Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10:00 Module name: Taxation Planning 2A Module code: TXP02A2 Year: 2022 Semester: First Assessment: Continuous Assessment 3 Release date: 1 April 2022 Submission deadline:

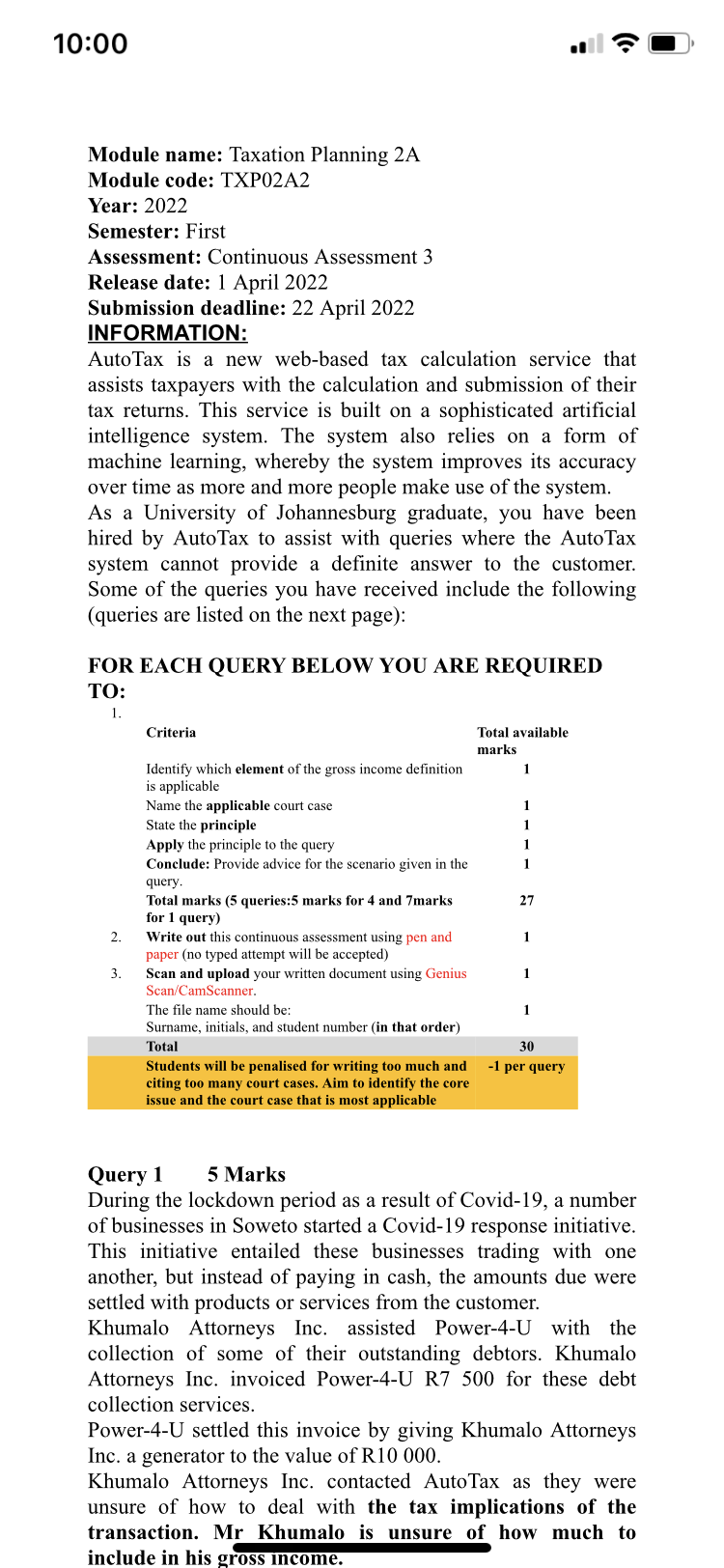

10:00 Module name: Taxation Planning 2A Module code: TXP02A2 Year: 2022 Semester: First Assessment: Continuous Assessment 3 Release date: 1 April 2022 Submission deadline: 22 April 2022 INFORMATION: AutoTax is a new web-based tax calculation service that assists taxpayers with the calculation and submission of their tax returns. This service is built on a sophisticated artificial intelligence system. The system also relies on a form of machine learning, whereby the system improves its accuracy over time as more and more people make use of the system. As a University of Johannesburg graduate, you have been hired by AutoTax to assist with queries where the AutoTax system cannot provide a definite answer to the customer. Some of the queries you have received include the following (queries are listed on the next page): FOR EACH QUERY BELOW YOU ARE REQUIRED TO: 1. Criteria Total available marks Identify which element of the gross income definition 1 is applicable Name the applicable court case 1 State the principle Apply the principle to the query 1 Conclude: Provide advice for the scenario given in the query. Total marks (5 queries:5 marks for 4 and 7marks for 1 query) 27 2. Write out this continuous assessment using pen and paper (no typed attempt will be accepted) 3. Scan and upload your written document using Genius Scan/CamScanner. The file name should be: 1 Surname, initials, and student number (in that order) Total Students will be penalised for writing too much and citing too many court cases. Aim to identify the core issue and the court case that is most applicable 30 -1 per query Query 1 5 Marks During the lockdown period as a result of Covid-19, a number of businesses in Soweto started a Covid-19 response initiative. This initiative entailed these businesses trading with one another, but instead of paying in cash, the amounts due were settled with products or services from the customer. Khumalo Attorneys Inc. assisted Power-4-U with the collection of some of their outstanding debtors. Khumalo Attorneys Inc. invoiced Power-4-U R7 500 for these debt collection services. Power-4-U settled this invoice by giving Khumalo Attorneys Inc. a generator to the value of R10 000. Khumalo Attorneys Inc. contacted AutoTax as they were unsure of how to deal with the tax implications of the transaction. Mr Khumalo is unsure of how much to include in his gross income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Query During the lockdown period as a result of Covid19 a number of businesses in Soweto started a Covid19 response initiative This initiative entaile...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started