Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10-7. Lakeway Thrift Savings and Trust is interested in doing some investment portfolio shifting. This institution has had a good year thus far, with

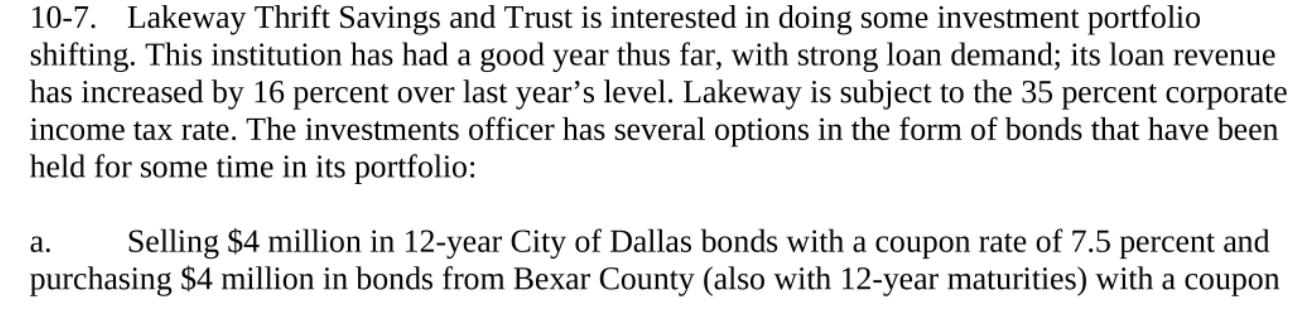

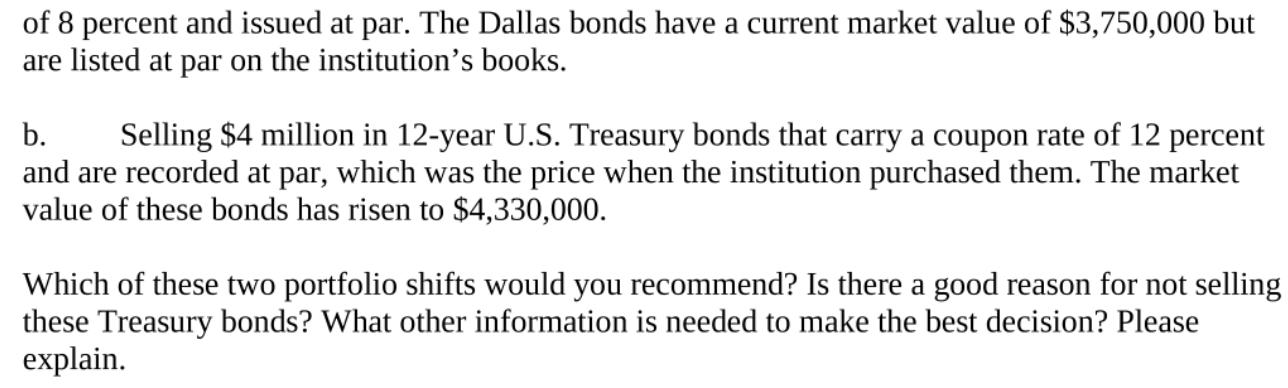

10-7. Lakeway Thrift Savings and Trust is interested in doing some investment portfolio shifting. This institution has had a good year thus far, with strong loan demand; its loan revenue has increased by 16 percent over last year's level. Lakeway is subject to the 35 percent corporate income tax rate. The investments officer has several options in the form of bonds that have been held for some time in its portfolio: a. Selling $4 million in 12-year City of Dallas bonds with a coupon rate of 7.5 percent and purchasing $4 million in bonds from Bexar County (also with 12-year maturities) with a coupon of 8 percent and issued at par. The Dallas bonds have a current market value of $3,750,000 but are listed at par on the institution's books. b. Selling $4 million in 12-year U.S. Treasury bonds that carry a coupon rate of 12 percent and are recorded at par, which was the price when the institution purchased them. The market value of these bonds has risen to $4,330,000. Which of these two portfolio shifts would you recommend? Is there a good reason for not selling these Treasury bonds? What other information is needed to make the best decision? Please explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which portfolio shift is recommended and whether there is a good reason for not selling the Treasury bonds we need to consider the follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started