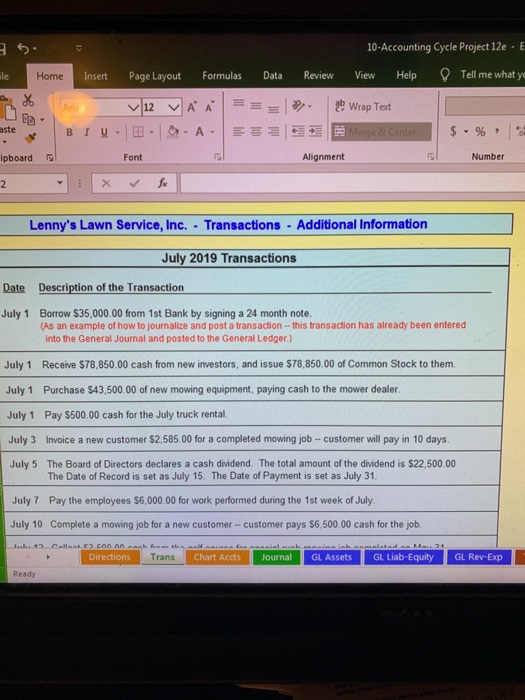

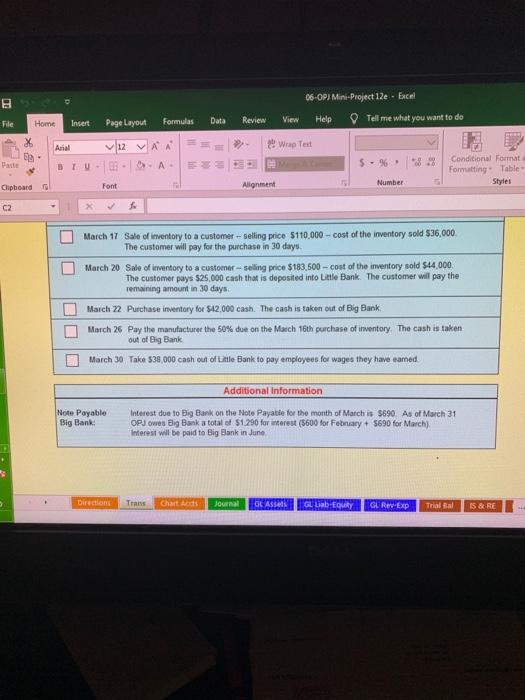

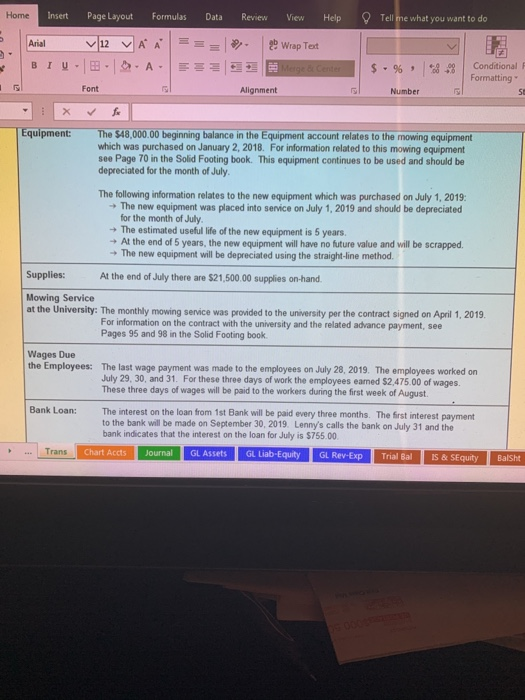

10-Accounting Cycle Project 12e - 1 ile Home Insert Page Layout Formulas Data Review View Help Tell me what yo Ar ~12 VAA BIU DOA- ab Wrap Text Merge & Center aste $ - % 0 ipboard Font Alignment Number 2 f Lenny's Lawn Service, Inc. - Transactions - Additional Information July 2019 Transactions Date Description of the Transaction July 1 Borrow $35,000.00 from 1st Bank by signing a 24 month note. (As an example of how to journalize and post a transaction -- this transaction has already been entered into the General Journal and posted to the General Ledger.) July 1 Receive $78,850.00 cash from new investors, and issue $78,850.00 of Common Stock to them. July 1 Purchase 543,500.00 of new mowing equipment, paying cash to the mower dealer. July 1 Pay $500.00 cash for the July truck rental. July 3 Invoice a new customer $2,585.00 for a completed mowing job -- customer will pay in 10 days. July 5 The Board of Directors declares a cash dividend. The total amount of the dividend is $22,500.00 The Date of Record is set as July 15. The Date of Payment is set as July 31. July 7 Pay the employees $6,000.00 for work performed during the 1st week of July. July 10 Complete a mowing job for a new customer -- customer pays $6,500.00 cash for the job. and 2 lub 1 Cellent con nennt firm than neneninlik Directions Trans Chart Accts Journal Ready GL Assets GL Liab-Equity GL Rev.Exp 06-OP) Mini-Project 12e - Excel Help Tell me what you want to do Home File Insert Page Layout Formulas Data Review View 26 Wrap Text Arial ~12 VAA BIU - SA Paste *3.99 $ - % Merge Center Alignment Conditional Format Formatting" Table Styles Number Clipboard Font C2 X . March 17 Sale of inventory to a customer selling price $110,000 - cost of the inventory sold $36,000 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer-selling price $183,500 - cost of the inventory sold $44,000 The customer pays $25,000 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $12,000 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank UD March 30 Take $38,000 cash out of Little Bank to pay employees for wages they have earned. Additional Information Note Payable Big Bank Interest due to Big Bank on the Note Payable for the month of March is $690. As of March 31 OPJ owes Big Bank a total of $1.290 for interest (5600 for February + $690 for March) Interest will be paid to Big Bank in June. Directions Trans Chart Acts Journal GL Assets GL Lab Equity GL Rev Exp Trial Bal IS & RE Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Arial V12 26 Wrap Text BIU - BA- $% Conditional Formatting 5 Font Alignment Number fx Equipment: The 548,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2018. For information related to this mowing equipment see Page 70 in the Solid Footing book. This equipment continues to be used and should be depreciated for the month of July. The following information relates to the new equipment which was purchased on July 1, 2019: The new equipment was placed into service on July 1, 2019 and should be depreciated for the month of July. The estimated useful life of the new equipment is 5 years - At the end of 5 years, the new equipment will have no future value and will be scrapped. The new equipment will be depreciated using the straight-line method. Supplies: At the end of July there are 521,500.00 supplies on-hand. Mowing Service at the University: The monthly mowing service was provided to the university per the contract signed on April 1, 2019. For information on the contract with the university and the related advance payment, see Pages 95 and 98 in the Solid Footing book. Wages Due the Employees: The last wage payment was made to the employees on July 28, 2019. The employees worked on July 29, 30, and 31. For these three days of work the employees eamed $2,475.00 of wages. These three days of wages will be paid to the workers during the first week of August. Bank Loan: The interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2019. Lenny's calls the bank on July 31 and the bank indicates that the interest on the loan for July is $755.00 Trans Chart Accts Journal GL Assets GL Liab-Equity GL Rev-Exp Trial Bal IS & SEquity BalSht 10-Accounting Cycle Project 12e - 1 ile Home Insert Page Layout Formulas Data Review View Help Tell me what yo Ar ~12 VAA BIU DOA- ab Wrap Text Merge & Center aste $ - % 0 ipboard Font Alignment Number 2 f Lenny's Lawn Service, Inc. - Transactions - Additional Information July 2019 Transactions Date Description of the Transaction July 1 Borrow $35,000.00 from 1st Bank by signing a 24 month note. (As an example of how to journalize and post a transaction -- this transaction has already been entered into the General Journal and posted to the General Ledger.) July 1 Receive $78,850.00 cash from new investors, and issue $78,850.00 of Common Stock to them. July 1 Purchase 543,500.00 of new mowing equipment, paying cash to the mower dealer. July 1 Pay $500.00 cash for the July truck rental. July 3 Invoice a new customer $2,585.00 for a completed mowing job -- customer will pay in 10 days. July 5 The Board of Directors declares a cash dividend. The total amount of the dividend is $22,500.00 The Date of Record is set as July 15. The Date of Payment is set as July 31. July 7 Pay the employees $6,000.00 for work performed during the 1st week of July. July 10 Complete a mowing job for a new customer -- customer pays $6,500.00 cash for the job. and 2 lub 1 Cellent con nennt firm than neneninlik Directions Trans Chart Accts Journal Ready GL Assets GL Liab-Equity GL Rev.Exp 06-OP) Mini-Project 12e - Excel Help Tell me what you want to do Home File Insert Page Layout Formulas Data Review View 26 Wrap Text Arial ~12 VAA BIU - SA Paste *3.99 $ - % Merge Center Alignment Conditional Format Formatting" Table Styles Number Clipboard Font C2 X . March 17 Sale of inventory to a customer selling price $110,000 - cost of the inventory sold $36,000 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer-selling price $183,500 - cost of the inventory sold $44,000 The customer pays $25,000 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $12,000 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank UD March 30 Take $38,000 cash out of Little Bank to pay employees for wages they have earned. Additional Information Note Payable Big Bank Interest due to Big Bank on the Note Payable for the month of March is $690. As of March 31 OPJ owes Big Bank a total of $1.290 for interest (5600 for February + $690 for March) Interest will be paid to Big Bank in June. Directions Trans Chart Acts Journal GL Assets GL Lab Equity GL Rev Exp Trial Bal IS & RE Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Arial V12 26 Wrap Text BIU - BA- $% Conditional Formatting 5 Font Alignment Number fx Equipment: The 548,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2018. For information related to this mowing equipment see Page 70 in the Solid Footing book. This equipment continues to be used and should be depreciated for the month of July. The following information relates to the new equipment which was purchased on July 1, 2019: The new equipment was placed into service on July 1, 2019 and should be depreciated for the month of July. The estimated useful life of the new equipment is 5 years - At the end of 5 years, the new equipment will have no future value and will be scrapped. The new equipment will be depreciated using the straight-line method. Supplies: At the end of July there are 521,500.00 supplies on-hand. Mowing Service at the University: The monthly mowing service was provided to the university per the contract signed on April 1, 2019. For information on the contract with the university and the related advance payment, see Pages 95 and 98 in the Solid Footing book. Wages Due the Employees: The last wage payment was made to the employees on July 28, 2019. The employees worked on July 29, 30, and 31. For these three days of work the employees eamed $2,475.00 of wages. These three days of wages will be paid to the workers during the first week of August. Bank Loan: The interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2019. Lenny's calls the bank on July 31 and the bank indicates that the interest on the loan for July is $755.00 Trans Chart Accts Journal GL Assets GL Liab-Equity GL Rev-Exp Trial Bal IS & SEquity BalSht