Answered step by step

Verified Expert Solution

Question

1 Approved Answer

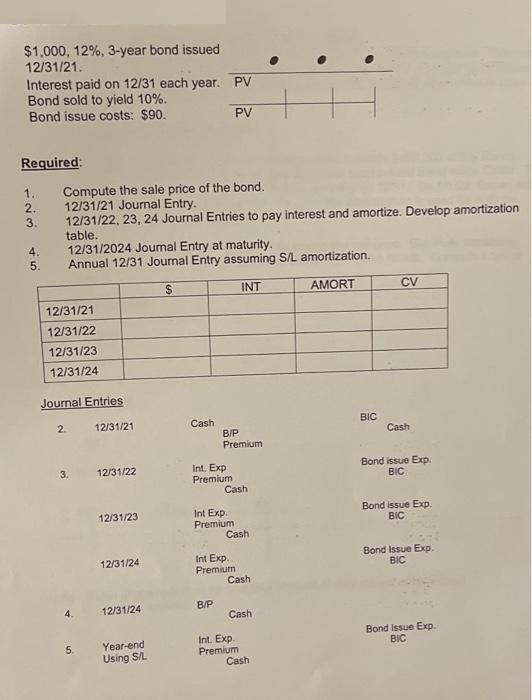

$1,000, 12%, 3-year bond issued 12/31/21. Interest paid on 12/31 each year. Bond sold to yield 10%. Bond issue costs: $90. Required: 1. 2.

$1,000, 12%, 3-year bond issued 12/31/21. Interest paid on 12/31 each year. Bond sold to yield 10%. Bond issue costs: $90. Required: 1. 2. 3. 4. 5. Compute the sale price of the bond. 12/31/21 Journal Entry. 12/31/22, 23, 24 Journal Entries to pay interest and amortize. Develop amortization table. 12/31/21 12/31/22 12/31/23 12/31/24 Journal Entries 2 12/31/2024 Journal Entry at maturity. Annual 12/31 Journal Entry assuming S/L amortization. $ INT AMORT 3. 4 5. 12/31/21 12/31/22 12/31/23 12/31/24 12/31/24 Year-end Using S/L Cash PV Int. Exp Premium PV B/P Premium Int Exp. Premium B/P Cash Int Exp.. Premium Cash Cash Cash Int. Exp. Premium Cash BIC CV Cash Bond issue Exp. BIC Bond issue Exp. BIC Bond Issue Exp. BIC Bond Issue Exp. BIC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Computation of Sale Price of Bond on 123121 The bond has a face value of 1000 and an interest rate o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started