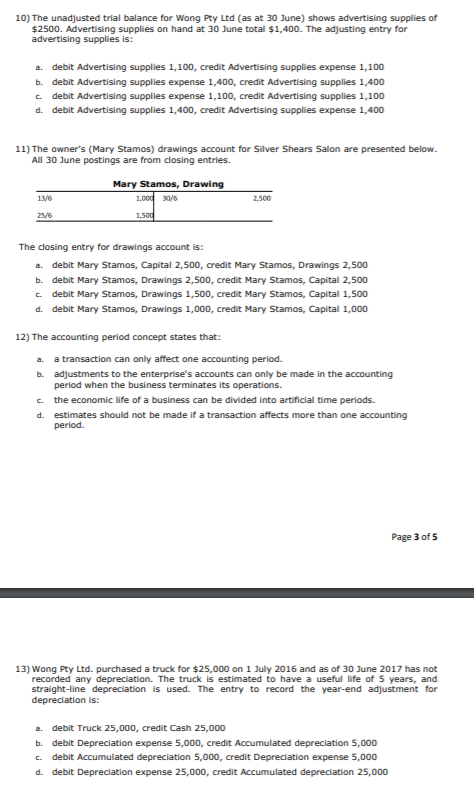

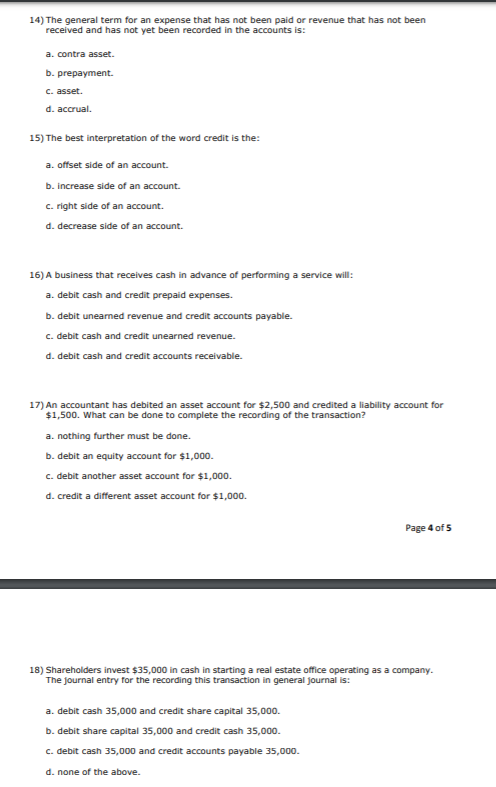

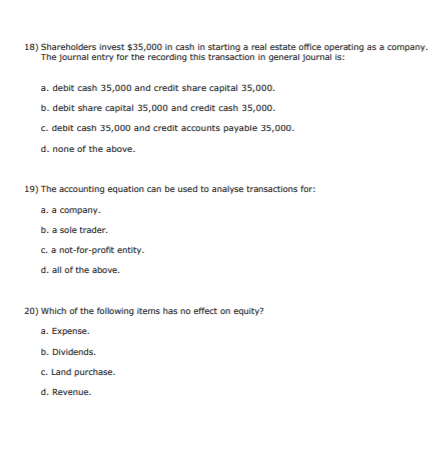

10) The unadjusted trial balance for Wong Pty Ltd (as at 30 June) shows advertising supplies of $2500. Advertising supplies on hand at 30 June total $1,400. The adjusting entry for advertising supplies is: a. debit Advertising supplies 1,100, credit Advertising supplies expense 1,100 b. debit Advertising supplies expense 1,400, credit Advertising supplies 1,400 c debit Advertising supplies expense 1,100, credit Advertising supplies 1,100 d. debit Advertising supplies 1,400, credit Advertising supplies expense 1,400 11) The owner's (Mary Stamos) drawings account for Silver Shears Salon are presented below. All 30 June postings are from closing entries. Mary Stamos, Drawing 1,000 30/6 13/6 2.500 25/6 1,500 The closing entry for drawings account is: a. debit Mary Stamos, Capital 2,500, credit Mary Stamos, Drawings 2,500 b. debit Mary Stamos, Drawings 2,500, credit Mary Stamos, Capital 2,500 debit Mary Stamos, Drawings 1,500, credit Mary Stamos, Capital 1,500 d. debit Mary Stamos, Drawings 1,000, credit Mary Stamos, Capital 1,000 12) The accounting period concept states that: a. a transaction can only affect one accounting period. b. adjustments to the enterprise's accounts can only be made in the accounting period when the business terminates its operations. c the economic life of a business can be divided into artificial time periods. d. estimates should not be made if a transaction affects more than one accounting period. Page 3 of 5 13) Wong Pty Ltd. purchased a truck for $25,000 on 1 July 2016 and as of 30 June 2017 has not recorded any depreciation. The truck is estimated to have a useful life of 5 years, and straight-line depreciation is used. The entry to record the year-end adjustment for depreciation is: a. debit Truck 25,000, credit Cash 25,000 b. debit Depreciation expense 5,000, credit Accumulated depreciation 5,000 debit Accumulated depreciation 5,000, credit Depreciation expense 5,000 d. debit Depreciation expense 25,000, credit Accumulated depreciation 25,000 14) The general term for an expense that has not been paid or revenue that has not been received and has not yet been recorded in the accounts is: a. contra asset. b. prepayment. C. asset. d. accrual 15) The best interpretation of the word credit is the: a. offset side of an account b. increase side of an account. c.right side of an account. d. decrease side of an account. 16) A business that receives cash in advance of performing a service will: a. debit cash and credit prepaid expenses. b. debit uneared revenue and credit accounts payable. C.debit cash and credit unearned revenue. d. debit cash and credit accounts receivable. 17) An accountant has debited an asset account for $2,500 and credited a liability account for $1,500. What can be done to complete the recording of the transaction? a. nothing further must be done. b. debit an equity account for $1,000 c. debit another asset account for $1,000. d. credit a different asset account for $1,000. Page 4 of 5 18) Shareholders invest $35,000 in cash in starting a real estate office operating as a company. The journal entry for the recording this transaction in general journal is: a. debit cash 35,000 and credit share capital 35,000. b. debit share capital 35,000 and credit cash 35,000 C.debit cash 35,000 and credit accounts payable 35,000. d. none of the above. 18) Shareholders invest $35,000 in cash in starting a real estate office operating as a company. The journal entry for the recording this transaction in general journal is: a. debit cash 35,000 and credit share capital 35,000. b. debit share capital 35,000 and credit cash 35,000. C. debit cash 35,000 and credit accounts payable 35,000. d. none of the above. 19) The accounting equation can be used to analyse transactions for: a. a company. b. a sole trader. c. a not-for-profit entity. d. all of the above. 20) Which of the following items has no effect on equity? a. Expense. b. Dividends. C. Land purchase. d. Revenue