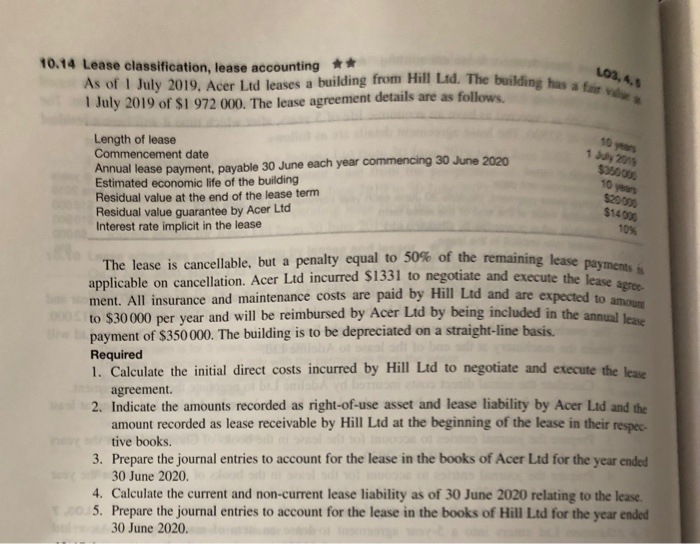

10.14 Lease classification, lease accounting As of I July 2019. Acer Ltd leases a building from Hill Ltd. The building has a 03 I July 2019 of $1 972 000. The lease agreement details are as follows. Length of lease Commencement date 40 year Annual lease payment, payable 30 June each year commencing 30 June 2020 Estimated economic life of the building Residual value at the end of the lease term Residual value guarantee by Acer Ltd Interest rate implicit in the lease 10 years $14030 10% ning lease payments is. te the lease agroe The lease is cancellable, but a penalty equal to 50% of the remai 1 to negotiate and applicable on cancellation. Acer Ltd incurred $133 ment. All insurance and maintenance costs are paid by Hill Ltd and to $30000 per year and will be reimbursed by Acer Ltd by being included in the annual leave payment of $350000. The building is to be depreciated on a straight-li Required 1. Calculate the initial direct costs incurred by Hill Ltd to negotiate and execute the lease are expected to ne basis. agreement. 2. Indicate the amounts recorded as right-of-use asset and lease liability by Acer Ltd and the amount recorded as lease receivable by Hill Ltd at the beginning of the lease in their respec tive books. Prepare the journal entries to account for the lease in the books of Acer Ltd for the year ended 30 June 2020 3. 4. Calculate the current and non-current lease liability as of 30 June 2020 relating to the lease 5. Prepare the journal entries to account for the lease in the books of Hill Ltd for the year ended 30 June 2020. 10.14 Lease classification, lease accounting As of I July 2019. Acer Ltd leases a building from Hill Ltd. The building has a 03 I July 2019 of $1 972 000. The lease agreement details are as follows. Length of lease Commencement date 40 year Annual lease payment, payable 30 June each year commencing 30 June 2020 Estimated economic life of the building Residual value at the end of the lease term Residual value guarantee by Acer Ltd Interest rate implicit in the lease 10 years $14030 10% ning lease payments is. te the lease agroe The lease is cancellable, but a penalty equal to 50% of the remai 1 to negotiate and applicable on cancellation. Acer Ltd incurred $133 ment. All insurance and maintenance costs are paid by Hill Ltd and to $30000 per year and will be reimbursed by Acer Ltd by being included in the annual leave payment of $350000. The building is to be depreciated on a straight-li Required 1. Calculate the initial direct costs incurred by Hill Ltd to negotiate and execute the lease are expected to ne basis. agreement. 2. Indicate the amounts recorded as right-of-use asset and lease liability by Acer Ltd and the amount recorded as lease receivable by Hill Ltd at the beginning of the lease in their respec tive books. Prepare the journal entries to account for the lease in the books of Acer Ltd for the year ended 30 June 2020 3. 4. Calculate the current and non-current lease liability as of 30 June 2020 relating to the lease 5. Prepare the journal entries to account for the lease in the books of Hill Ltd for the year ended 30 June 2020