Answered step by step

Verified Expert Solution

Question

1 Approved Answer

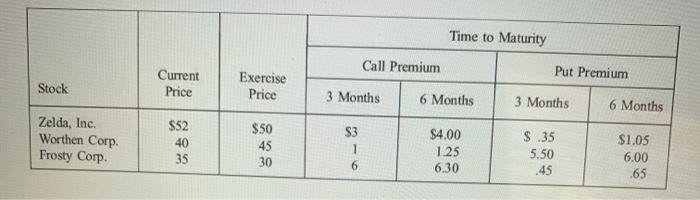

100 shares per contract Time to Maturity Call Premium Put Premium Stock Current Price Exercise Price 3 Months 6 Months 3 Months 6 Months Zelda,

100 shares per contract

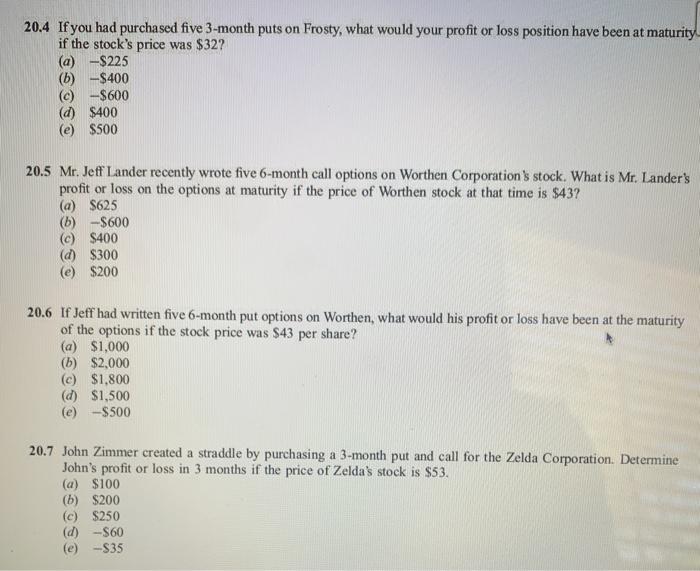

Time to Maturity Call Premium Put Premium Stock Current Price Exercise Price 3 Months 6 Months 3 Months 6 Months Zelda, Inc. Worthen Corp Frosty Corp. $52 40 35 $50 45 30 $3 1 6 $4.00 1.25 6.30 $.35 5.50 $1.05 6.00 .65 20.4 If you had purchased five 3-month puts on Frosty, what would your profit or loss position have been at maturity if the stock's price was $32? (a) $225 (6) -$400 -$600 (d) $400 (e) $500 20.5 Mr. Jeff Lander recently wrote five 6-month call options on Worthen Corporation's stock. What is Mr. Lander's profit or loss on the options at maturity if the price of Worthen stock at that time is $43? (a) $625 (6) -$600 (c) $400 (d) $300 (e) $200 20.6 If Jeff had written five 6-month put options on Worthen, what would his profit or loss have been at the maturity of the options if the stock price was $43 per share? (a) $1,000 (b) $2,000 (c) $1,800 (d) $1,500 (e) -$500 20.7 John Zimmer created a straddle by purchasing a 3-month put and call for the Zelda Corporation. Determine John's profit or loss in 3 months if the price of Zelda's stock is $53. (a) $100 (b) $200 (c) $250 (d) -S60 (e) -S35 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started