Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10-) You can use interest rate parity to answer this question. A U.S. investor has a choice between a risk-free one-year U.S. security with

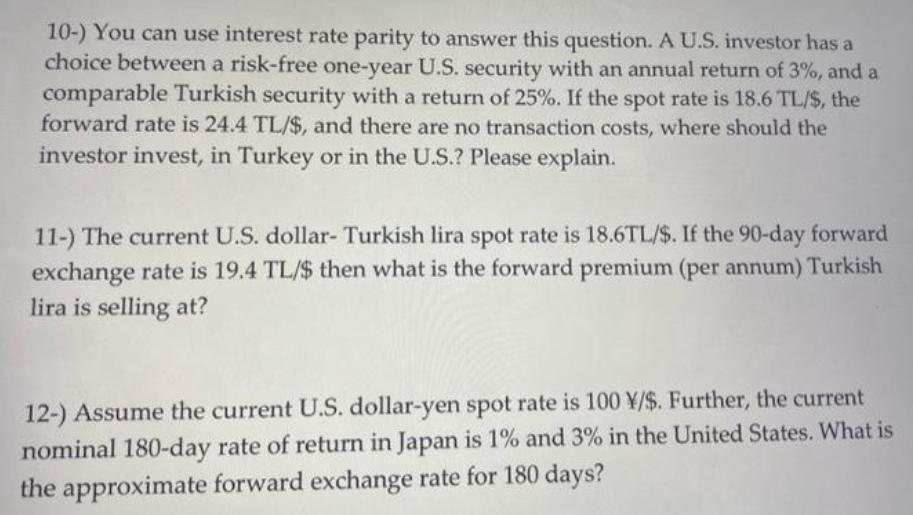

10-) You can use interest rate parity to answer this question. A U.S. investor has a choice between a risk-free one-year U.S. security with an annual return of 3%, and a comparable Turkish security with a return of 25%. If the spot rate is 18.6 TL/$, the forward rate is 24.4 TL/$, and there are no transaction costs, where should the investor invest, in Turkey or in the U.S.? Please explain. 11-) The current U.S. dollar- Turkish lira spot rate is 18.6TL/$. If the 90-day forward exchange rate is 19.4 TL/$ then what is the forward premium (per annum) Turkish lira is selling at? 12-) Assume the current U.S. dollar-yen spot rate is 100 Y/$. Further, the current nominal 180-day rate of return in Japan is 1% and 3% in the United States. What is the approximate forward exchange rate for 180 days?

Step by Step Solution

★★★★★

3.58 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Answer 10 In order to answer this question we must use the concept of interest rate parity IRP IRP states that the difference between the interest rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started