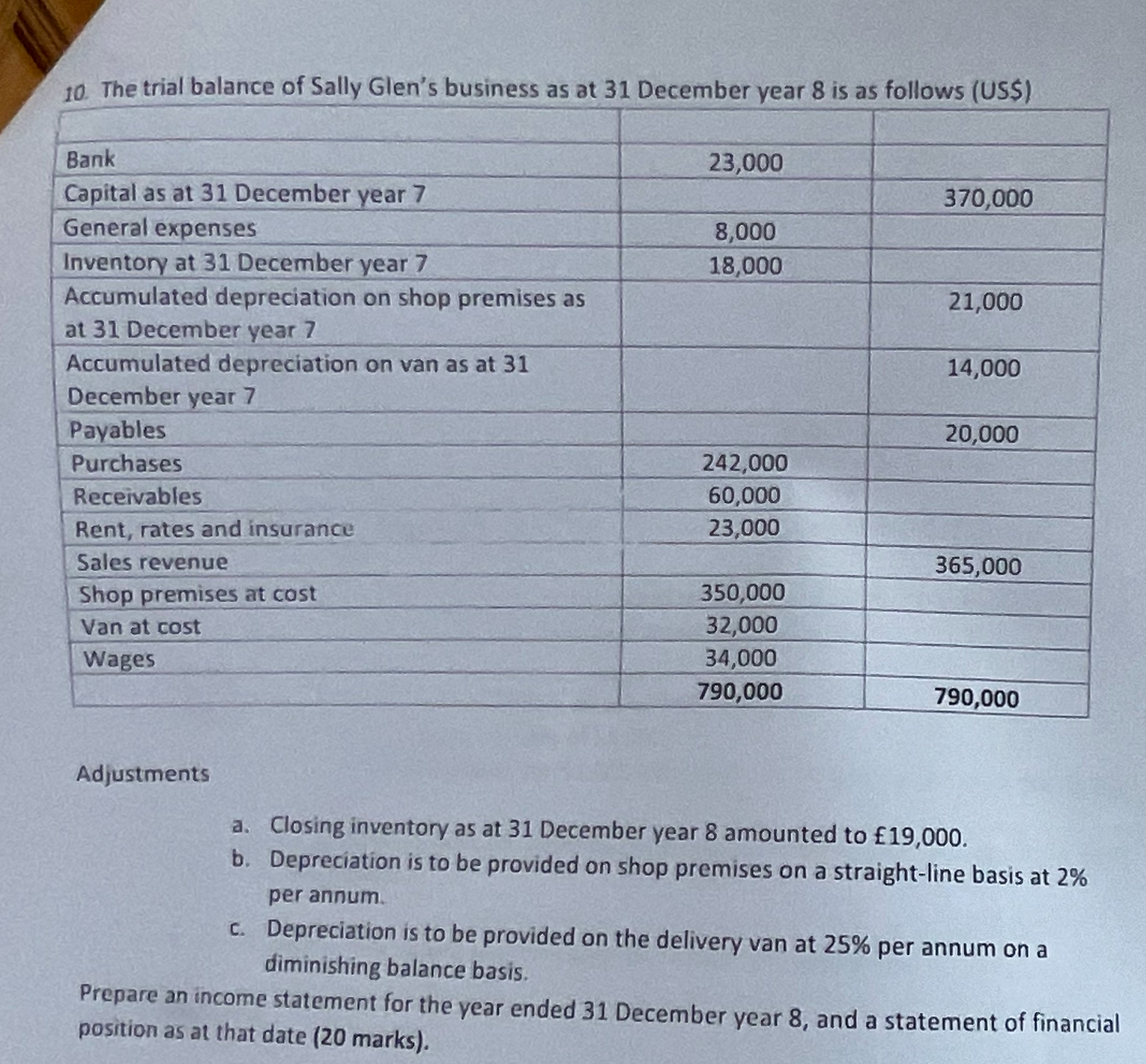

10. The trial balance of Sally Glen's business as at 31 December year 8 is as follows (US$) Bank 23,000 Capital as at 31

10. The trial balance of Sally Glen's business as at 31 December year 8 is as follows (US$) Bank 23,000 Capital as at 31 December year 7 370,000 General expenses 8,000 Inventory at 31 December year 7 18,000 Accumulated depreciation on shop premises as 21,000 at 31 December year 7 Accumulated depreciation on van as at 31 14,000 December year 7 Payables 20,000 Purchases 242,000 Receivables 60,000 Rent, rates and insurance 23,000 Sales revenue 365,000 Shop premises at cost 350,000 Van at cost 32,000 Wages 34,000 790,000 790,000 Adjustments a. Closing inventory as at 31 December year 8 amounted to 19,000. b. Depreciation is to be provided on shop premises on a straight-line basis at 2% per annum. c. Depreciation is to be provided on the delivery van at 25% per annum on a diminishing balance basis. Prepare an income statement for the year ended 31 December year 8, and a statement of financial position as at that date (20 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started