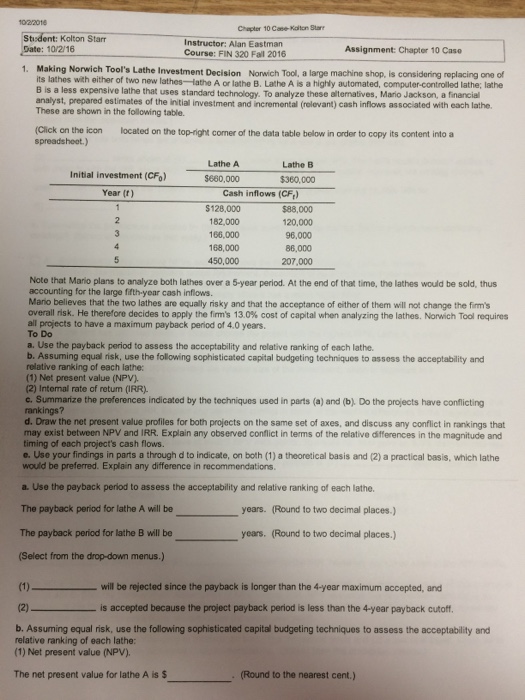

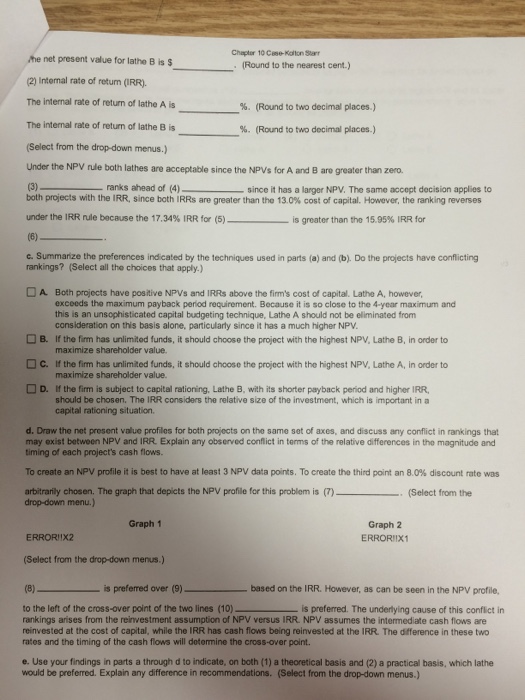

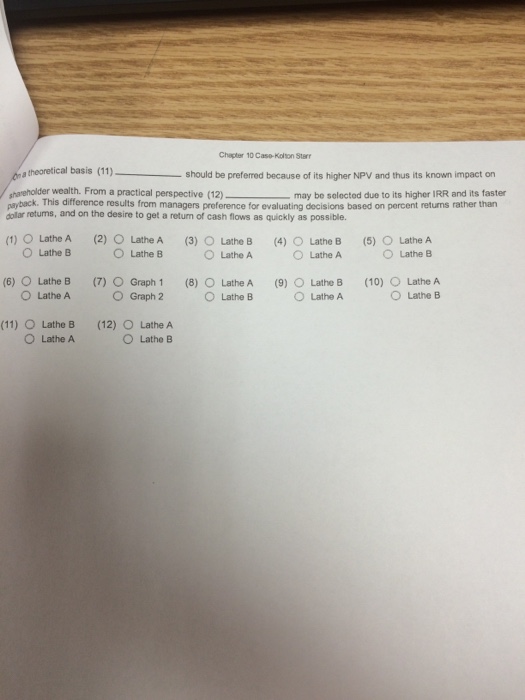

10/22018 Chapter 10 Case Katon Star Student: Kolton Starr Date: 10/2/16 Instructor: Alan Eastman Course: FIN 320 Fall 2016 Assignment: Chapter 10 Case 1. Making Norwich Tool's Lathe Investment Decision Norwich Tool, a large machine shop, is considering roplacing one of its lathes wit B is a less expensive lathe that uses standard technology. To analyze these alternatives, Mario Jackson, a financial analyst, prepared estimates of the initial investment These are shown in the following table h either of two new lathes athe A or lathe B. Lathe A is a highly automated, computer-controlled lathe; lathe and incremental (relevant) cash inflows associated with each lathe. (Click on the icon located on the top-right comer of the data table below in order to copy its content into a spreadshoot.) Lathe A Lathe B Initial investment (CFo) e80,000 $360,000 Cash inflows (CF) $128,000 182,000 166,000 168,000 Year (f) $88,000 120,000 96,000 86,000 207,000 Note that Mario plans to analyze both lathes over a 5-year perilod. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows Mario belleves that the two lathes are equally risky and that the acceptance of either of them ill not change the firms overall nsk. He therefore decides to apply the firm's 13.0% cost of capital when analyzing the lathes. Norwich Tool requires all projects to have a maximum payback period of 4.0 years. To Do a. Use the payback period to assess the acceptability and relative ranking of each lathe. b. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV) (2) Internal rate of retum (IRR). c. Summarize the preferences indicated by the techniques used in parts (a) and (b). Do the projects have conflicting rankings? dDraw the net present value profiles for both projects on the same set of axes, and discuss any conflict in rankings that may exist between NPV and IRR. Explain any observed conflict in terms of the relative differences in the magnitude and timing of each project's cash flows. e. Use your findings in parts a through d to indicate, on both (1) a theoretical basis and (2) a practical basis, which lathe would be preferred. Explain any difference in recommendations a. Use the payback period to assess the acceptability and relative ranking of each lathe. The payback period for lathe A will be years. (Round to two decimal places.) The payback period for lathe B will be years. (Round to two decimal places.) Select from the drop-down menus.) (1) will be rejected since the payback is longer than the 4-year maximum accepted, and is accepted because the project payback period is less than the 4-year payback cutoff b. Assuming equal risk, use the following sophisticated capital budgeting techniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV). The net present value for lathe A iss Round to the nearest cent)