Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. William, Gothong & Aboitiz, Inc. (WG & A) is a domestic company engaged in the transport of cargoes. It's present treatment of the

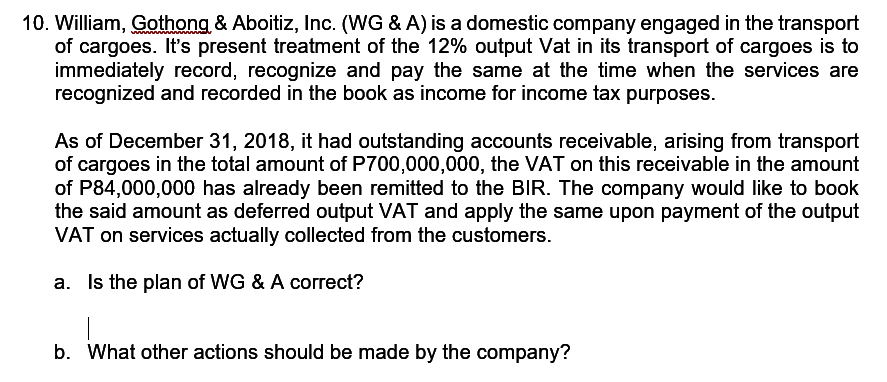

10. William, Gothong & Aboitiz, Inc. (WG & A) is a domestic company engaged in the transport of cargoes. It's present treatment of the 12% output Vat in its transport of cargoes is to immediately record, recognize and pay the same at the time when the services are recognized and recorded in the book as income for income tax purposes. As of December 31, 2018, it had outstanding accounts receivable, arising from transport of cargoes in the total amount of P700,000,000, the VAT on this receivable in the amount of P84,000,000 has already been remitted to the BIR. The company would like to book the said amount as deferred output VAT and apply the same upon payment of the output VAT on services actually collected from the customers. a. Is the plan of WG & A correct? b. What other actions should be made by the company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The plan of WG A to book the VAT on outstanding accounts receivable as deferred output VAT is not ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started