Answered step by step

Verified Expert Solution

Question

1 Approved Answer

102. I am need help solving this problem for my corporate finance homework and was hoping someone could help me with it and provide work

102. I am need help solving this problem for my corporate finance homework and was hoping someone could help me with it and provide work shown with the correct answer! Also provided the data table to help solve the probelm

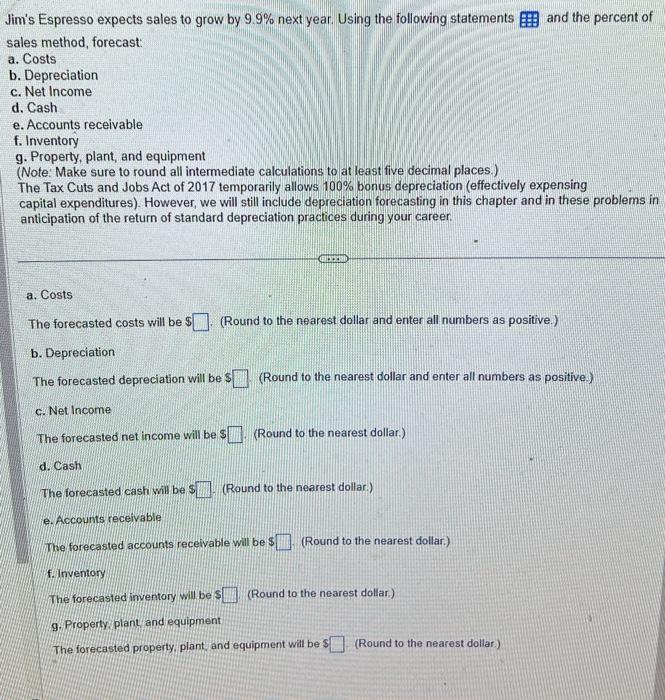

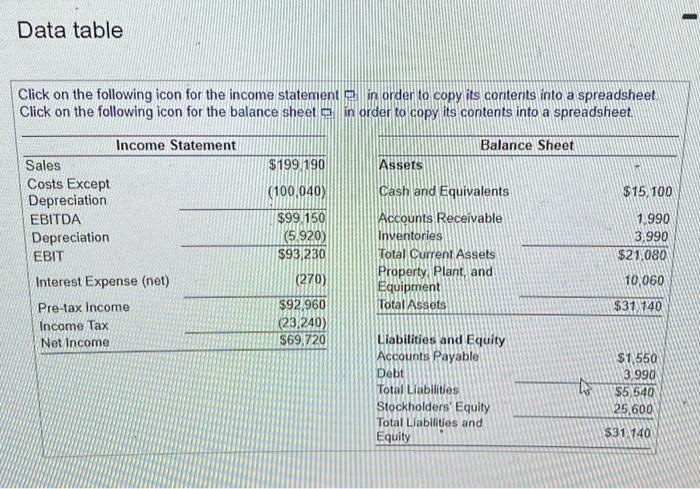

Jim's Espresso expects sales to grow by 9.9% next year. Using the following statements and the percent of sales method, forecast: a. Costs b. Depreciation c. Net Income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment (Note: Make sure to round all intermediate calculations to at least five decimal places.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. a. Costs The forecasted costs will be $ (Round to the nearest dollar and enter all numbers as positive.) b. Depreciation The forecasted depreciation will be \$ (Round to the nearest dollar and enter all numbers as positive.) c. Net lncome The forecasted net income will be $ (Round to the nearest dollar.) d. Cash The forecasted cash will be \$ (Round to the nearest dollar.) e. Accounts receivable The forecasted accounts receivable will be\$ (Round to the nearest dollar.) f. Inventory The forecasted inventory will be $ (Round to the nearest dollar.) 9. Property, plant and equipment The forecasted property, plant, and equipment will be \$ (Round to the nearest dollar.) Data table Click on the following icon for the income statement p in order to copy its contents into a spreadsheet Click on the following icon for the balance sheet in order to copy its contents into a spreadsheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started