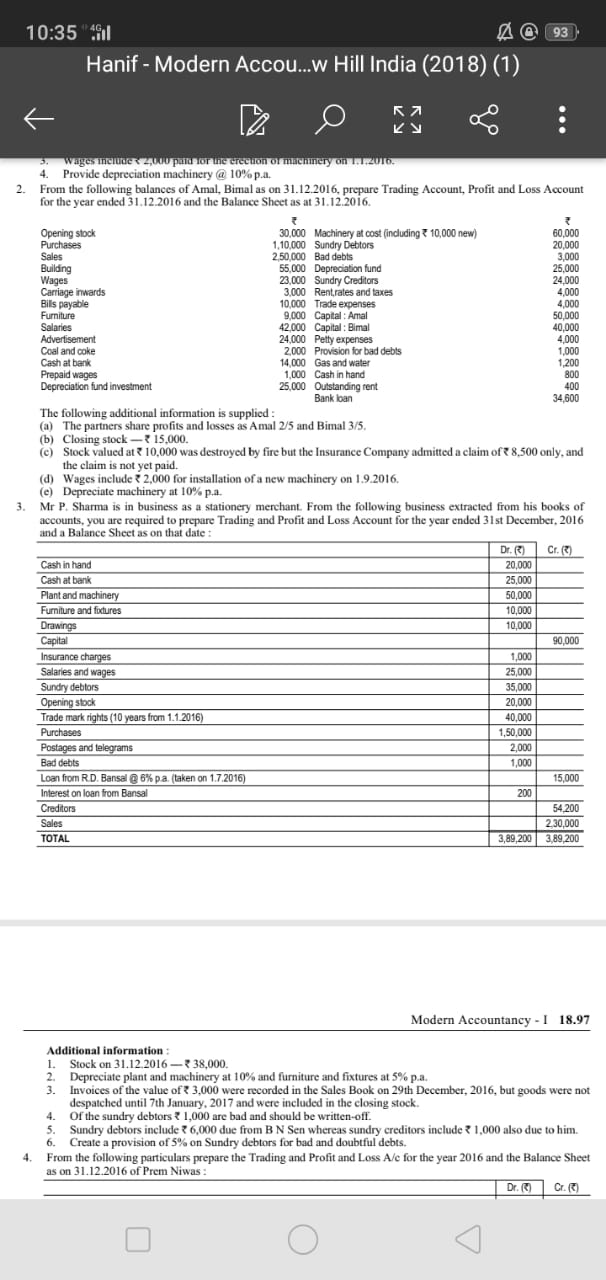

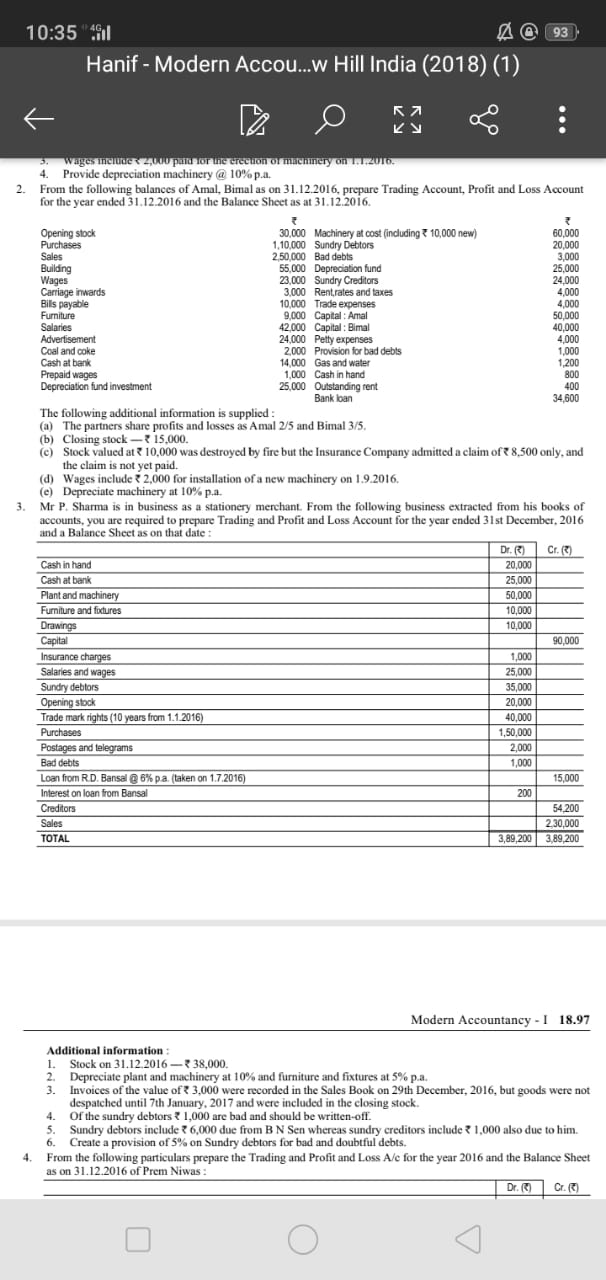

10:35 Gil @ 93 Hanif - Modern Accou...w Hill India (2018) (1) KY 2. Wages include ou par tor ne erection of machinery on 2010 4. Provide depreciation machinery @ 10%p.a. From the following balances of Amal, Bimal as on 31.12.2016, prepare Trading Account, Profit and Loss Account for the year ended 31.12.2016 and the Balance Sheet as at 31.12.2016. 7 Opening stock 30,000 Machinery at cost (including 10,000 new) 60,000 Purchases 1.10,000 Sundry Debtors 20,000 Sales 250,000 Bad debts 3,000 Building 55,000 Depreciation fund 25,000 Wages 23,000 Sundry Creditors 24,000 Carriage inwards 3.000 Rent rates and taxes 4.000 Bills payable 10,000 Trade expenses 4,000 Furniture 9,000 Capital : Amal 50,000 Salaries 42.000 Capital: Bimal 40,000 Advertisement 24,000 Petty expenses 4,000 Coal and coke 2,000 Provision for bad debts 1,000 Cash at bank 14,000 Gas and water 1,200 Prepaid wages 1,000 Cash in hand 800 Depreciation fund investment 25,000 Outstanding rent 400 Bank loan 34,600 The following additional information is supplied (a) The partners share profits and losses as Amal 2/5 and Bimal 3/5 (b) Closing stock - 15,000. Stock valued at 10,000 was destroyed by fire but the Insurance Company admitted a claim of 8,500 only, and the claim is not yet paid, (d) Wages include 2,000 for installation of a new machinery on 1.9.2016. (C) Depreciate machinery at 10%p.a. Mr P. Sharma is in business as a stationery merchant. From the following business extracted from his books of accounts, you are required to prepare Trading and Profit and Loss Account for the year ended 31st December, 2016 and a Balance Sheet as on that date : Dr.) Cr. (3) Cash in hand 20,000 Cash at bank 25,000 Plant and machinery 50,000 Furniture and fixtures 10,000 Drawings 10,000 Capital 90,000 Insurance charges 1,000 Salaries and wages 25,000 Sundry debtors 35,000 Opening stock 20,000 Trade mark rights (10 years from 1.1.2016) 40.000 Purchases 1,50,000 Postages and telegrams 2,000 Bad debts 1,000 Loan from RD. Bansal @ 6% pa taken on 1.7.2016) 15,000 Interest on loan from Bansal 200 Creditors 54200 Sales 230,000 TOTAL 3,89,2003,89,200 3 Modern Accountancy - I 18.97 Additional information 1. Stock on 31.12.2016 -238,000. 2 Depreciate plant and machinery at 10% and furniture and fixtures at 5% pa 3. Invoices of the value of 3,000 were recorded in the Sales Book on 29th December, 2016, but goods were not despatched until 7th January, 2017 and were included in the closing stock. of the sundry debtors 1,000 are bad and should be written-off. 5. Sundry debtors include