Answered step by step

Verified Expert Solution

Question

1 Approved Answer

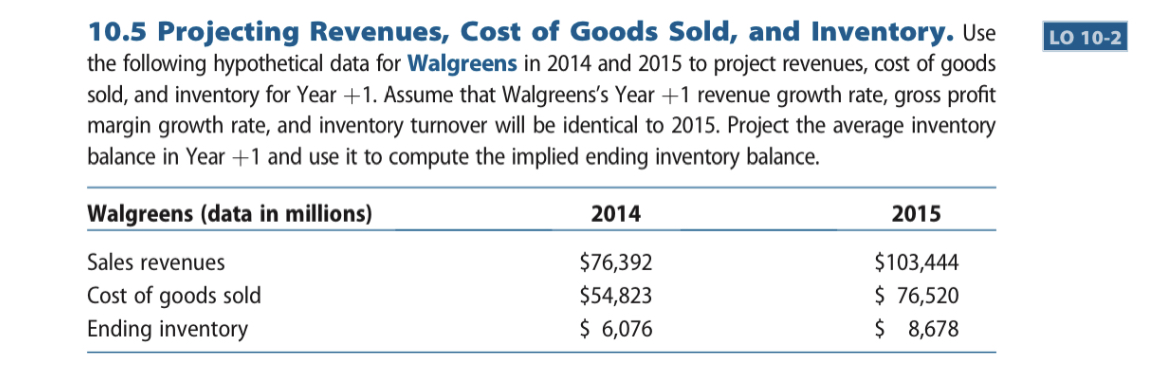

10.5 Projecting Revenues, Cost of Goods Sold, and Inventory. Use the following hypothetical data for Walgreens in 2014 and 2015 to project revenues, cost

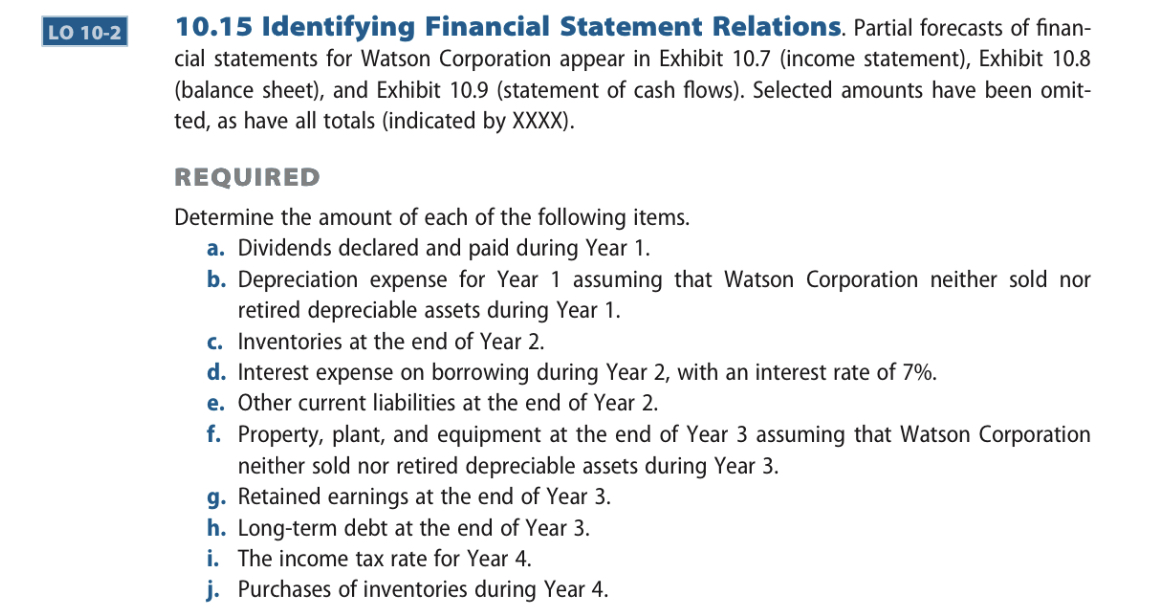

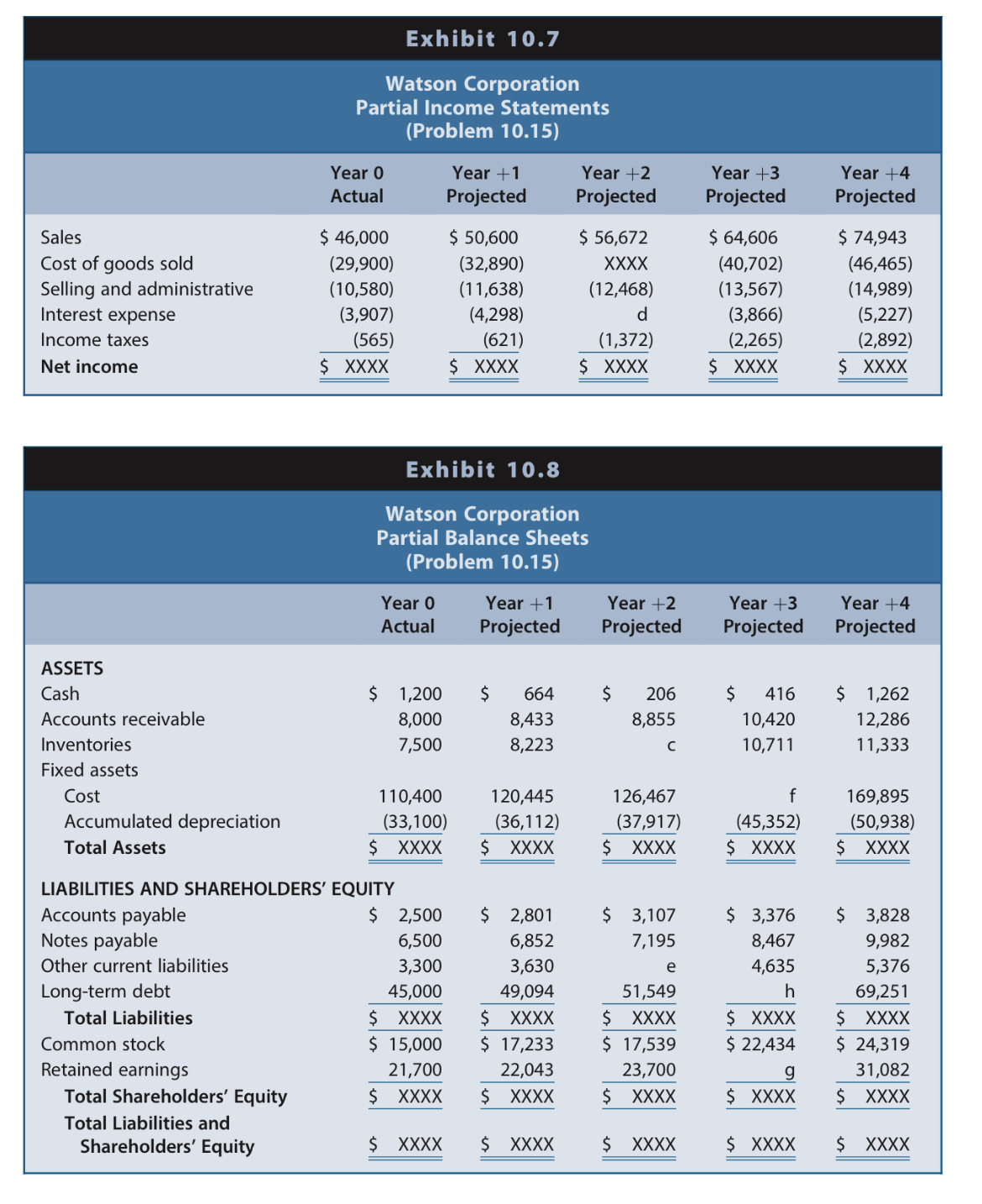

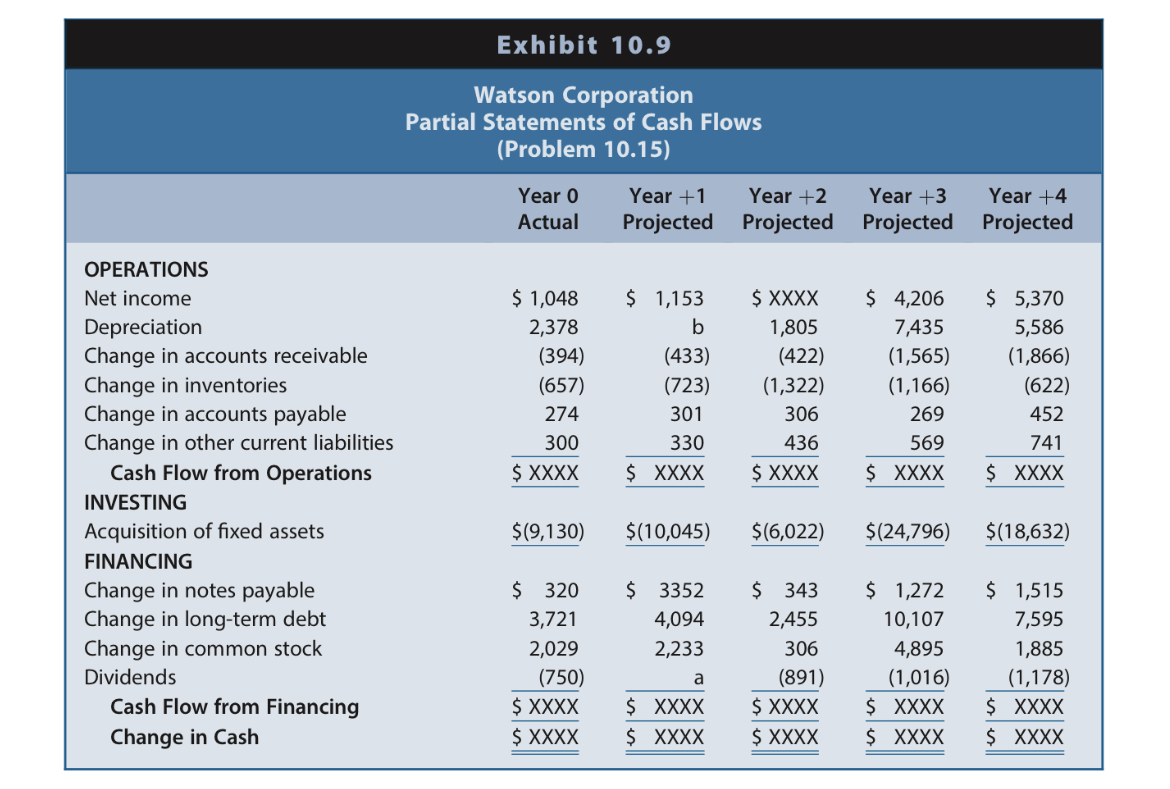

10.5 Projecting Revenues, Cost of Goods Sold, and Inventory. Use the following hypothetical data for Walgreens in 2014 and 2015 to project revenues, cost of goods sold, and inventory for Year +1. Assume that Walgreens's Year +1 revenue growth rate, gross profit margin growth rate, and inventory turnover will be identical to 2015. Project the average inventory balance in Year +1 and use it to compute the implied ending inventory balance. Walgreens (data in millions) 2015 LO 10-2 Sales revenues Cost of goods sold Ending inventory 2014 $76,392 $103,444 $54,823 $ 76,520 $ 6,076 $ 8,678 LO 10-2 10.15 Identifying Financial Statement Relations. Partial forecasts of finan- cial statements for Watson Corporation appear in Exhibit 10.7 (income statement), Exhibit 10.8 (balance sheet), and Exhibit 10.9 (statement of cash flows). Selected amounts have been omit- ted, as have all totals (indicated by XXXX). REQUIRED Determine the amount of each of the following items. a. Dividends declared and paid during Year 1. b. Depreciation expense for Year 1 assuming that Watson Corporation neither sold nor retired depreciable assets during Year 1. c. Inventories at the end of Year 2. d. Interest expense on borrowing during Year 2, with an interest rate of 7%. e. Other current liabilities at the end of Year 2. f. Property, plant, and equipment at the end of Year 3 assuming that Watson Corporation neither sold nor retired depreciable assets during Year 3. g. Retained earnings at the end of Year 3. h. Long-term debt at the end of Year 3. i. The income tax rate for Year 4. j. Purchases of inventories during Year 4. Sales Cost of goods sold Selling and administrative Interest expense Income taxes Net income Exhibit 10.7 Watson Corporation Partial Income Statements (Problem 10.15) Year 0 Actual Year +1 Projected Year +2 Projected $ 46,000 $ 50,600 (29,900) (32,890) $ 56,672 XXXX $ 64,606 Year +3 Projected Year +4 Projected $ 74,943 (40,702) (46,465) (10,580) (11,638) (12,468) (13,567) (14,989) (3,907) (4,298) d (3,866) (5,227) (565) (621) (1,372) (2,265) (2,892) $ XXXX $ XXXX $ XXXX $ XXXX $ XXXX Exhibit 10.8 Watson Corporation Partial Balance Sheets (Problem 10.15) Year 0 Year +1 Actual Projected Year +2 Projected Year +3 Projected Year +4 Projected ASSETS Cash $ 1,200 $ 664 $ 206 $ 416 $ 1,262 Accounts receivable 8,000 8,433 8,855 10,420 12,286 Inventories 7,500 8,223 10,711 11,333 Fixed assets Cost 110,400 120,445 126,467 Accumulated depreciation (33,100) (36,112) (37,917) f (45,352) 169,895 (50,938) Total Assets $ XXXX $ XXXX $ XXXX $ XXXX $ XXXX LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable $ 2,500 $ 2,801 $ 3,107 $ 3,376 $ 3,828 Notes payable Other current liabilities 6,500 3,300 6,852 3,630 7,195 8,467 4,635 9,982 5,376 Long-term debt 45,000 49,094 51,549 h 69,251 Total Liabilities $ XXXX Common stock $ 15,000 $ XXXX $ 17,233 Retained earnings 21,700 Total Shareholders' Equity $ XXXX 22,043 $ XXXX $ XXXX $ 17,539 23,700 $ XXXX $ XXXX $ 22,434 $ 24,319 g 31,082 $ XXXX $ XXXX $ XXXX Total Liabilities and Shareholders' Equity $ XXXX $ XXXX $ XXXX $ XXXX $ XXXX OPERATIONS Exhibit 10.9 Watson Corporation Partial Statements of Cash Flows (Problem 10.15) Year 0 Actual Year +1 Projected Year +2 Projected Year +3 Projected Year +4 Projected $ 5,370 Net income $ 1,048 $ 1,153 $ XXXX $ 4,206 Depreciation 2,378 b 1,805 7,435 5,586 Change in accounts receivable (394) (433) (422) (1,565) (1,866) Change in inventories (657) (723) (1,322) (1,166) (622) Change in accounts payable Change in other current liabilities Cash Flow from Operations INVESTING Acquisition of fixed assets FINANCING 274 301 306 269 452 300 330 436 569 741 $ XXXX $ XXXX $ XXXX $ XXXX $ XXXX $(9,130) $(10,045) $(6,022) $(24,796) $(18,632) Change in notes payable $ 320 $ 3352 $ 343 $ 1,272 $ 1,515 Change in long-term debt 3,721 Change in common stock 2,029 4,094 2,233 2,455 306 10,107 7,595 Dividends (750) a (891) Cash Flow from Financing $ XXXX $ XXXX $ XXXX $ XXXX 4,895 (1,016) $ XXXX 1,885 (1,178) Change in Cash $ XXXX $ XXXX $ XXXX $ XXXX $ XXXX

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started