Answered step by step

Verified Expert Solution

Question

1 Approved Answer

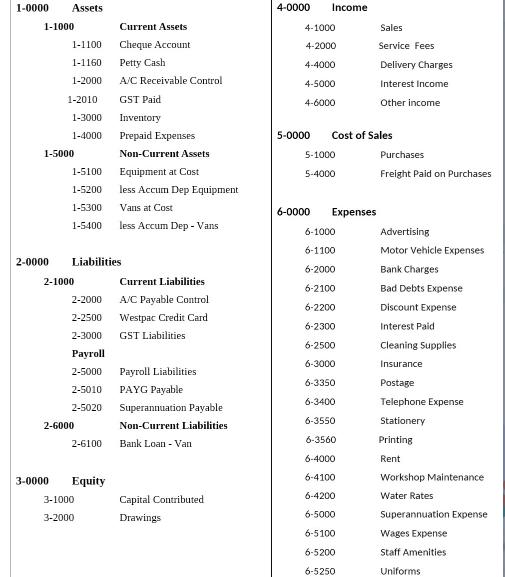

1-0000 Assets 1-1000 1-5000 2-0000 1-1100 1-1160 1-2000 1-2010 1-3000 1-4000 1-5100 1-5200 1-5300 1-5400 3-0000 2-1000 2-2000 2-2500 2-3000 Liabilities Payroll 2-5000 2-5010

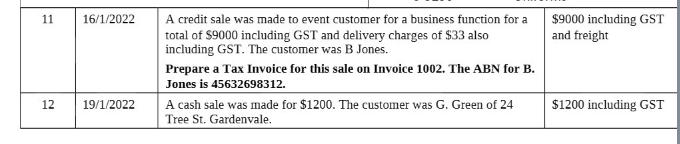

1-0000 Assets 1-1000 1-5000 2-0000 1-1100 1-1160 1-2000 1-2010 1-3000 1-4000 1-5100 1-5200 1-5300 1-5400 3-0000 2-1000 2-2000 2-2500 2-3000 Liabilities Payroll 2-5000 2-5010 2-5020 2-6000 2-6100 Equity Current Assets Cheque Account Petty Cash A/C Receivable Control GST Paid 3-1000 3-2000 Inventory Prepaid Expenses Non-Current Assets Equipment at Cost less Accum Dep Equipment Vans at Cost less Accum Dep - Vans Current Liabilities A/C Payable Control Westpac Credit Card GST Liabilities Payroll Liabilities PAYG Payable Superannuation Payable Non-Current Liabilities Bank Loan - Van Capital Contributed Drawings 4-0000 Income 4-1000 4-2000 4-4000 4-5000 4-6000 5-1000 5-4000 5-0000 Cost of Sales 6-0000 Expenses Sales Service Fees 6-1000 6-1100 6-2000 6-2100 6-2200 6-2300 6-2500 6-3000 6-3350 6-3400 6-3550 6-3560 6-4000 6-4100 6-4200 6-5000 6-5100 6-5200 6-5250 Delivery Charges Interest Income Other income Purchases Freight Paid on Purchases Advertising Motor Vehicle Expenses Bank Charges Bad Debts Expense Discount Expense Interest Paid Cleaning Supplies Insurance Postage Telephone Expense Stationery Printing Rent Workshop Maintenance Water Rates Superannuation Expense Wages Expense Staff Amenities Uniforms 11 12 16/1/2022 19/1/2022 A credit sale was made to event customer for a business function for a total of $9000 including GST and delivery charges of $33 also including GST. The customer was B Jones. Prepare a Tax Invoice for this sale on Invoice 1002. The ABN for B. Jones is 45632698312. A cash sale was made for $1200. The customer was G. Green of 24 Tree St. Gardenvale. $9000 including GST and freight $1200 including GST

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Tax Invoice Invoice 1002 Description Quantity Unit Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started