Answered step by step

Verified Expert Solution

Question

1 Approved Answer

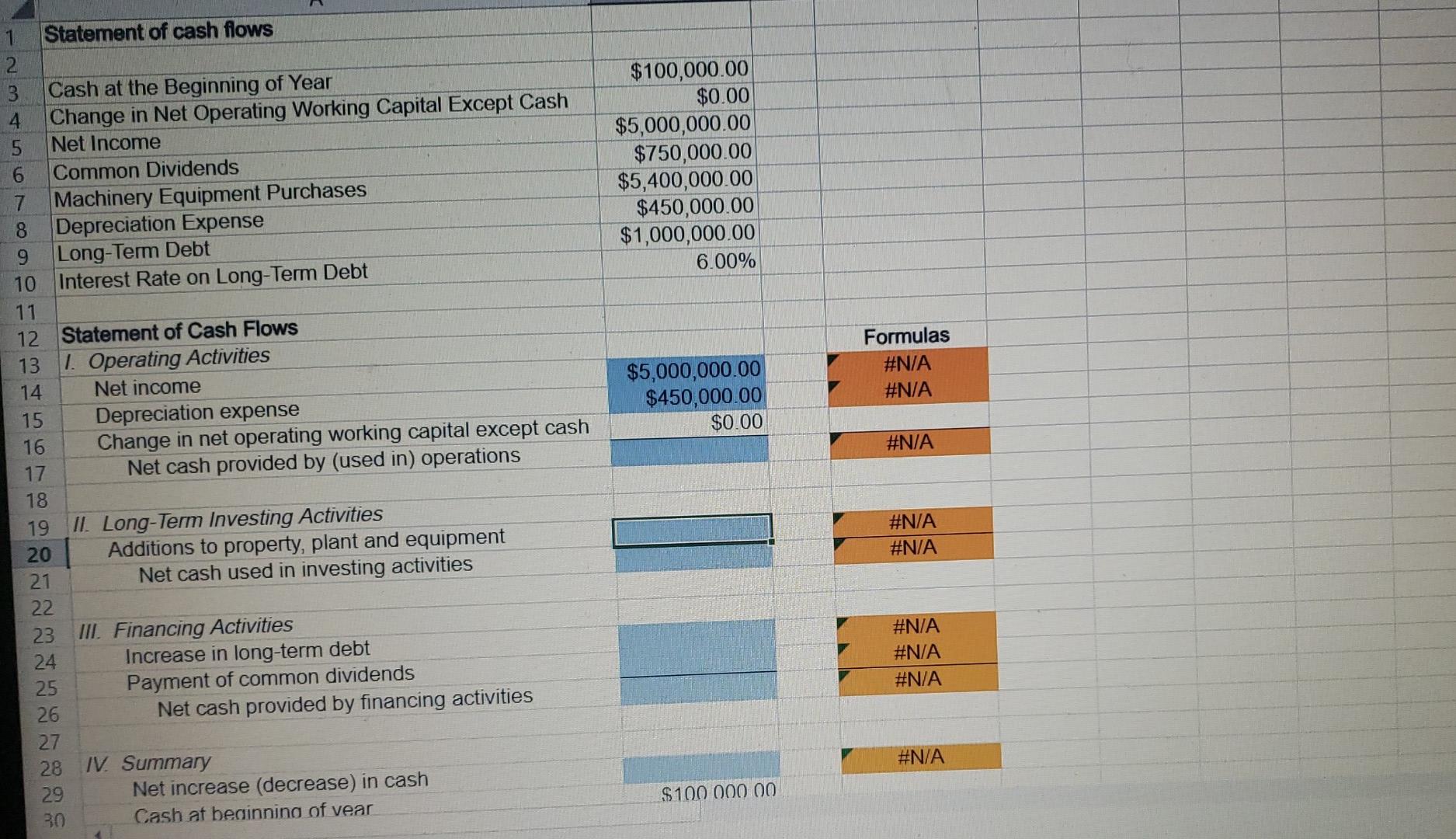

$100,000.00 $0.00 $5,000,000.00 $750,000.00 $5,400,000.00 $450,000.00 $1,000,000.00 6.00% 1 Statement of cash flows 2 Cash at the Beginning of Year 4 Change in Net Operating

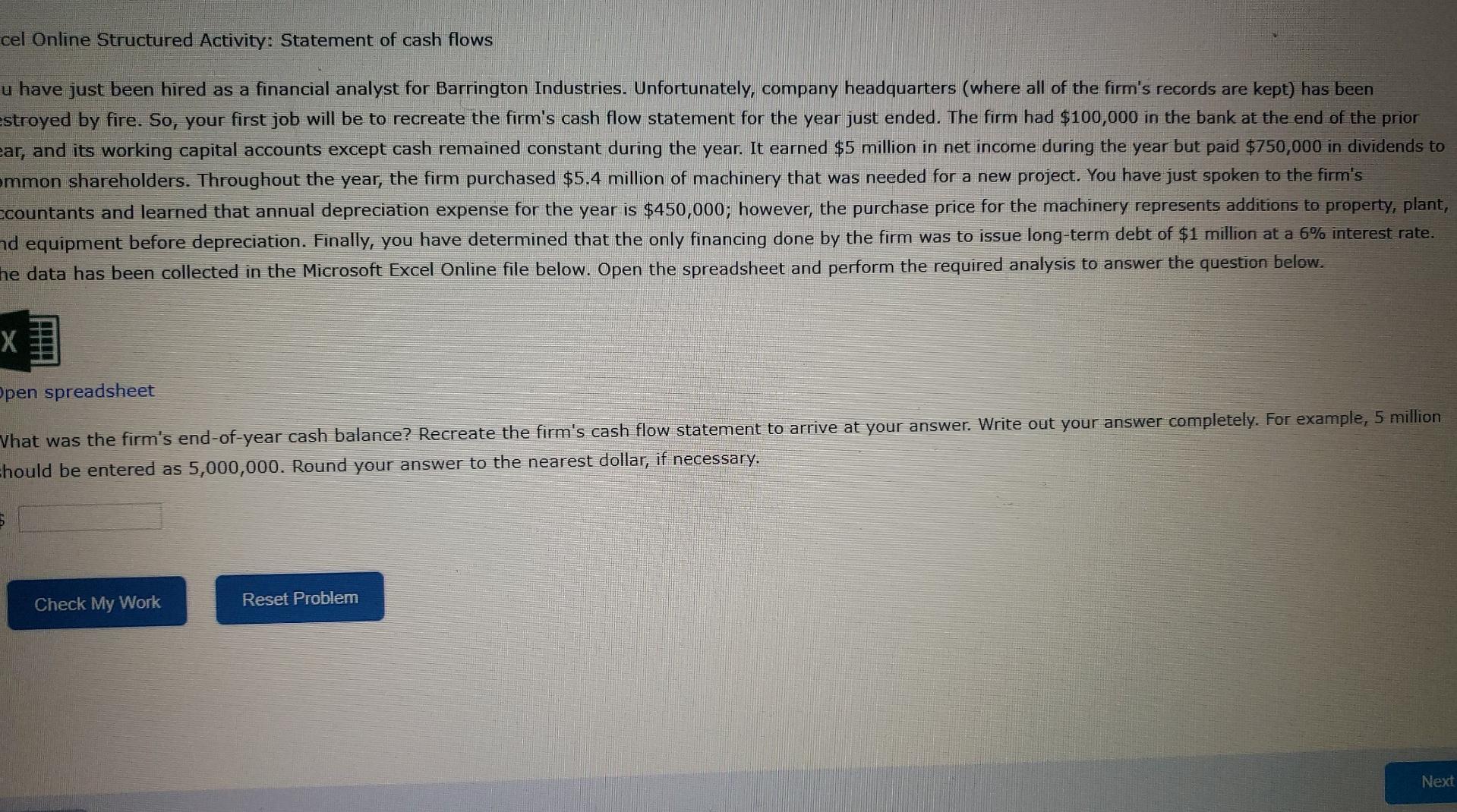

$100,000.00 $0.00 $5,000,000.00 $750,000.00 $5,400,000.00 $450,000.00 $1,000,000.00 6.00% 1 Statement of cash flows 2 Cash at the Beginning of Year 4 Change in Net Operating Working Capital Except Cash 5 Net Income 6 Common Dividends 7 Machinery Equipment Purchases 8 Depreciation Expense 9 Long-Term Debt 10 Interest Rate on Long-Term Debt 11 12 Statement of Cash Flows 13 1. Operating Activities 14 Net income 15 Depreciation expense 16 Change in net operating working capital except cash 17 Net cash provided by (used in) operations 18 19 II. Long-Term Investing Activities 20 Additions to property, plant and equipment 21 Net cash used in investing activities 22 23 III. Financing Activities 24 Increase in long-term debt 25 Payment of common dividends 26 Net cash provided by financing activities 27 28 IV. Summary 29 Net increase (decrease) in cash Cash at beginning of vear Formulas #N/A #N/A $5,000,000.00 $450,000.00 $0.00 #N/A #N/A #N/A #N/A #N/A #N/A #N/A $ 100 000 00 30 cel Online Structured Activity: Statement of cash flows u have just been hired as a financial analyst for Barrington Industries. Unfortunately, company headquarters (where all of the firm's records are kept) has been stroyed by fire. So, your first job will be to recreate the firm's cash flow statement for the year just ended. The firm had $100,000 in the bank at the end of the prior ear, and its working capital accounts except cash remained constant during the year. It earned $5 million in net income during the year but paid $750,000 in dividends to emmon shareholders. Throughout the year, the firm purchased $5.4 million of machinery that was needed for a new project. You have just spoken to the firm's ccountants and learned that annual depreciation expense for the year is $450,000; however, the purchase price for the machinery represents additions to property, plant, nd equipment before depreciation. Finally, you have determined that the only financing done by the firm was to issue long-term debt of $1 million at a 6% interest rate. he data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Vhat was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar, if necessary. Check My Work Reset Problem Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started