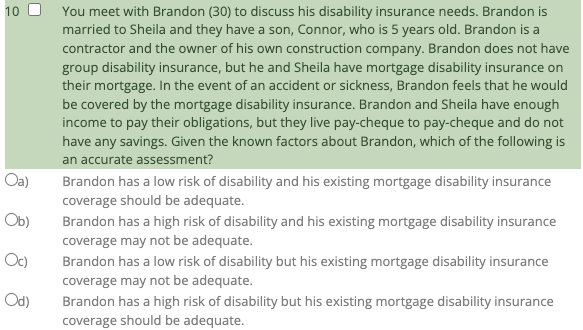

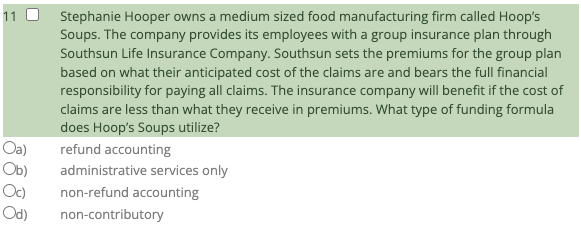

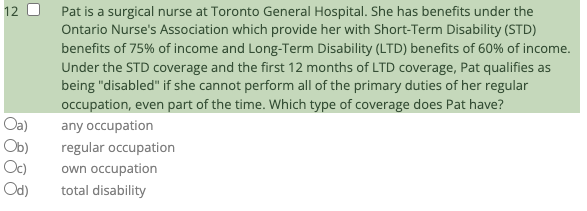

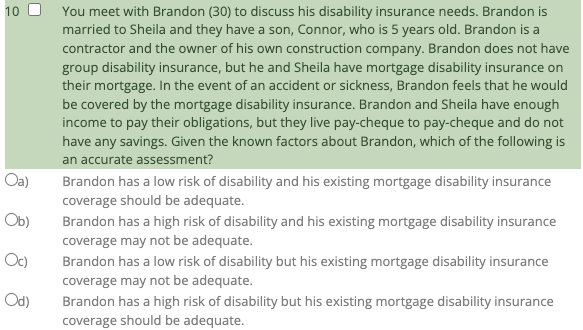

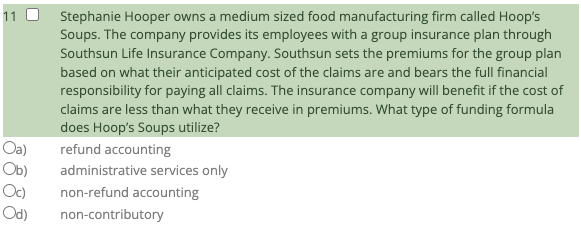

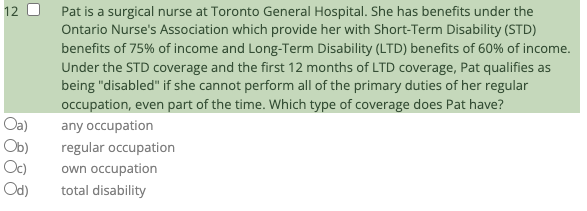

10 You meet with Brandon (30) to discuss his disability insurance needs. Brandon is married to Sheila and they have a son, Connor, who is 5 years old. Brandon is a contractor and the owner of his own construction company. Brandon does not have group disability insurance, but he and Sheila have mortgage disability insurance on their mortgage. In the event of an accident or sickness, Brandon feels that he would be covered by the mortgage disability insurance. Brandon and Sheila have enough income to pay their obligations, but they live pay-cheque to pay-cheque and do not have any savings. Given the known factors about Brandon, which of the following is an accurate assessment? Brandon has a low risk of disability and his existing mortgage disability insurance coverage should be adequate. Brandon has a high risk of disability and his existing mortgage disability insurance coverage may not be adequate. Brandon has a low risk of disability but his existing mortgage disability insurance coverage may not be adequate. Brandon has a high risk of disability but his existing mortgage disability insurance coverage should be adequate. Oa) Ob) Oc) Od) Stephanie Hooper owns a medium sized food manufacturing firm called Hoop's Soups. The company provides its employees with a group insurance plan through Southsun Life Insurance Company. Southsun sets the premiums for the group plan based on what their anticipated cost of the claims are and bears the full financial responsibility for paying all claims. The insurance company will benefit if the cost of claims are less than what they receive in premiums. What type of funding formula does Hoop's Soups utilize? refund accounting administrative services only non-refund accounting non-contributory Oa) Ob) Oc) Od) 12 Pat is a surgical nurse at Toronto General Hospital. She has benefits under the Ontario Nurse's Association which provide her with Short-Term Disability (STD) benefits of 75% of income and Long-Term Disability (LTD) benefits of 60% of income. Under the STD coverage and the first 12 months of LTD coverage, Pat qualifies as being "disabled" if she cannot perform all of the primary duties of her regular occupation, even part of the time. Which type of coverage does Pat have? any occupation regular occupation own occupation total disability Oa) Ob) Oc) Od)