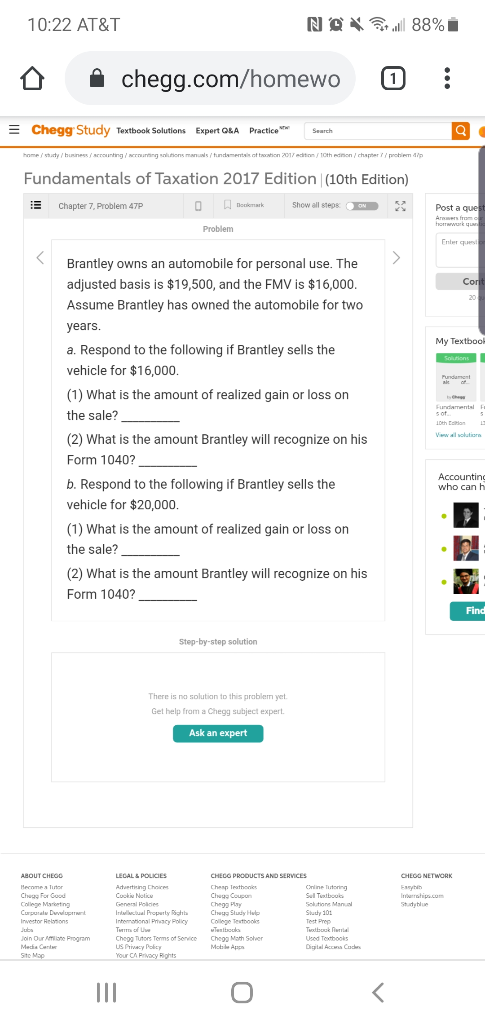

10:22 AT&T NOX l 88% o chegg.com/homewo 0 Chegg Study Textbook Solutions Expert OLA Practice Search Fundamentals of Taxation 2017 Edition (10th Edition) E Chapter 7. Problem 47P 0 k k Show all steps Post a que Problem My Textbool Brantley owns an automobile for personal use. The adjusted basis is $19,500, and the FMV is $16,000. Assume Brantley has owned the automobile for two years. a. Respond to the following if Brantley sells the vehicle for $ 16,000 (1) What is the amount of realized gain or loss on the sale? (2) What is the amount Brantley will recognize on his Form 1040? b. Respond to the following if Brantley sells the vehicle for $20,000. (1) What is the amount of realized gain or loss on the sale? (2) What is the amount Brantley will recognize on his Form 1040? Accountini v Canh Find Step-by-step solution There is no solution to this problem yet Get help from a chegg subject expert Ask an expert ABOUT CHEGO LEGAL & POLICIES CHED PRODUCTS AND SERVICES CHLOG NETWORK C D Chaty Hube Join Our Mecha Program in i Pracy Policy Tumo Chege Tumors Terms of Service US Privacy Policy Your CA Privacy Rights Chego Math Sohver Und Textbooks Digital Access Cache IM 10:22 AT&T NOX l 88% o chegg.com/homewo 0 Chegg Study Textbook Solutions Expert OLA Practice Search Fundamentals of Taxation 2017 Edition (10th Edition) E Chapter 7. Problem 47P 0 k k Show all steps Post a que Problem My Textbool Brantley owns an automobile for personal use. The adjusted basis is $19,500, and the FMV is $16,000. Assume Brantley has owned the automobile for two years. a. Respond to the following if Brantley sells the vehicle for $ 16,000 (1) What is the amount of realized gain or loss on the sale? (2) What is the amount Brantley will recognize on his Form 1040? b. Respond to the following if Brantley sells the vehicle for $20,000. (1) What is the amount of realized gain or loss on the sale? (2) What is the amount Brantley will recognize on his Form 1040? Accountini v Canh Find Step-by-step solution There is no solution to this problem yet Get help from a chegg subject expert Ask an expert ABOUT CHEGO LEGAL & POLICIES CHED PRODUCTS AND SERVICES CHLOG NETWORK C D Chaty Hube Join Our Mecha Program in i Pracy Policy Tumo Chege Tumors Terms of Service US Privacy Policy Your CA Privacy Rights Chego Math Sohver Und Textbooks Digital Access Cache IM