1040,8829,sch C from

1040,8829,sch C from

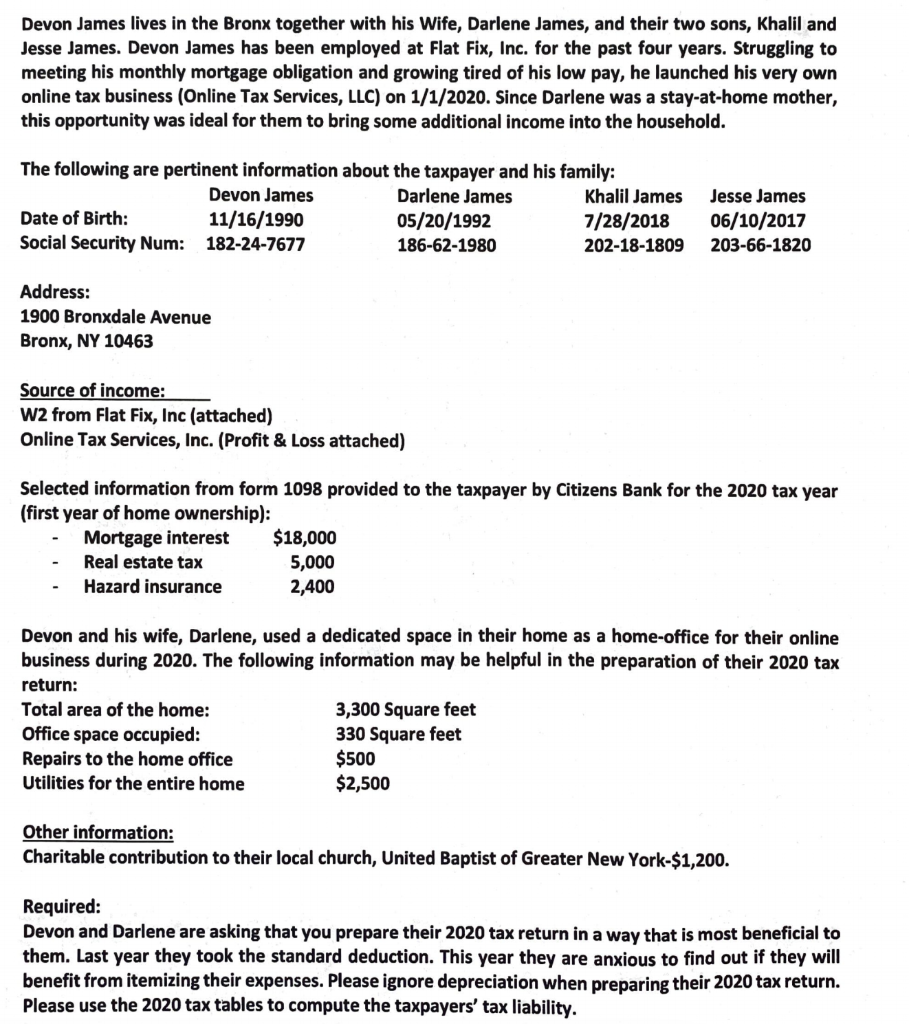

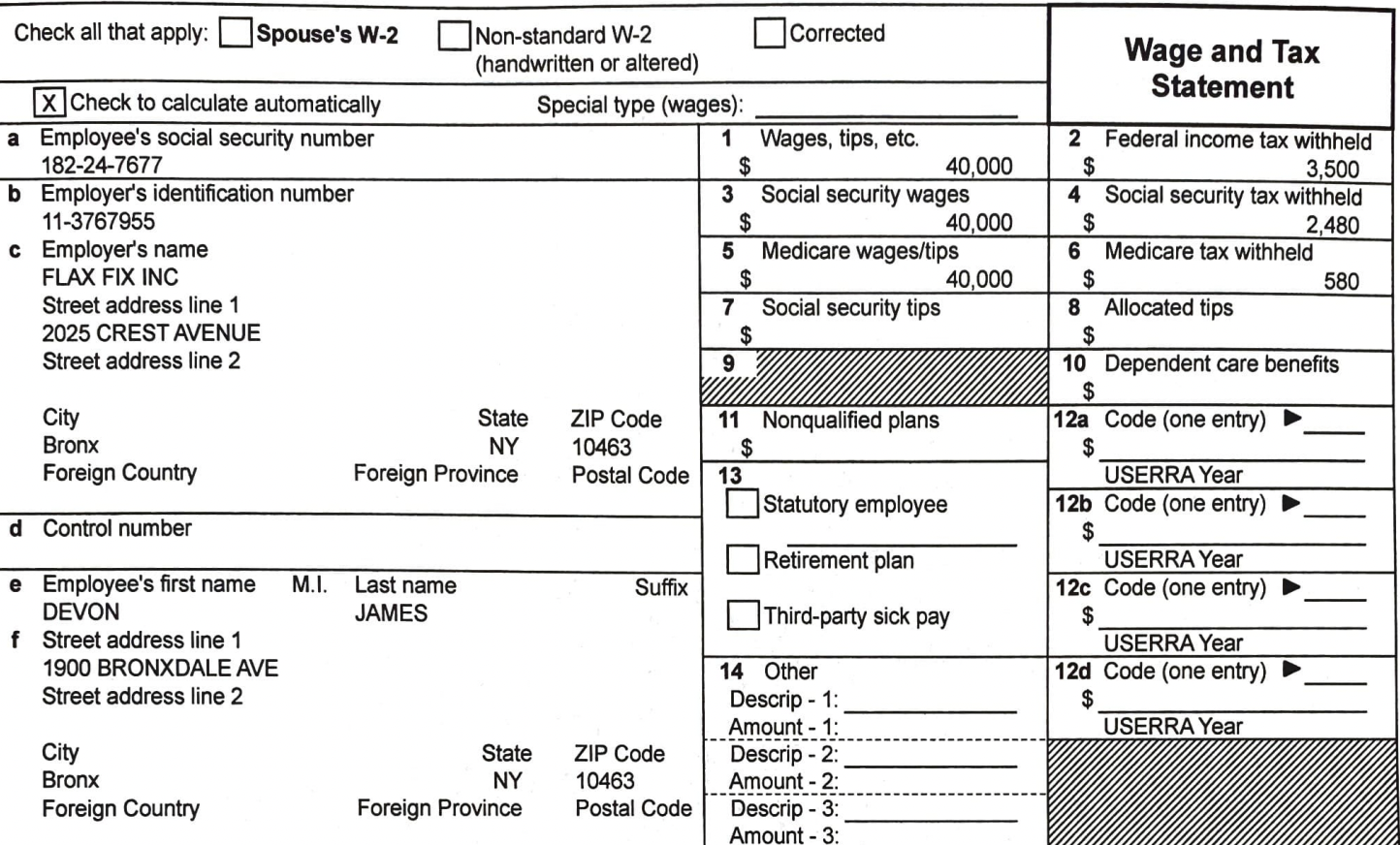

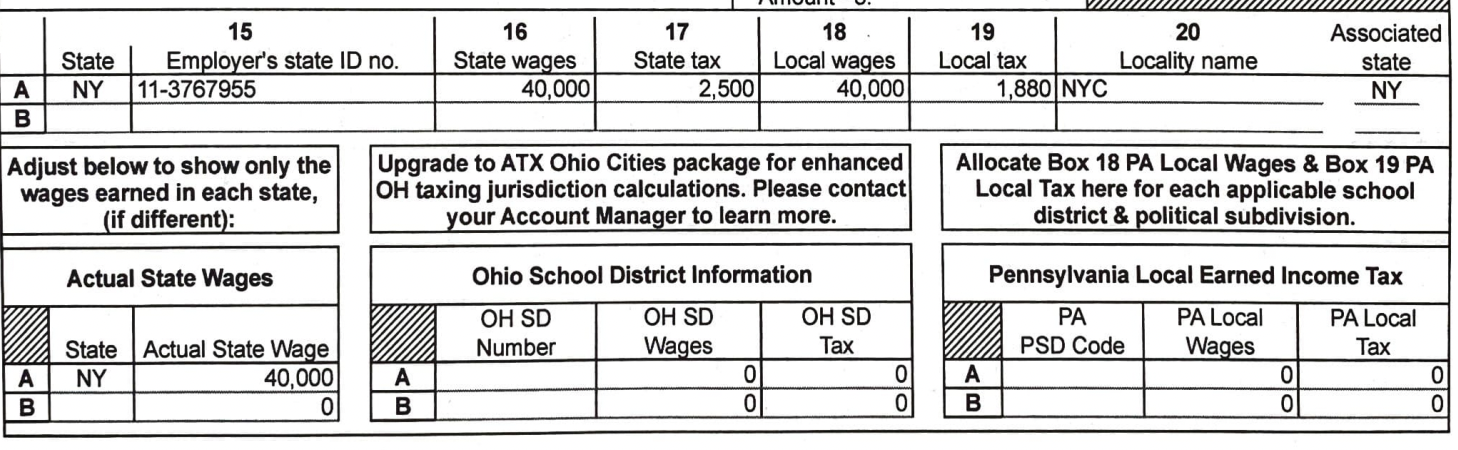

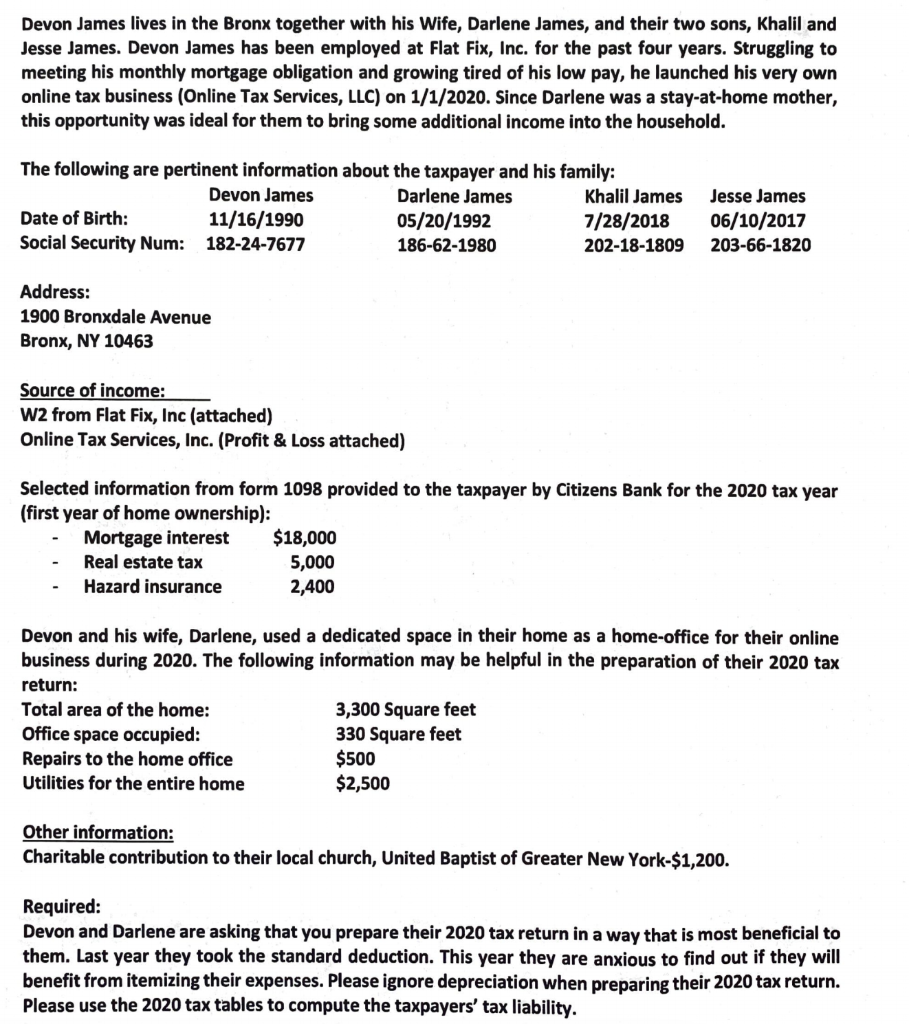

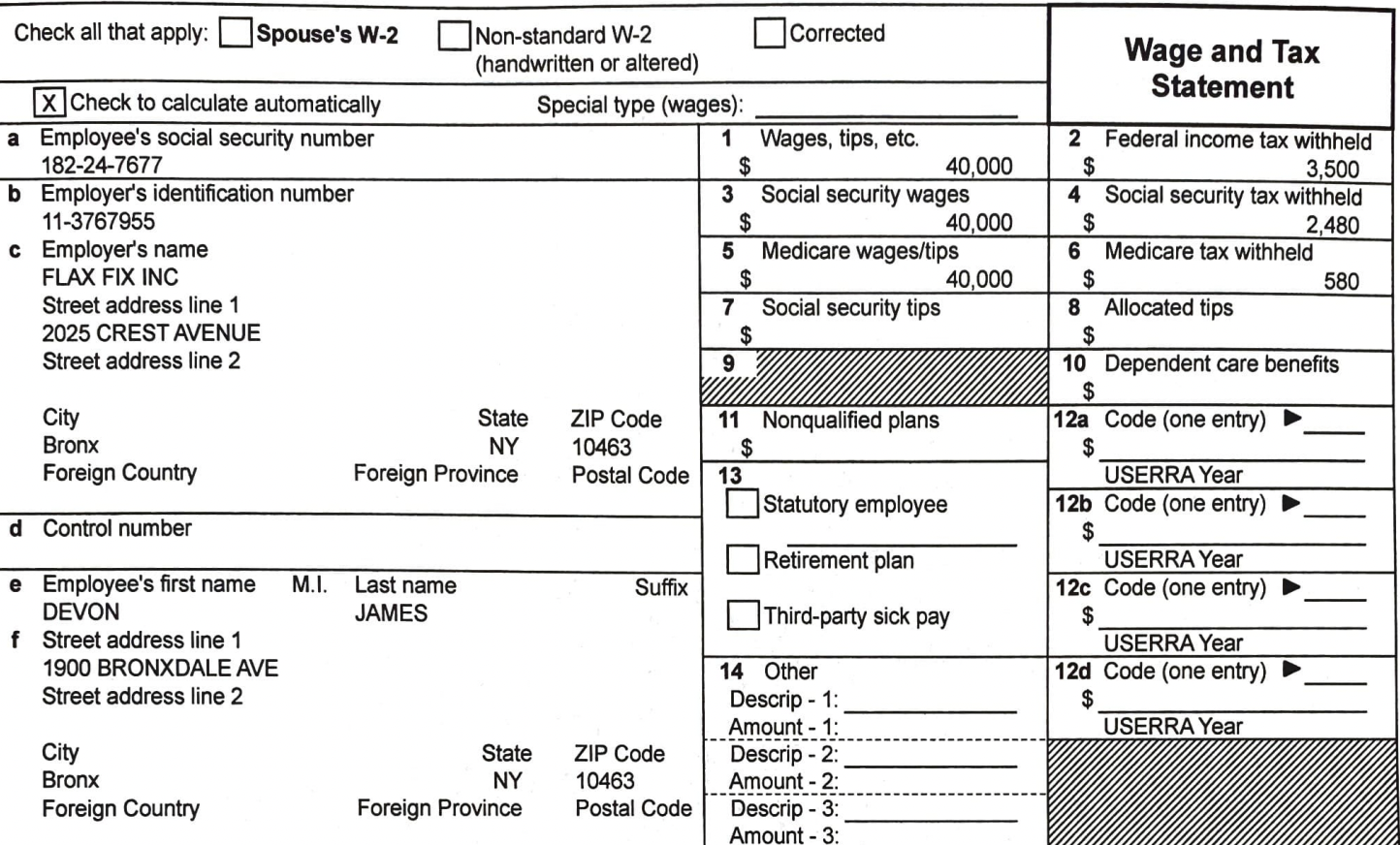

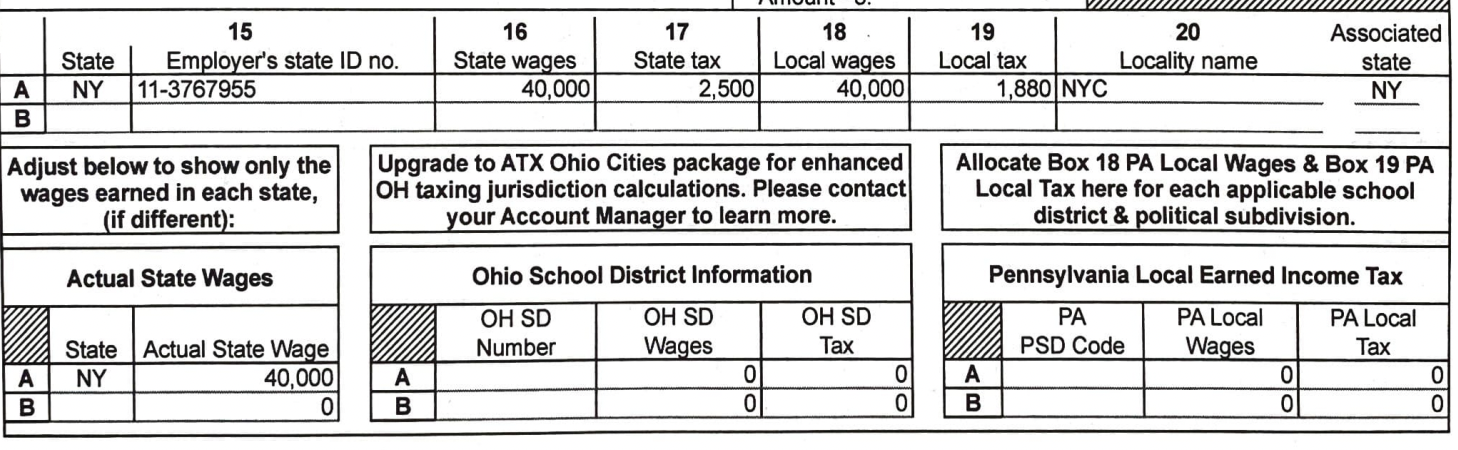

Devon James lives in the Bronx together with his wife, Darlene James, and their two sons, Khalil and Jesse James. Devon James has been employed at Flat Fix, Inc. for the past four years. Struggling to meeting his monthly mortgage obligation and growing tired of his low pay, he launched his very own online tax business (Online Tax Services, LLC) on 1/1/2020. Since Darlene was a stay-at-home mother, this opportunity was ideal for them to bring some additional income into the household. The following are pertinent information about the taxpayer and his family: Devon James Darlene James Khalil James Date of Birth: 11/16/1990 05/20/1992 7/28/2018 Social Security Num: 182-24-7677 186-62-1980 202-18-1809 Jesse James 06/10/2017 203-66-1820 Address: 1900 Bronxdale Avenue Bronx, NY 10463 Source of income: W2 from Flat Fix, Inc (attached) Online Tax Services, Inc. (Profit & Loss attached) Selected information from form 1098 provided to the taxpayer by Citizens Bank for the 2020 tax year (first year of home ownership): Mortgage interest $18,000 Real estate tax 5,000 Hazard insurance 2,400 Devon and his wife, Darlene, used a dedicated space in their home as a home-office for their online business during 2020. The following information may be helpful in the preparation of their 2020 tax return: Total area of the home: 3,300 Square feet Office space occupied: 330 Square feet Repairs to the home office $500 Utilities for the entire home $2,500 Other information: Charitable contribution to their local church, United Baptist of Greater New York-$1,200. Required: Devon and Darlene are asking that you prepare their 2020 tax return in a way that is most beneficial to them. Last year they took the standard deduction. This year they are anxious to find out if they will benefit from itemizing their expenses. Please ignore depreciation when preparing their 2020 tax return. Please use the 2020 tax tables to compute the taxpayers' tax liability. Check all that apply: Spouse's W-2 Wage and Tax Statement X Check to calculate automatically a Employee's social security number 182-24-7677 b Employer's identification number 11-3767955 C Employer's name FLAX FIX INC Street address line 1 2025 CREST AVENUE Street address line 2 Non-standard W-2 Corrected (handwritten or altered) Special type (wages): 1 Wages, tips, etc. $ 40,000 3 Social security wages $ 40,000 5 Medicare wages/tips $ 40,000 7 Social security tips $ 9 City State Bronx Foreign Country 2 Federal income tax withheld $ 3,500 4 Social security tax withheld $ 2,480 6 Medicare tax withheld $ 580 8 Allocated tips $ 10 Dependent care benefits $ 12a Code (one entry) $ USERRA Year 12b Code (one entry) $ USERRA Year 12c Code (one entry) $ USERRA Year 12d Code (one entry) $ USERRA Year ZIP Code 10463 Postal Code NY Foreign Province 11 Nonqualified plans $ 13 Statutory employee d Control number Retirement plan M.I. Last name JAMES Suffix Third-party sick pay e Employee's first name DEVON f Street address line 1 1900 BRONXDALE AVE Street address line 2 City Bronx Foreign Country State NY Foreign Province ZIP Code 10463 Postal Code 14 Other Descrip - 1: Amount - 1: Descrip - 2: Amount - 2: Descrip - 3: Amount - 3: State NY 15 Employer's state ID no. 11-3767955 16 State wages 40,000 17 State tax 2,500 18 Local wages 40,000 19 20 Local tax Locality name 1,880 NYC Associated state NY A B Adjust below to show only the wages earned in each state, (if different): Upgrade to ATX Ohio Cities package for enhanced OH taxing jurisdiction calculations. Please contact your Account Manager to learn more. Allocate Box 18 PA Local Wages & Box 19 PA Local Tax here for each applicable school district & political subdivision. Actual State Wages Ohio School District Information OH SD Number OH SD Wages OH SD Tax Pennsylvania Local Earned Income Tax PA PA Local PA Local PSD Code Wages Tax A 0 0 B 0 State NY A B Actual State Wage 40,000 0 A B 0 0 olol Online Tax Services, LLC Profit & Loss Statement FYI Ended December 31, 2020 EIN: 46-2451976 Revenue: Fees collected from customers $ 55,000.00 $ Expenses Independent contractor expense Advertising expense Software expense Insurance expense-Liab Travel expense Supplies expense Tax preparation fees ($500 allocated to Sch C) Entertainment expense 16,400.00 2,815.00 .00 850.00 2,400.00 1,000.00 900.00 1,520.00 Meals expense 800.00 Postage expense 439.00 Total expense $ 29,103.00 Net Income $ 25,897.00 Note: The books are kept on a "cash basis" and all 1099 NEC have been filed Devon James lives in the Bronx together with his wife, Darlene James, and their two sons, Khalil and Jesse James. Devon James has been employed at Flat Fix, Inc. for the past four years. Struggling to meeting his monthly mortgage obligation and growing tired of his low pay, he launched his very own online tax business (Online Tax Services, LLC) on 1/1/2020. Since Darlene was a stay-at-home mother, this opportunity was ideal for them to bring some additional income into the household. The following are pertinent information about the taxpayer and his family: Devon James Darlene James Khalil James Date of Birth: 11/16/1990 05/20/1992 7/28/2018 Social Security Num: 182-24-7677 186-62-1980 202-18-1809 Jesse James 06/10/2017 203-66-1820 Address: 1900 Bronxdale Avenue Bronx, NY 10463 Source of income: W2 from Flat Fix, Inc (attached) Online Tax Services, Inc. (Profit & Loss attached) Selected information from form 1098 provided to the taxpayer by Citizens Bank for the 2020 tax year (first year of home ownership): Mortgage interest $18,000 Real estate tax 5,000 Hazard insurance 2,400 Devon and his wife, Darlene, used a dedicated space in their home as a home-office for their online business during 2020. The following information may be helpful in the preparation of their 2020 tax return: Total area of the home: 3,300 Square feet Office space occupied: 330 Square feet Repairs to the home office $500 Utilities for the entire home $2,500 Other information: Charitable contribution to their local church, United Baptist of Greater New York-$1,200. Required: Devon and Darlene are asking that you prepare their 2020 tax return in a way that is most beneficial to them. Last year they took the standard deduction. This year they are anxious to find out if they will benefit from itemizing their expenses. Please ignore depreciation when preparing their 2020 tax return. Please use the 2020 tax tables to compute the taxpayers' tax liability. Check all that apply: Spouse's W-2 Wage and Tax Statement X Check to calculate automatically a Employee's social security number 182-24-7677 b Employer's identification number 11-3767955 C Employer's name FLAX FIX INC Street address line 1 2025 CREST AVENUE Street address line 2 Non-standard W-2 Corrected (handwritten or altered) Special type (wages): 1 Wages, tips, etc. $ 40,000 3 Social security wages $ 40,000 5 Medicare wages/tips $ 40,000 7 Social security tips $ 9 City State Bronx Foreign Country 2 Federal income tax withheld $ 3,500 4 Social security tax withheld $ 2,480 6 Medicare tax withheld $ 580 8 Allocated tips $ 10 Dependent care benefits $ 12a Code (one entry) $ USERRA Year 12b Code (one entry) $ USERRA Year 12c Code (one entry) $ USERRA Year 12d Code (one entry) $ USERRA Year ZIP Code 10463 Postal Code NY Foreign Province 11 Nonqualified plans $ 13 Statutory employee d Control number Retirement plan M.I. Last name JAMES Suffix Third-party sick pay e Employee's first name DEVON f Street address line 1 1900 BRONXDALE AVE Street address line 2 City Bronx Foreign Country State NY Foreign Province ZIP Code 10463 Postal Code 14 Other Descrip - 1: Amount - 1: Descrip - 2: Amount - 2: Descrip - 3: Amount - 3: State NY 15 Employer's state ID no. 11-3767955 16 State wages 40,000 17 State tax 2,500 18 Local wages 40,000 19 20 Local tax Locality name 1,880 NYC Associated state NY A B Adjust below to show only the wages earned in each state, (if different): Upgrade to ATX Ohio Cities package for enhanced OH taxing jurisdiction calculations. Please contact your Account Manager to learn more. Allocate Box 18 PA Local Wages & Box 19 PA Local Tax here for each applicable school district & political subdivision. Actual State Wages Ohio School District Information OH SD Number OH SD Wages OH SD Tax Pennsylvania Local Earned Income Tax PA PA Local PA Local PSD Code Wages Tax A 0 0 B 0 State NY A B Actual State Wage 40,000 0 A B 0 0 olol Online Tax Services, LLC Profit & Loss Statement FYI Ended December 31, 2020 EIN: 46-2451976 Revenue: Fees collected from customers $ 55,000.00 $ Expenses Independent contractor expense Advertising expense Software expense Insurance expense-Liab Travel expense Supplies expense Tax preparation fees ($500 allocated to Sch C) Entertainment expense 16,400.00 2,815.00 .00 850.00 2,400.00 1,000.00 900.00 1,520.00 Meals expense 800.00 Postage expense 439.00 Total expense $ 29,103.00 Net Income $ 25,897.00 Note: The books are kept on a "cash basis" and all 1099 NEC have been filed

1040,8829,sch C from

1040,8829,sch C from