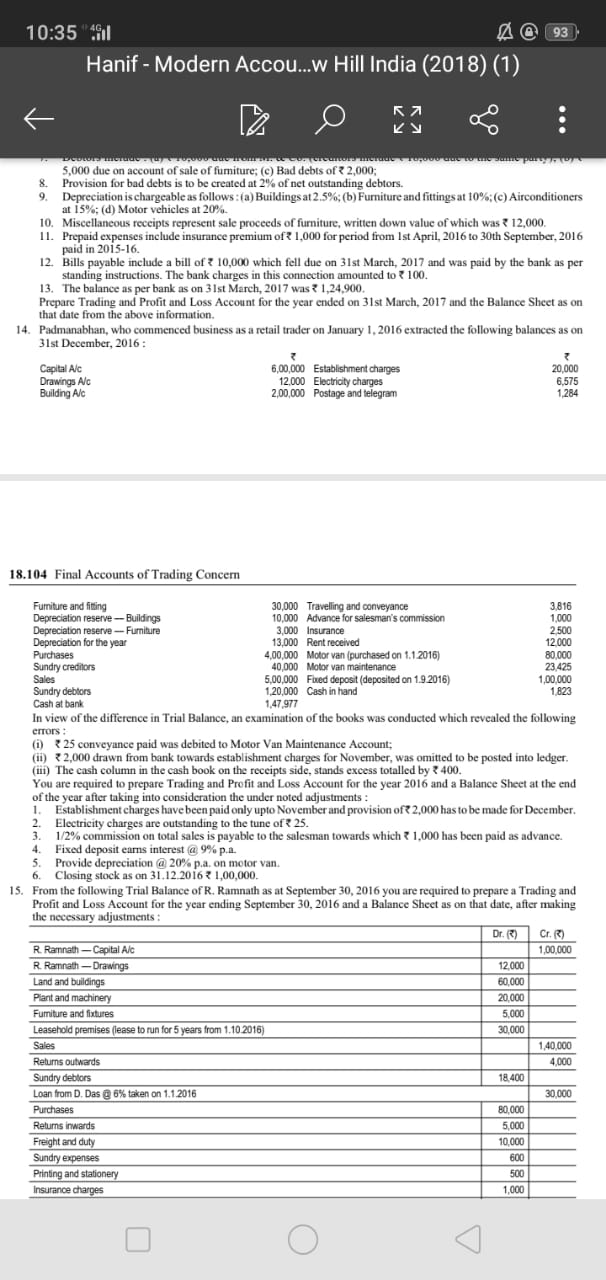

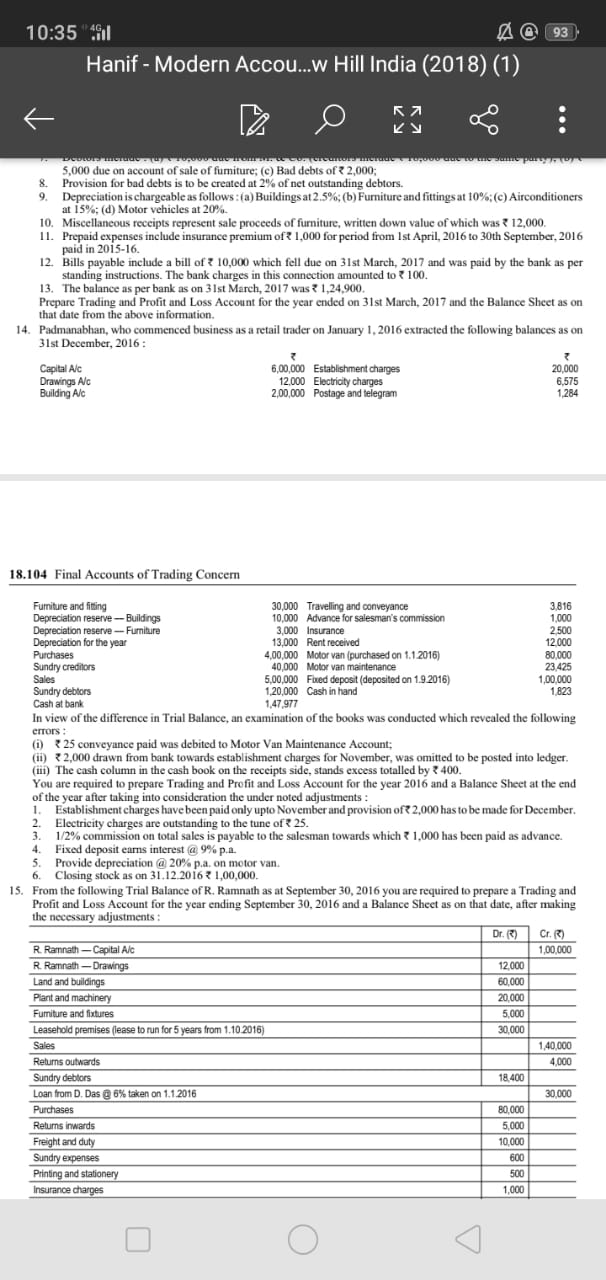

10:35 SI @ 93 Hanif - Modern Accou...w Hill India (2018) (1) e o KV GILER 9 COCO Corner pur 5,000 due on account of sale of fumiture; (c) Bad debts of 2,000; 8 Provision for bad debts is to be created at 2% of net outstanding debtors. Depreciation is chargeable as follows: (a) Buildings at 2.5%;(b) Furniture and fittings at 10%; (c) Airconditioners at 15%: (d) Motor vehicles at 20% 10. Miscellaneous receipts represent sale proceeds of furniture, written down value of which was 12,000. 11. Prepaid expenses include insurance premium of 1,000 for period from Ist April, 2016 to 30th September, 2016 paid in 2015-16. 12. Bills payable include a bill of 10,000 which fell due on 31st March, 2017 and was paid by the bank as per standing instructions. The bank charges in this connection amounted to 100. 13. The balance as per bank as on 31st March, 2017 was 21,24,900. Prepare Trading and Profit and Loss Account for the year ended on 31st March, 2017 and the Balance Sheet as on that date from the above information. 14. Padmanabhan, who commenced business as a retail trader on January 1, 2016 extracted the following balances as on 31st December, 2016: 3 Capital Alc 6,00,000 Establishment charges 20,000 Drawings Ac 12.000 Electricity charges 6,575 Building Alc 2,00,000 Postage and telegram 1.284 18.104 Final Accounts of Trading Concem Furniture and fitting 30,000 Travelling and conveyance 3,816 Depreciation reserve - Buildings 10,000 Advance for salesman's commission 1,000 Depreciation reserve - Furniture 3,000 Insurance 2 500 Depreciation for the year 13,000 Rent received 12.000 Purchases 4,00,000 Motor van (purchased on 1.1.2016) 80,000 Sundry creditors 40,000 Motor van maintenance 23.425 Sales 5,00,000 Fixed deposit (deposited on 1.92016) 1,00,000 Sundry debtors 1,20,000 Cash in hand 1.823 Cash at bank 1.47.977 In view of the difference in Trial Balance, an examination of the books was conducted which revealed the following errors: (i) 25 conveyance paid was debited to Motor Van Maintenance Account: (11) 32,000 drawn from bank towards establishment charges for November, was omitted to be posted into ledger (iii) The cash column in the cash book on the receipts side, stands excess totalled by