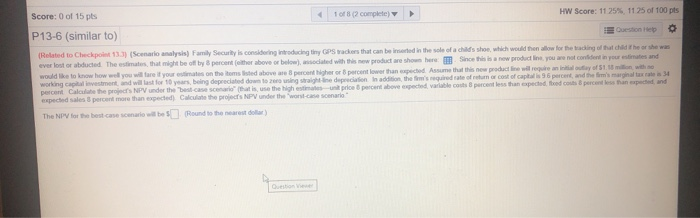

102 complete) Score: 0 of 15 pts HW Score: 11 25% 11 25 of 100 pts Question P13-6 (similar to) Related to Checkpoint 133) Scenario analysis) Family Security is considering introducing tiny GPS Trackers that can be made in the sole of a child's shon, which would thenow for the lading of that he or she was ever lost or abducted. The estimate that might be off by percent other above or below dated with new product are shown here . Since this is a new product in your not content in your states and would like to know how well you will fare it your mes on the m isted over 8 percent her or percent lower than spected Assume that this new product line will require an y of 51.18 with so working ca v estment and will last for 10 years being deprecated down to sing straight the depreciation in addition ther's requirate of return of cost of capital 96 percent, and the firm's marginal taxes 34 percent Calculate the proje NPV under the case scenario that is use the highest price percent above expected are cos percent less than expected food out percent less than speed, and expected sales percent more than expected) Calculate the role's NPV under the worst case scenario The NPV for the best case scenario Round to the nearest dolar) 102 complete) Score: 0 of 15 pts HW Score: 11 25% 11 25 of 100 pts Question P13-6 (similar to) Related to Checkpoint 133) Scenario analysis) Family Security is considering introducing tiny GPS Trackers that can be made in the sole of a child's shon, which would thenow for the lading of that he or she was ever lost or abducted. The estimate that might be off by percent other above or below dated with new product are shown here . Since this is a new product in your not content in your states and would like to know how well you will fare it your mes on the m isted over 8 percent her or percent lower than spected Assume that this new product line will require an y of 51.18 with so working ca v estment and will last for 10 years being deprecated down to sing straight the depreciation in addition ther's requirate of return of cost of capital 96 percent, and the firm's marginal taxes 34 percent Calculate the proje NPV under the case scenario that is use the highest price percent above expected are cos percent less than expected food out percent less than speed, and expected sales percent more than expected) Calculate the role's NPV under the worst case scenario The NPV for the best case scenario Round to the nearest dolar)