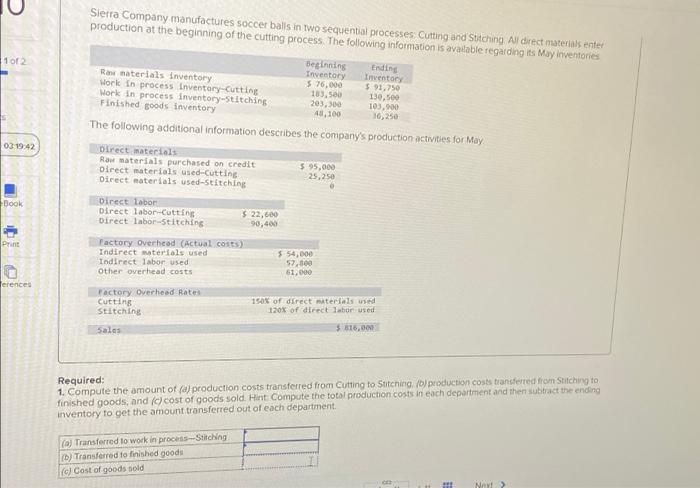

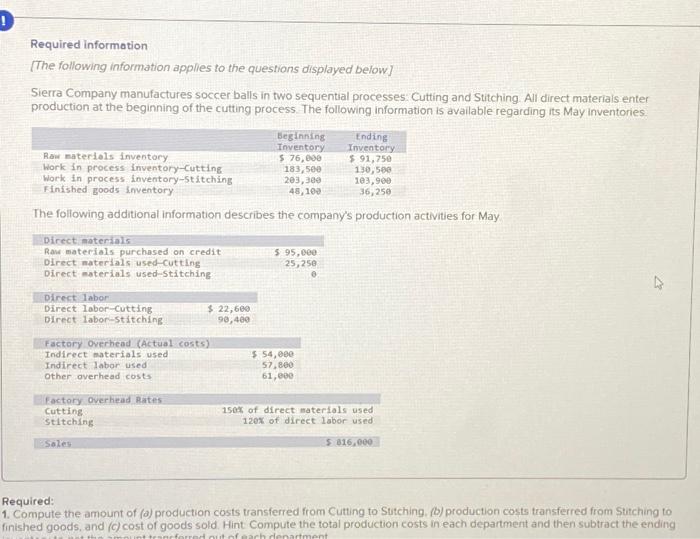

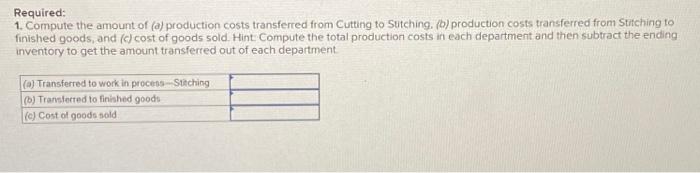

102 Sierra Company manufactures soccer balls in two sequential processes Cutting and Stitching All direct materials entet production at the beginning of the cutting process. The following information is available regarding its May inventories Beginning Ending Rane materials inventory Inventory Inventor 576.000 $ 93,750 Work in process Inventory-Cutting 183,500 Work in process inventory-stitching 203,300 103,00 Finished goods inventory 43, 100 The following additional information describes the company's production activities for May Direct materials Raw materials purchased on credit $ 95,000 Oirect materials used-Cutting 25,250 Direct materials used-stitching 03 19:42 Book Direct labor Direct labor-Cutting $ 22,600 Direct labor-Stitching 90,400 Factory Overhead (actual costs) Indirect materials used $ 54,000 Indirect labor used 57.100 Other overhead costs 61,000 Print erences Factory Overhead Bates Cutting Stitching 150% of direct materials used 120% of direct labor used $ 516,00 Sales Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching, (b) production costs transferred from Stiching to finished goods, and (c) cost of goods sold. Hint Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department (a) Transferred to work in process-Stitching ) Transferred to finished goods (c) Cost of goods sold 11 Nyt ! Required information (The following information applies to the questions displayed below) Sierra Company manufactures soccer balls in two sequential processes Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May Inventories Beginning Ending Inventory Inventory Raw materials inventory 5 76,000 $ 91,750 Work in process inventory-Cutting 183,500 130,500 Work in process Inventory-stitching 203,380 103,900 Finished goods Inventory 48, 100 36,250 The following additional information describes the company's production activities for May $ 95,000 25,250 Direct materials Raw materials purchased on credit Direct materials used-cutting Direct materials used-stitching Direct labor Direct labor-Cutting $ 22,600 Direct labor-stitching 90,400 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $ 54,000 57.800 61,000 Factory Overhead Rates Cutting Stitching 150% of direct materials used 120% of direct labor used Sales 5 816,000 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Sutching, (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint Compute the total production costs in each department and then subtract the ending mutfach denartment Required: 1. Compute the amount of (a) production costs transferred from Cutting to Sutching. (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint. Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department () Transferred to work in process Sitching (0) Transferred to finished goods (e) Cost of goods sold