Answered step by step

Verified Expert Solution

Question

1 Approved Answer

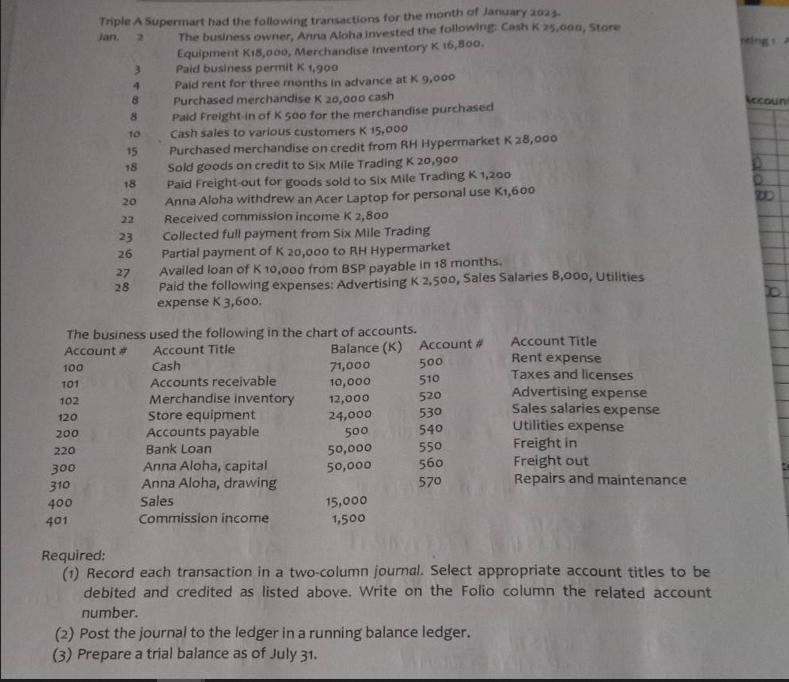

100 101 102 120 200 220 300 310 400 Triple A Supermart had the following transactions for the month of January 2023. Jan. 2

100 101 102 120 200 220 300 310 400 Triple A Supermart had the following transactions for the month of January 2023. Jan. 2 401 3 4 8 8 10 15 18 18 20 22 23 26 27 28 The business used the following in the chart of accounts. Account # Account Title Cash Accounts receivable Merchandise inventory The business owner, Anna Aloha invested the following Cash K 25,000, Store Equipment K18,000, Merchandise Inventory K 16,800. Paid business permit K 1,900 Paid rent for three months in advance at K 9,000 Purchased merchandise K 20,000 cash Paid Freight-in of K 500 for the merchandise purchased Cash sales to various customers K 15,000 Purchased merchandise on credit from RH Hypermarket K 28,000 Sold goods on credit to Six Mile Trading K 20,900 Paid Freight-out for goods sold to Six Mile Trading K 1,200 Anna Aloha withdrew an Acer Laptop for personal use K1,600 Received commission income K 2,800 Collected full payment from Six Mile Trading Partial payment of K 20,000 to RH Hypermarket Availed loan of K 10,000 from BSP payable in 18 months. Paid the following expenses: Advertising K 2,500, Sales Salaries 8,000, Utilities expense K 3,600. Store equipment Accounts payable Bank Loan Anna Aloha, capital Anna Aloha, drawing Sales Commission income Balance (K) Account # 71,000 10,000 12,000 24,000 500 50,000 50,000 15,000 1,500 500 510 520 530 540 550 560 570 Account Title Rent expense Taxes and licenses Advertising expense Sales salaries expense Utilities expense Freight in Freight out Repairs and maintenance Required: (1) Record each transaction in a two-column journal. Select appropriate account titles to be debited and credited as listed above. Write on the Folio column the related account number. (2) Post the journal to the ledger in a running balance ledger. (3) Prepare a trial balance as of July 31. Account B

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Transaction Journal Date Transaction Description Debit Credit Folio Jan 1 Cash investment by Anna Aloha Cash Capital 71000 Jan 1 Store equipment purchased with cash Equipment Cash 18000 Jan 1 Merchand...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started