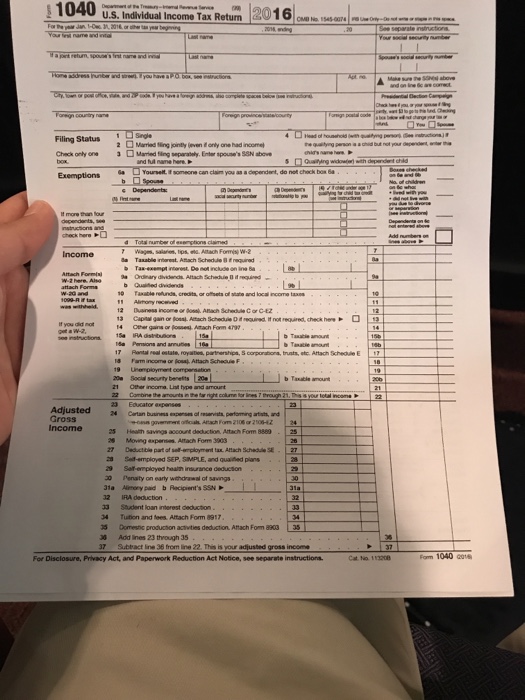

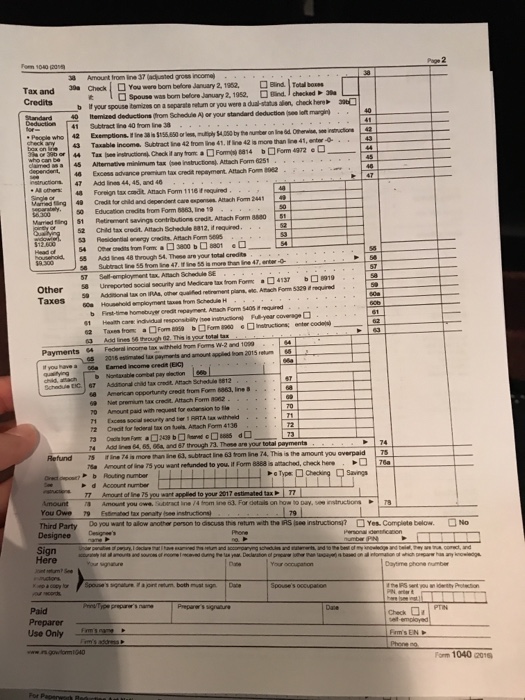

1040 20 16 US. Individual Income Tax Return separate instructions Filing Status 20 Marrassing jointly en only had income 3 O Married sing separately, Enter spouse's ssNabove Check only dependent, do not check boa Ba Yourmelt.Itsomeone can claim you as a It more check here O awexempt interest. Denotinclude online Ba sa Ordinary dividends. Altach Schedule Taatle refunds, eredita. Daness income ar Asach Schedule Cor CEZ Capital gan or Moss. Atach Schedue gains or Anach Form 16a Pemnions and annutes. Rental real estate, royautes, partnerships, Scorporations, tunts, etc. Attach Schedule b Tarable amount Gross Health savings aooount deduction. Attach Form 8889 Moving expenses. Attach Fome 3008 Deductible part of sel-mployment tax. Attach Schedule SE Seif-employed SEP, SMPLE, and quaised plans Sal-employed health insurance deduction 20 Penalty on earty wthdrawal Gt savings Alimony paid b Recipient's SSN 32 Saudent loan interest deducton Tuition and Maes, Attach Form 8917 Domestic producton acvties deduction. Attach Form 8003 Add lines 23 though 35 Subtact line 36 from line 22. This is your adjusted For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat No. 113208 1040 20 16 US. Individual Income Tax Return separate instructions Filing Status 20 Marrassing jointly en only had income 3 O Married sing separately, Enter spouse's ssNabove Check only dependent, do not check boa Ba Yourmelt.Itsomeone can claim you as a It more check here O awexempt interest. Denotinclude online Ba sa Ordinary dividends. Altach Schedule Taatle refunds, eredita. Daness income ar Asach Schedule Cor CEZ Capital gan or Moss. Atach Schedue gains or Anach Form 16a Pemnions and annutes. Rental real estate, royautes, partnerships, Scorporations, tunts, etc. Attach Schedule b Tarable amount Gross Health savings aooount deduction. Attach Form 8889 Moving expenses. Attach Fome 3008 Deductible part of sel-mployment tax. Attach Schedule SE Seif-employed SEP, SMPLE, and quaised plans Sal-employed health insurance deduction 20 Penalty on earty wthdrawal Gt savings Alimony paid b Recipient's SSN 32 Saudent loan interest deducton Tuition and Maes, Attach Form 8917 Domestic producton acvties deduction. Attach Form 8003 Add lines 23 though 35 Subtact line 36 from line 22. This is your adjusted For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat No. 113208