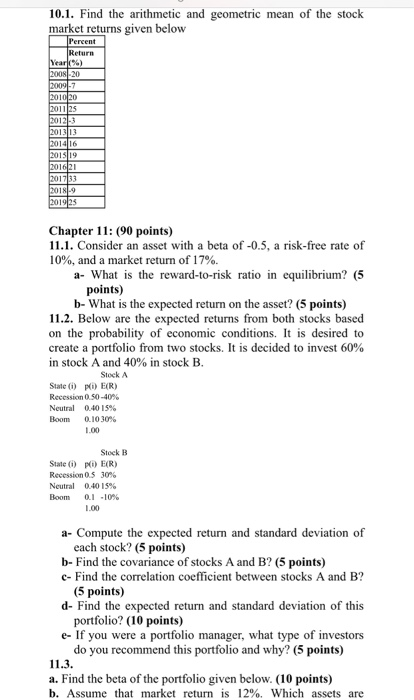

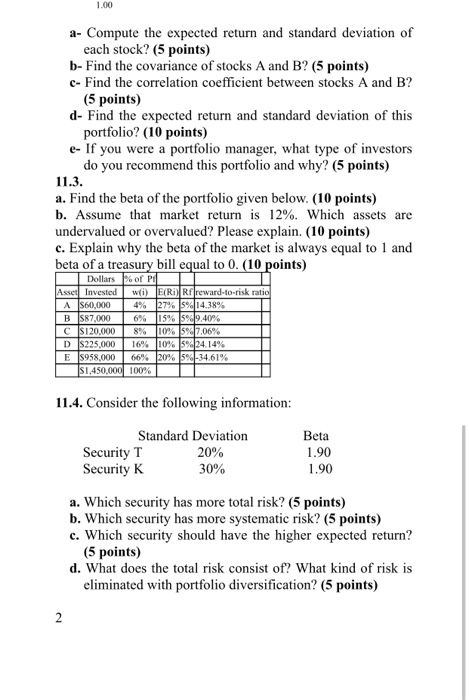

10.1. Find the arithmetic and geometric mean of the stock market returns given below Percent Return Year (%) 2008-20 10091-7 2010 20 2011125 2012-3 201313 101416 2015119 2016/21 201733 2018-9 201925 Chapter 11: (90 points) 11.1. Consider an asset with a beta of -0.5, a risk-free rate of 10%, and a market return of 17%. a- What is the reward-to-risk ratio in equilibrium? (5 points) b- What is the expected return on the asset? (5 points) 11.2. Below are the expected returns from both stocks based on the probability of economic conditions. It is desired to create a portfolio from two stocks. It is decided to invest 60% in stock A and 40% in stock B. Stock State (1) PD) E(R) Recession 0.50-40% Neutral 0.40 15% Boom 0.10 30% Stock B State (1) PE(R) Recession 0.5 30% Neutral 0.40 15% Boom 0.1 -10% 1.00 a- Compute the expected return and standard deviation of each stock? (5 points) b- Find the covariance of stocks A and B? (5 points) c- Find the correlation coefficient between stocks A and B? (5 points) d- Find the expected return and standard deviation of this portfolio? (10 points) - If you were a portfolio manager, what type of investors do you recommend this portfolio and why? (5 points) 11.3. a. Find the beta of the portfolio given below. (10 points) b. Assume that market return is 12%. Which assets are 1.00 a- Compute the expected return and standard deviation of each stock? (5 points) b- Find the covariance of stocks A and B? (5 points) C- Find the correlation coefficient between stocks A and B? (5 points) d- Find the expected return and standard deviation of this portfolio? (10 points) - If you were a portfolio manager, what type of investors do you recommend this portfolio and why? (5 points) 11.3. a. Find the beta of the portfolio given below. (10 points) b. Assume that market return is 12%. Which assets are undervalued or overvalued? Please explain. (10 points) c. Explain why the beta of the market is always equal to 1 and beta of a treasury bill equal to 0. (10 points) Dollars of P Asset Invested w(i) E(R) Rf reward-to-risk ratio A $60,000 4% 27% 5% 14.38% B $87,000 6% 15% 59.40% C 120,000 8% 10% 5% 7,06% D $225,000 16% 10% 5%24.14% E $958,000 66% 20% 5%-34.61% $1,450,000 100% 11.4. Consider the following information: Standard Deviation Security T 20% Security K 30% Beta 1.90 1.90 a. Which security has more total risk? (5 points) b. Which security has more systematic risk? (5 points) c. Which security should have the higher expected return? (5 points) d. What does the total risk consist of? What kind of risk is eliminated with portfolio diversification? (5 points) 2